A Chase Student Checking Account is an excellent choice for most college students. However be aware that you may be transitioned into a total once youre 26 or so.

Chase Checking Accounts Compare Apply Today Chase

Chase Checking Accounts Compare Apply Today Chase

Students between the ages of 17-24 dont have to worry about maintenance fees.

Chase student checking account. This account is open to college students between ages 17 and 24 at the account opening. The information for Chase College Checking has been collected independently by Johnny Jet. This account comes with.

Our Chase College Checking Account has great benefits for students and new Chase customers can enjoy this special offer. The Chase College Checking account is available to college students ages 17-24 and for a. Students age 1724 can open a Chase College Checking account.

Chase College Checking Chase High School Checking. Plus the low monthly fee isnt a problem if you can waive it. Chase College Checking SM account is a very simple checking account.

The Chase Bank College Checking Account offers all the features a student needs for banking. PNC Bank Virtual Wallet Student. Capital One 360.

You can apply for the Chase college checking account either in person at a branch or online. One of the best college checking accounts available to students today comes from Chase. The student checking account is perfect for students who are looking for a place to store their money.

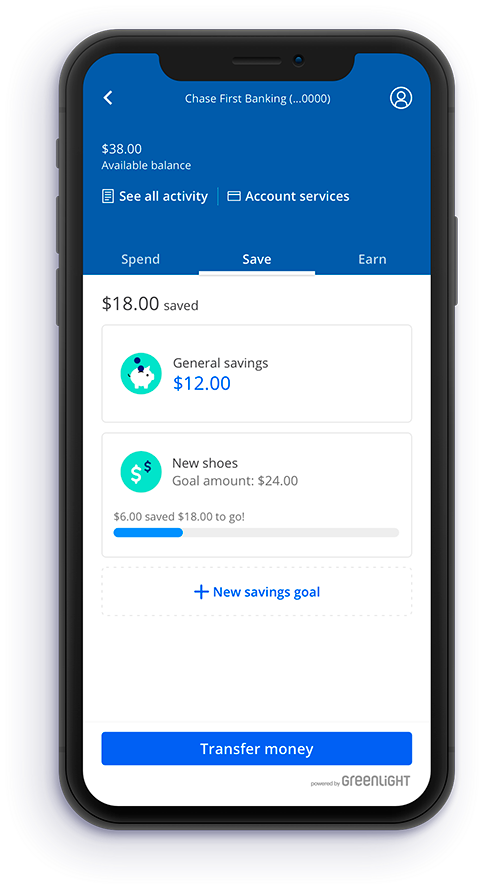

Its especially good for students who will be attending a college where. All you need is any direct deposit going into the account. For parents with kids and teens explore Chase High School Checking or Chase First Banking as an account that helps parents teach good money habits.

The card details on this page have not been reviewed or provided by the card issuer. Best student checking accounts 1. Enjoy 100 if you open a Chase College Checking SM account by October 8.

In fact you can use this account without paying monthly fees for up to 5 years during your college career. Our Chase College Checking Account has great benefits for students and new Chase customers can enjoy this special offer. Checking for teens and kids.

Checking account details Monthly fee waived for up to 5 years while youre in college OR make a qualifying direct deposit OR keep an average ending day balance of 5000. Chase Student Checking Account Im trying to open up another checking account to fall back on just in case something happens to my Ally account. Otherwise BofA will charge you a maintenance fee of 12.

For parents with kids and teens explore Chase High School Checking or Chase First Banking as an account that helps parents teach good money habits. You can have the fee waived for up to fives years as a student. 0 Chase Bank offers two separate accounts for.

0 Students dont need to worry about a monthly fee for six years after. Exclusively for Chase checking customers Chase First Banking helps parents teach teens and kids about money by giving parents the control they want and kids the freedom they need to learn. For example Wells Fargo does not offer a dedicated Student Checking account but customers between the ages of 17-24 receive a 5 discount off the 10 monthly service fee on their checking account.

These fees are waived for students but college grads get the unhappy gift of a real-world account. Chase is known for offering new account holder bonuses and currently new Chase College Checking account customers can earn 100 after completing 10 qualifying transactions within. You can apply before you officially start college as long as you have proof of student status.

For Bank of Americas Core Checking Account you need to either have a qualifying direct deposit of 250 each month or a daily minimum of 1500 in your account. Current I only have a Learner Permit ID NY State and was wondering if I can use this as the ID number they are asking for. Chase College Checking is Chases only college student checking account.

For college students between the ages of 17 and 24 the Chase College Checking Account has. The Chase College Checking account is one of the best checking accounts designed for students. It doesnt happen to everyone though and certain in-branch account maintenance requires you upgrade your account adding a new person to your account.