Before the date of maturity your bank should. A certificate of deposit earns so much interest because youre giving money to your bank or credit union to use for many months or even years.

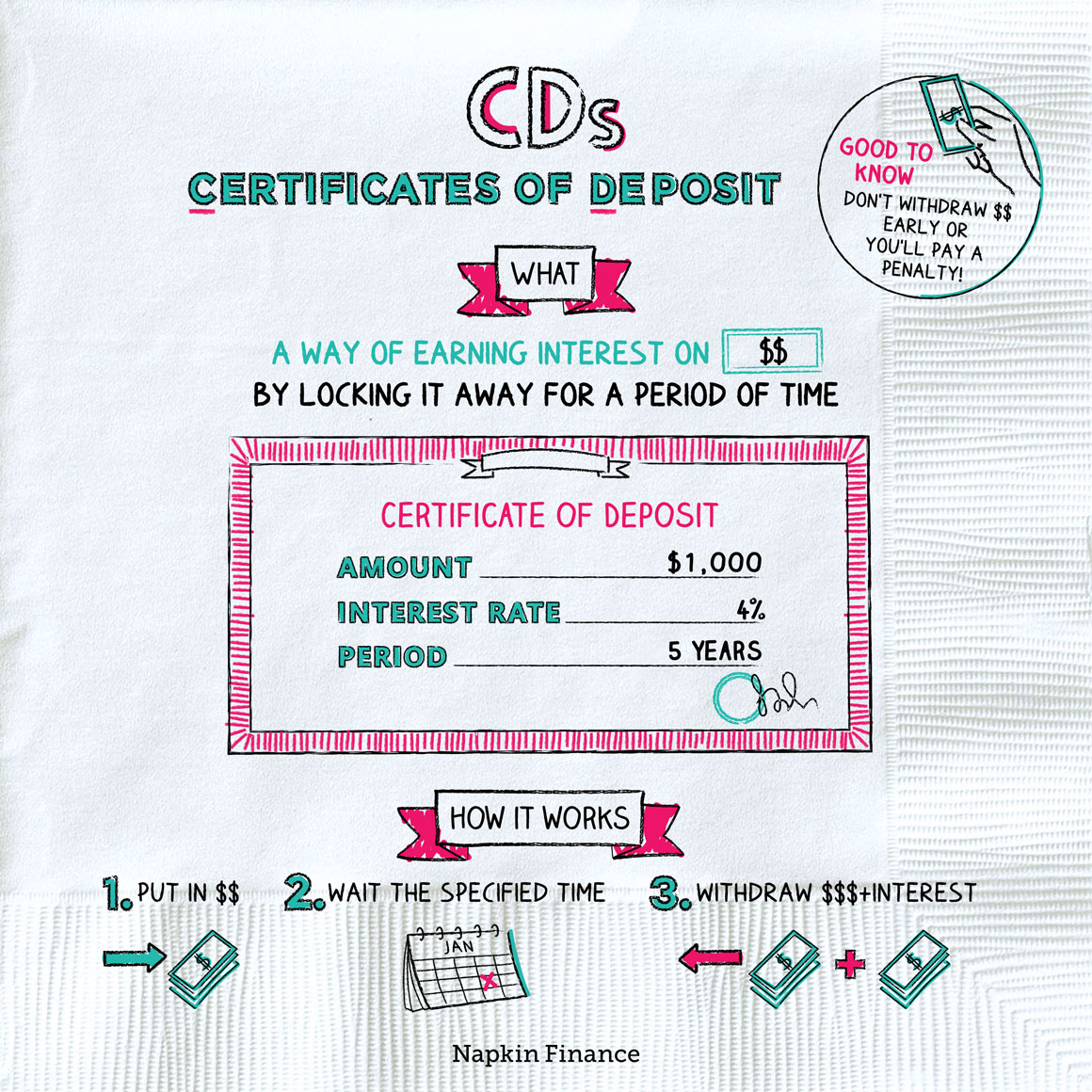

What Is A Cd Certificate Of Deposit Napkin Finance Has The Answer

What Is A Cd Certificate Of Deposit Napkin Finance Has The Answer

When the certificate matures it will be worth 550.

Are certificates of deposit worth it. CDs require you to lock in a lump sum deposit for a specified period of time at a set interest rate. Shop around the for best CD not the worst one or the average one. When you open a CD youll have a variety of maturity dates to choose from.

Perhaps you have cash you dont need now but will want within the next few yearsmaybe for a special vacation or to buy a new. If you are looking for a way to save money for the future a Certificate of Deposit CD may be for you. For a 5-10 year time frame you should probably consider some other investment like unit trusts in a.

A certificate of deposit is not going to eat up your capital due to market volatility. Opening a CD today means locking in a historic low rate. The size of your deposit may also impact the CDs rates.

Unlike the stock market CDs are dependable forms of income. CDs worth 100000 or more are often called jumbo CDs and they typically offer higher interest rates. Many CDs penalize early withdrawals.

This can give yourself increased access to potential liquidity as you earn interest income. Fdic insurance coverage m1 m2. Color photo with rates bank negotiable Color photo with bank negotiable interest rates Need more pictures of negotiable interest rates cds like this for 2016 I had been looking at interest rates cds buy for years Cds buy interest perfect images are great.

Roughly 5 of my diversified net worth is in certificates of deposit and other stable instruments currently yielding a blended rate of around 2 as of 2021. Certificates of deposit are useful in a few different situations. Further earning 2 is better than losing money in case theres another stock market correction.

CDs are for consumers who want to earn interest on their account without touching their funds until the maturity. BTW you can find 1 year CDs paying 28 which is more than the expected rate of inflation--although that doesnt really matter because the closest alternatives are also subject to inflation. Definatly worth it for some people as you get a guaranteed return every year.

In fact Im reluctant to call it an investment. Certificate of Deposits or CDs as they are more commonly known are a savings vehicle offered by banks that many people thumb their nose at. Private Finance Insider writes about merchandise methods and ideas that can assist you make sensible selections together with your cash.

2 is not a high rate but its enough to keep up with stated inflation. Yields on short-term CDs. This is called the term or maturity period.

You cant use the money in a CD for a long time. Are certificates of deposit worth it. It is a completely secure financial instrument with an assured sum at maturity similar to traditional.

The Federal Reserves decision to drop rates twice in 2020. Theyre popular when interest rates are high. Certificates of deposit traditionally have had the highest interest rates among bank accounts with the best rates once reaching 2 to 3 in the past decade.

A CD is a special type of deposit account with a bank or thrift institution that typically offers a higher rate of interest than a regular savings account. Certificates of deposit or CDs are a type of savings account with a fixed interest rate and minimal risk. The Advantages of Investing in a Certificate of Deposit CD CDs Are Dependable Investment CDs are investments that investors can depend on to make them money.

In some cases you can use a CD to create a secure line of credit with the bank holding the CD as a form of collateral. When you purchase a CD you invest a fixed sum of money for fixed period of time six months one year five years or more and in exchange the issuing bank pays you interest typically at regular intervals. Weighing the certificate of deposit advantages and disadvantages can be a great way to narrow down your decision.

Since there are so many options for building wealth CDs may not be the right choice for everyone. Principle and interest are guaranteed as long as the original agreement remains intact. Are certificates of deposit worth it.

When CDs arent worth it. That answer depends on a variety of factors and your current financial situation. Are Certificates Of Deposit Worth It search trends.

If you are able to lock in funds for a period of time without accessing it then a CD is absolutely worth it.