When you log into your Mint account you can add your Acorns account by clicking Settings button followed by the Accounts and Plus buttons to enter your Acorns login information. You can also connect it using our QuickBooks Self-Employed mobile app.

Acorns App Review How To Make Money With The Acorns App Youtube

Acorns App Review How To Make Money With The Acorns App Youtube

One of the best ways to promote the Acorns app is through blogging or YouTube videos and it works very much like affiliate marketing.

How to use acorns app. Acorns will also let you create a four-digit passcode to log in on your phone. 6 Ways to Make Money 500 with the Acorns App. Enter the sign-in info.

Save and Invest claim refers to a clients ability to utilize the Acorns Spend Instant Round-up feature to set aside small amounts of money from purchases made using an Acorns Spend account and seamlessly investing those small amounts. Once you download the Acorns app or sign up through our web app youll need. Take Advantage of Found Money.

If you dont bank with Bank of America Chase Citibank PNC Bank USAA US Bank US Navy Federal. Acorns Visa debit cards are issued by Lincoln Savings Bank member FDIC for Acorns Spend account holders. Let me show you.

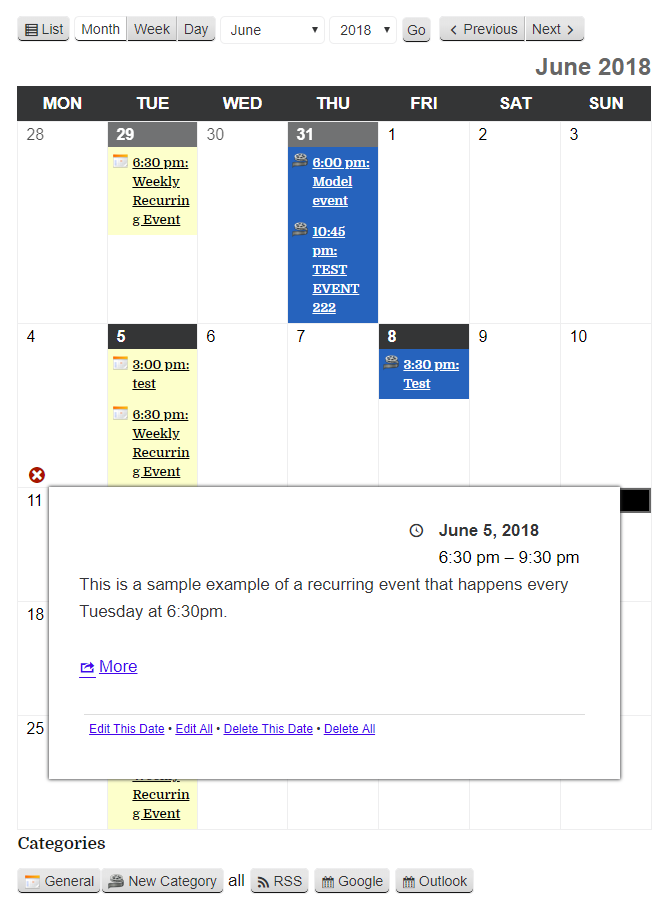

If you use the free online budgeting app Mint you can link your Acorns account to track your investing progress with your monthly budget. Acorns is a savings and investing app that helps people save for their future automatically. We review the app that allows you to save tiny amounts for long term wins.

Heres what its like to use Acorns. While Acorns started as an app its also available as a web-based version for desktop and portable users. You create a content a blog post or a video targeting an audience and place the referral link to lead visitors to the app.

If I have to remember to move 100 from my checking account to my investing account. What is Acorns. In todays Acorns app review I cover how to make money with the Acorns app break down all its automation tools and explain why its one of the best inve.

Your online banking log in information to link your accounts to Round-Up spare change and to fund your investments. They use some of the highest security measures and encryption methods to prevent your data from being stolen. The Acorns app is good for long-term wealth building not short-term savings.

Lets discuss and review Acorns Investment App go over all of its features and whether or not its actually a good value - Enjoy. A valid email address where we can reach you and regularly send you account information. How Does Acorns Work.

For example if you buy a coffee for 275 Acorns will round up to 300 and automatically invest 25. Brokerage services are provided to clients of Acorns Advisers by Acorns Securities LLC an SEC registered broker-dealer and member FINRA. We can link it using the banking feature.

Im a big fan of anything automated. In addition to an individual investment account Acorns also offers a retirement account a checking account and an UGMAUTMA account for kids with Acorns Early. Earn Up to 10 Bonus Investments with.

Add me on Instagram. Investing can be intimidating but not with apps like Acorns. Overall Acorns is a safe and secure financial services app.

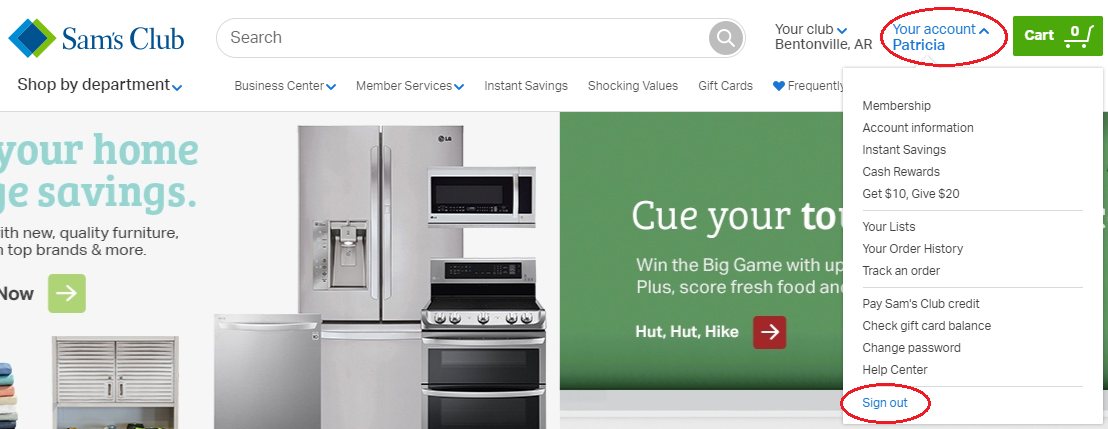

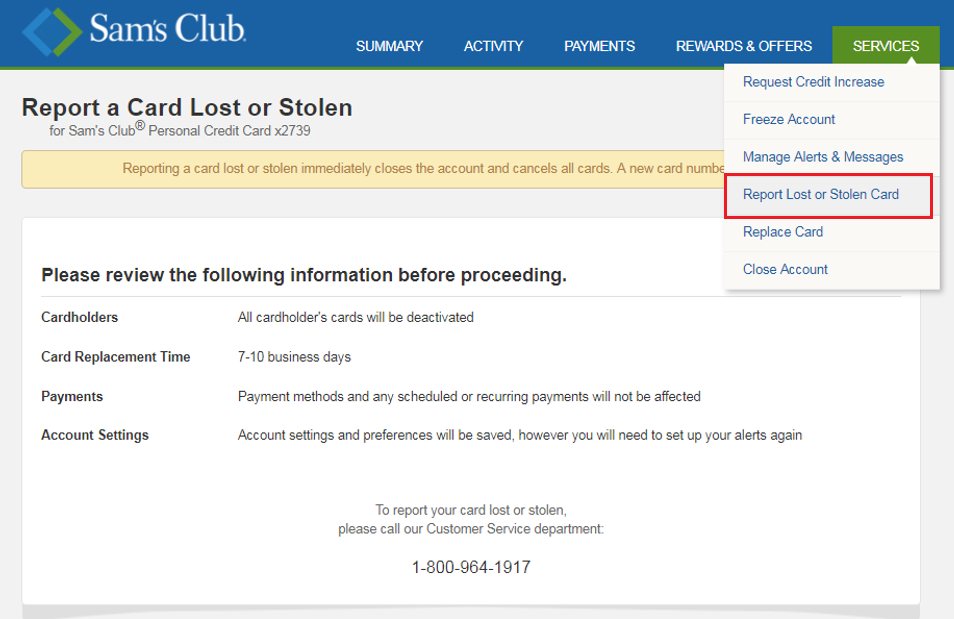

Founded in 2012 Acorns has continued to grow in popularity. Go to the Gear icon and select Bank accounts. Search and select Acorns or enter the URL.

When youre ready select Connect securely. This website is operated by Acorns Advisers LLC an SEC Registered Investment Advisor. The Acorns investing app encourages you to invest your spare change using a system it calls round-ups Acorns monitors your bank account and automatically invests the change from your daily purchases.

How does Acorns work. Although nothing is 100 infallible they take many steps to keep your account and. To start out you need an email address and a secure password.

By linking your credit card and checking account Acorns reads your spending habits on your credit card and rounds each transaction up.

:max_bytes(150000):strip_icc()/005_configure-camera-microphone-setting-in-google-chrome-4103623-5c02f00946e0fb000142d73a.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/67167803/acastro_180522_facebook_0001.0.jpg)