Short term traders usually use a 10 20-period moving average while longer-term players use the 50 100 and the 200 day. The moving average is used to observe price changes.

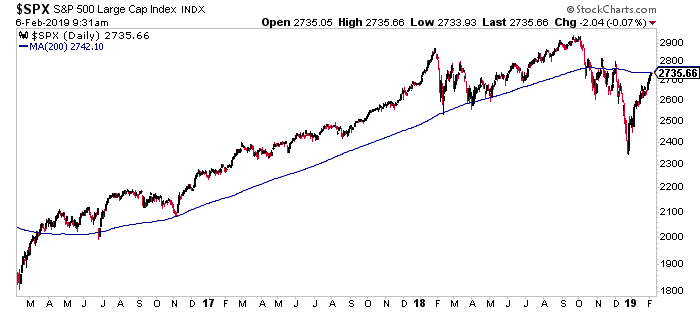

I Will Build A Wall At The 200 Day Moving Average The Reformed Broker

I Will Build A Wall At The 200 Day Moving Average The Reformed Broker

While the 50-day moving average may appear to offer support or resistance to price it is an illusion.

S&p 500 50 day moving average. There is no best moving average although shorter length averages will be more sensitive to price shocks. The effect of the moving average is to smooth the price movement. Its slope indicates the strength of the trend.

It just so happens to be right around the 2800 mark which the market surged through in January on its path to all-time highs. The Moving Average is the average price of the security or contact for the Period shown. He also speaks to the.

When the SP 500 crosses over its 50-day moving average a key technical level stocks almost always keep moving higher. For example a 9-period moving average is the average of the closing prices for the past 9 periods including the current period. It is a chart showing where the average stock is in relation to its 200-day moving average.

Meanwhile the SP 500 has weathered a noteworthy technical test this week. Below is a chart showing the 50-day moving average spread for the SP 500 since October 2008. Delving deeper the 50-day moving average currently 31567 is rising toward the former range top circa 31650.

The average stock in the SP 500 is about 20 above the moving average. That has happened 10. In theory the direction of the moving average higher lower or flat indicates the trend of the market.

The SP 500 was trading at 3821 at last check but had slipped beneath its 50-day moving average in Friday morning action at 380860 according to FactSet data. Market technicians and chart. Both of the Dow and SP 500 Indexes sliced through their 50 100 and 200-day moving averages in a matter of days.

While theres been a lot of. Longer averages are used to identify longer-term trends. Thats about equal to the average return the market gives out in a year.

For the major indices on the site this widget shows the percentage of stocks contained in the index that are above their 20-Day 50-Day 100-Day 150-Day and 200-Day Moving Averages. Right now the 10-day moving average the green line is a very important place for the SP 500. 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 100 200 300 400 500 600 700 800 900 1000 1100 1200 100 200 300 400 500 600 700 800 900 1000 1100 1200 SP 500 TRANSPORATION INDEX ratio scale 426.

Percentage of Stocks Above Moving Average. Moving averages for SPDR SP 500 Trust ETF SPY. 10 day simple moving average compared with 50 day 100 day 200 day.

SP 500 Index 418762 200-day moving average 363537 50-day moving average 398174 Source. Host David Keller CMT describes the overall rotation from risk-on to risk-off and how Mondays bounce could fit into both scenarios. As you can see the SP has moved well above both its 50-day and 200-day at this point and its currently trading at the top of an uptrend channel that began forming over a year ago.

In depth view into SP 500 50-Day Simple Moving Average including historical data from 1950 charts and stats. For intraday data the current price is used in place of the closing price. SP 500 SPX 418017 4519 109 USD Apr 23 2000.

Bloomberg -- The SP 500 Index has had better months than the more than 5 gain it posted this April but never before has a rally been so widespread and far reaching according to at least one measure tracked by BloombergDuring 18 sessions this month through trading on Thursday 95 or more of the indexs members traded above their 200-day moving average. See the moving averages on the chart. The chart below shows four support levels that may help the markets.

This simply measures the percentage that the SPs price is trading from its 50-day.