Tax day has been extended to May 17 2021. 1 of this year.

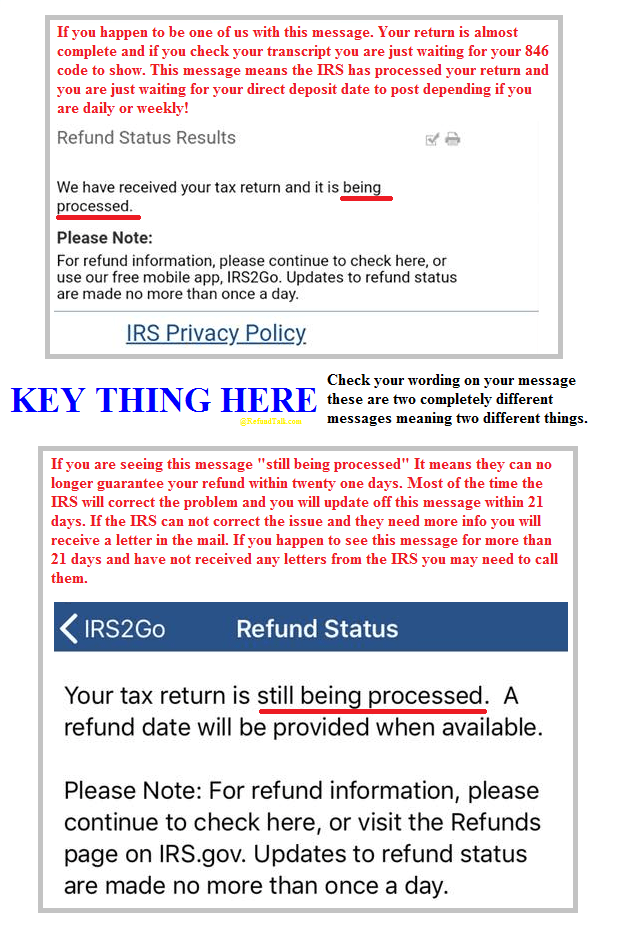

Irs Still Being Processed Vs Being Processed Refundtalk Com

Irs Still Being Processed Vs Being Processed Refundtalk Com

The extra time is intended to ease the burden on taxpayers who are dealing with the economic upheaval caused by the pandemic which has left millions without jobs or with reduced work hours.

When will taxes be processed. When Are Taxes Due. The 2020 tax refund season is underway - the IRS started accepting 2019 income tax returns on Monday January 27 2020. After the tax return has been Accepted by the IRS meaning only that they received the return it will be in the Processing mode until the tax refund has been Approved and then an Issue Date will be available on the IRS website.

The aim is that you pay the right amount of tax at the right time so that you dont overpay during the year or have a bill to pay at the end of the tax year. What does your tax return is still being processed a refund date will be provided when available mean. 2021 TAX FILING.

While not exact our chart below can help you predict when you will get. If it didnt and its been at least two weeks since you sent the payment call the IRS at 1-800-829-1040 to ask if the amount has been credited to your account. According to IRS data 67 million tax returns have not yet been processed in 2021 but in 2020 only around 2 million returns faced processing delays reflecting the effects of the stimulus.

The sad part is though that many honest people may see their tax returns delayed by several weeks. The first day to officially file your tax return is February 12 2021. Even if you e-file early the IRS wont start processing your tax return until February 12 2021.

You also can use this number to confirm that your return has been processed. And in 2021 there is another reason your tax refund will be delayed. The deadline for submitting tax returns and making tax payments has been extended to May 17 2021.

Almost 90 of tax refunds are processed and issued within 21 days. In case you encounter any delay in your tax return then IRS is responsible for processing and approving your details. If you submit your tax return by mail the IRS says it could take six to eight weeks for your tax refund to arrive.

While the 2020 tax season has clearly been unique in that it happened in the midst of a pandemic the reality is that tax refunds are processed much more quickly for. Millions of backlogged tax returns may be processed by summer IRS commissioner says There is a backlog of 24 million individual income tax returns filed prior to Jan. During non-peak times funds are usually withdrawn on the payment date you specify assuming your e-filed return has already been accepted received by the IRS.

The tax year is from 1 April to 31 March. Now if you filed right before or on the busy May 17 2021. If that date happens to fall on a weekend or federal holiday the funds are typically withdrawn the next business day.

Yes its that late this year. Last year the IRS pushed back to July 15 2020 the filing deadline for 2019 taxes due to the ongoing Coronavirus pandemicIf you still cant meet the tax filing deadline you can file for an. What to do if Your tax return is still being processed message appears You filed your tax return for 2020 early and are now waiting for your refund but with the IRS stretched to.

The Covid-19 and Coronavirus pandemic. After the end of each tax year well send you one of these. The deadline to submit your 2020 tax return and pay your tax bill has been pushed back a month to May 17 2021 to give people more time to file during the Coronavirus pandemic.

If you filed an amended return go to IRSgov and click the Wheres My Amended Return button. A refund date will be provided when available. If you have filed for tax returns lately chances are you receiving a message from the IRS stating--your tax return is still being processed.

Thats where tracking your refund comes in handy.