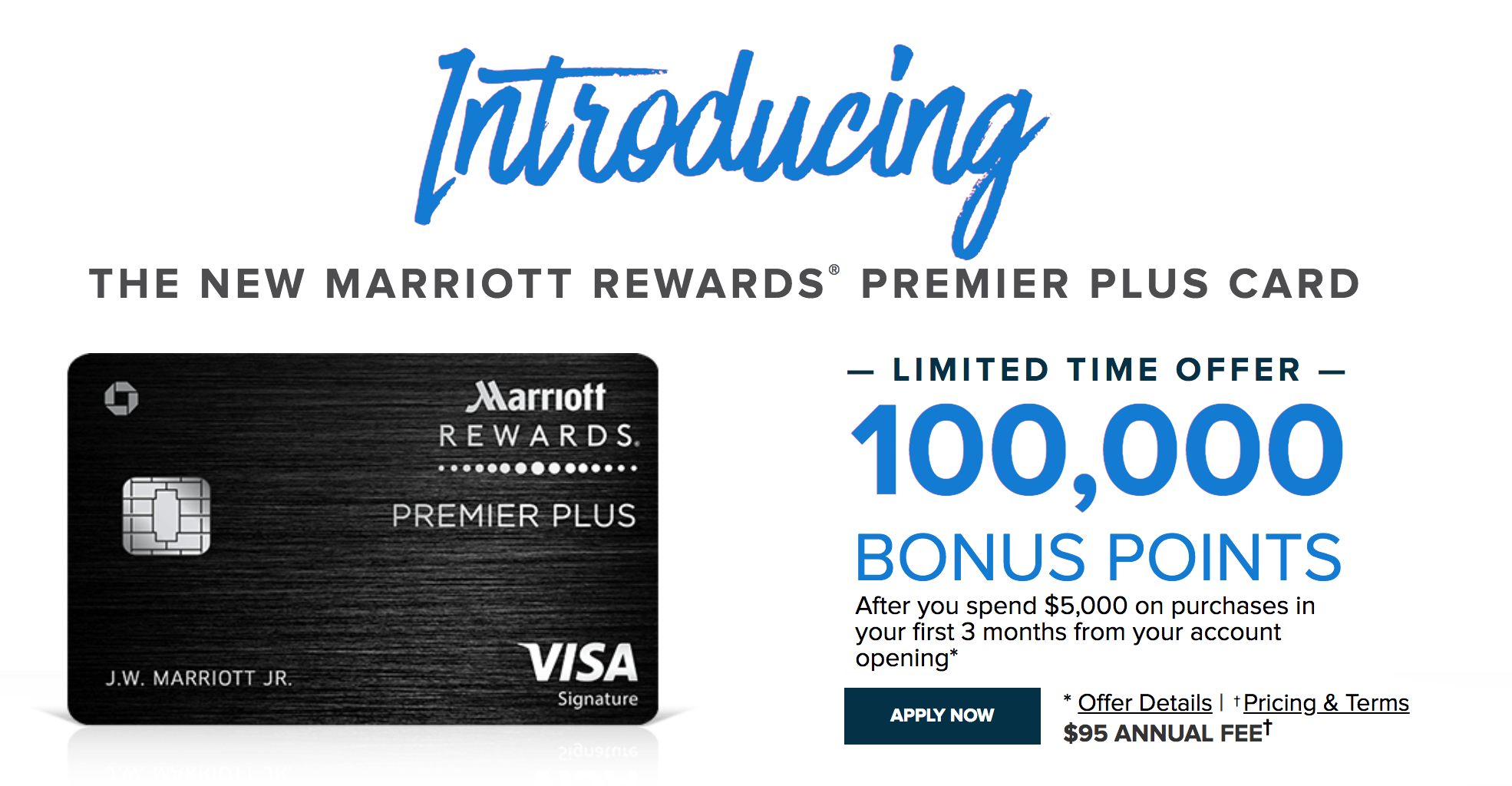

This is usually only a temporary dip in your credit rating but too many hard searches or credit applications can lead to a decrease in your credit. On top of that Klarna will issue a free debit card in cooperation with payment provider Visa.

Does Klarna Impact My Credit Score Klarna Uk

Does Klarna Impact My Credit Score Klarna Uk

No fees it pays to know how each payment plan could affect your credit rating before you go diving in.

Does klarna help build credit. You can try to make a purchase that is above your credit limit and if we are able to grant that increase it will be done at that time. One wholl repay debt on time. If you need to make a larger purchase you can use Klarnas interest-free payment option to spread out payments or take a loan.

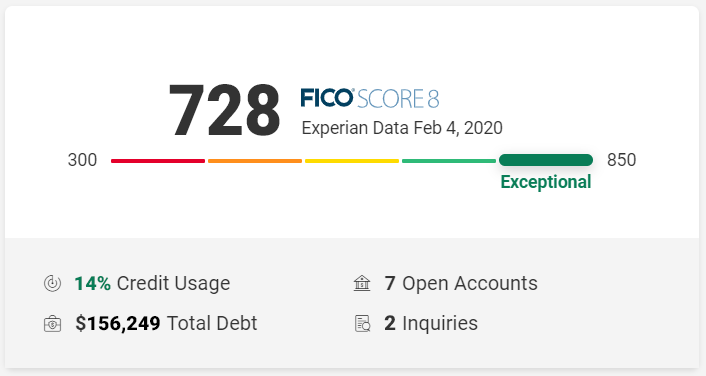

For installment and pay-later purchases Klarna runs a soft credit check which does not impact the consumers credit score or appear on their credit report. Your credit score is the number that banks and other lenders look at to decide if youre a safe borrower ie. Klarna a 10-year-old Swedish company that has big ambitions in the US.

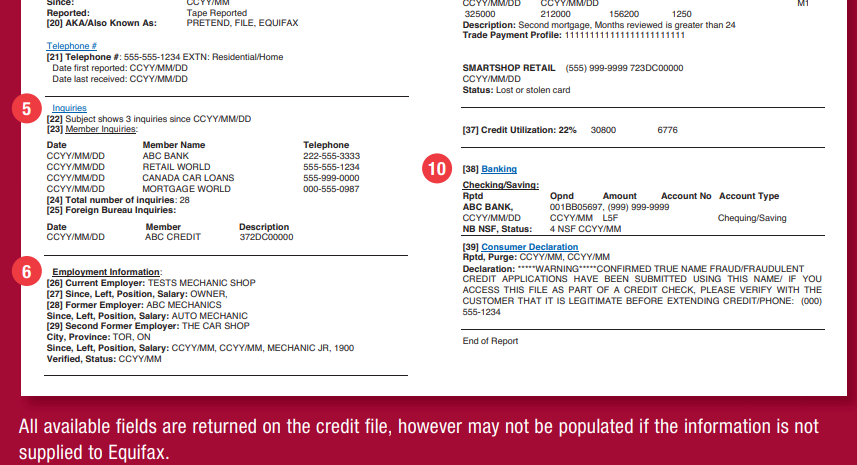

However most Klarna financing requires an application complete with a credit check which will result in a hard pull of your credit report. In essence Klarna offers credit by letting shoppers delay payment. This credit check will show up as an inquiry on your credit report will be visible to other lenders and might impact your credit score.

Thats a file of your financial history the people and institutions youre linked to and court records. But like many other innovative. What did Klarna say.

Financing formerly known as Slice it is Klarnas only regulated credit product with payment plans typically from 6-36 months. If you decide to use Financing we might perform a credit check with credit reference agencies to complete your credit assessment. Taking out a standard payment holiday for our Financing payment options.

We will perform a credit check when. We will not perform a credit check on you when. Applying for one of our Financing options.

Similarly missing a payment for the Pay Later option wont hurt your credit score because Klarna doesnt report these payments to credit reference agencies CRAs. Klarna is not a good idea if you. Want to use a POS loan to build credit.

Deciding to Pay in 4 interest-free installments. In this instance there will. Klarna and ClearPay told The Sun that no customers credit scores have been impacted by using their pay later or pay 30 days later products even if they have failed to pay on time.

Customers credit scores are not supposed to get affected by using Klarna but there are caveats. To date a customers credit score has not been impacted by using Klarnas Pay later products even if they have failed to pay on time. We do have another product called Financing formerly known as Slice it.

Whenever you pay with your debit or credit card a so-called interchange fee is applied. Its assembled by credit bureaus like TransUnion Equifax and Experian which then pass it directly onto lenders. But like many other innovative payment solutions there are both pros and cons.

To date a customers credit score has not been impacted by using Klarnas Pay later products even if they have failed to pay on time. Downloading the Klarna App. Was this article helpful.

If you apply for Financing with Klarna a hard search will be made into your credit report. In some cases you can be preapproved for Klarna financing plans which wont trigger a hard pull to your credit. Theres a way that using Klarna might help build your credit.

This is Klarnas only regulated credit product with payment plans typically lasting 6-36 months. We automatically determine if you are eligible for a credit line increase when you shop with Klarna. Preferring to Pay in 30 days.

In the UK itll come as part of a credit report. Monthly financing through a Klarna credit. While Klarnas website states No interest.

It runs a hard credit check for those. Currently we cannot accept customer-initiated requests for credit line increases. The payment network does a soft credit check for Pay Later and Pay in 3 choices which means that technically your customers credit scores will remain untouched.

However if the customer misses a payment on any of the deferred payment systems. Similar to all traditional finance providers who offer products of this nature with the customers consent a hard credit check is undertaken. Applying for one of our Financing options.

Does Klarna Financing affect your credit score. Interchange fees are paid by the merchant and normally are less than 1 percent. Hard credit searches will appear on your report for both you and lenders or creditors to see and they can have a detrimental impact on your credit score.

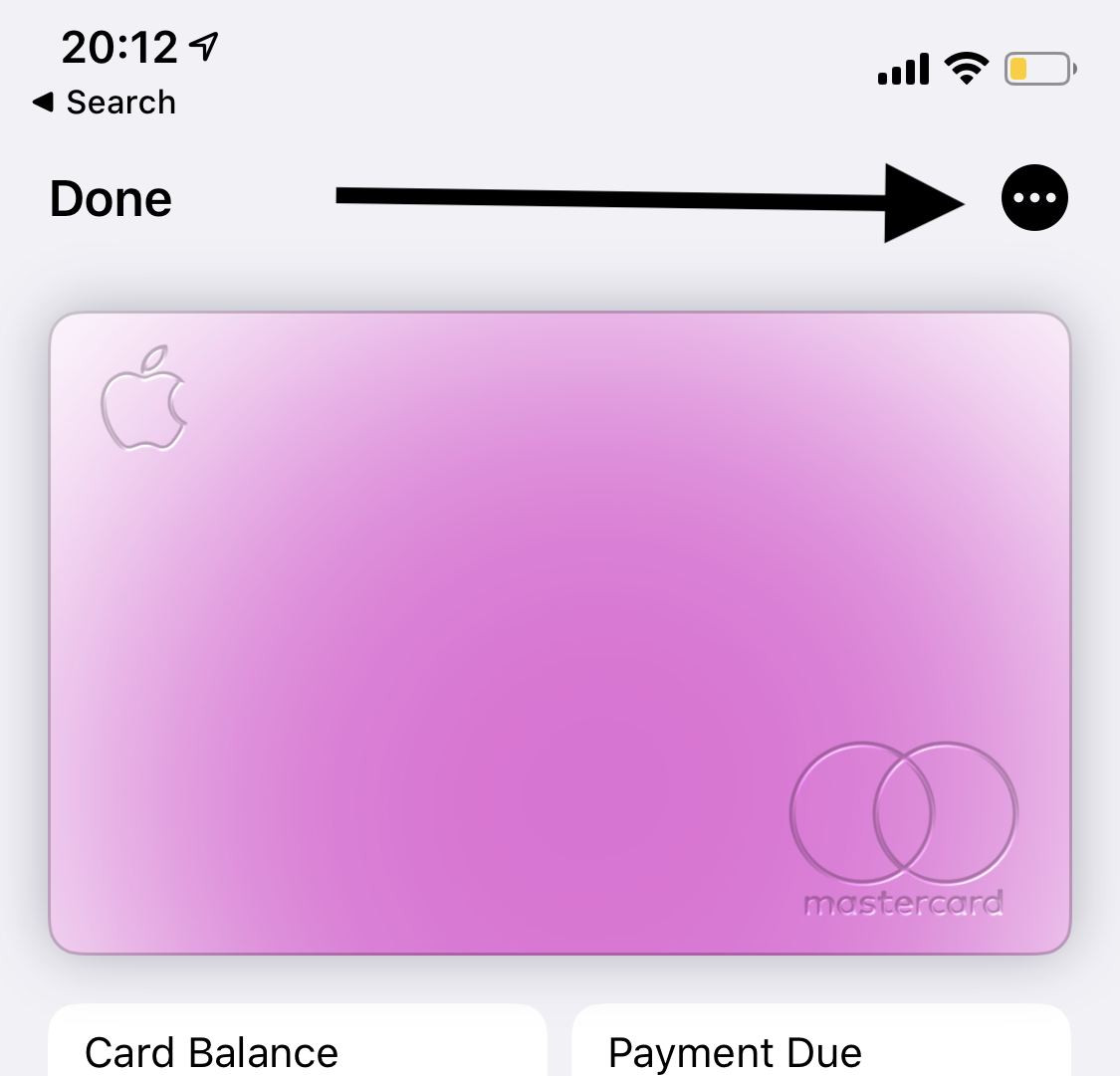

Signing up to use Klarna. This allows spenders to make a purchase and spread the cost out over three interest-free monthly payments. So if you buy something for 100 around 1 of that would go to Visa.

The first instalment will be taken upon purchase and Klarna will. How can Klarnas payment options affect your credit score. Using Klarna might affect your credit score when.

Klarna does not report on-time payments to the credit bureaus though it. That means - to date - a customers credit score has never been impacted by using their Pay Later products even if they fail to pay on time.

/who-are-the-three-major-credit-bureaus-960416-Final-5c5363db46e0fb0001c07a68.png)

/bank-of-america-premium-rewards-credit-card_art_FINAL-9cbade9c28bc4264a7da4ee06cdea043.jpg)

/bank_of_america_premium_rewards_FINAL-a3e56338a9f848359e1c0fe05e490c56.png)