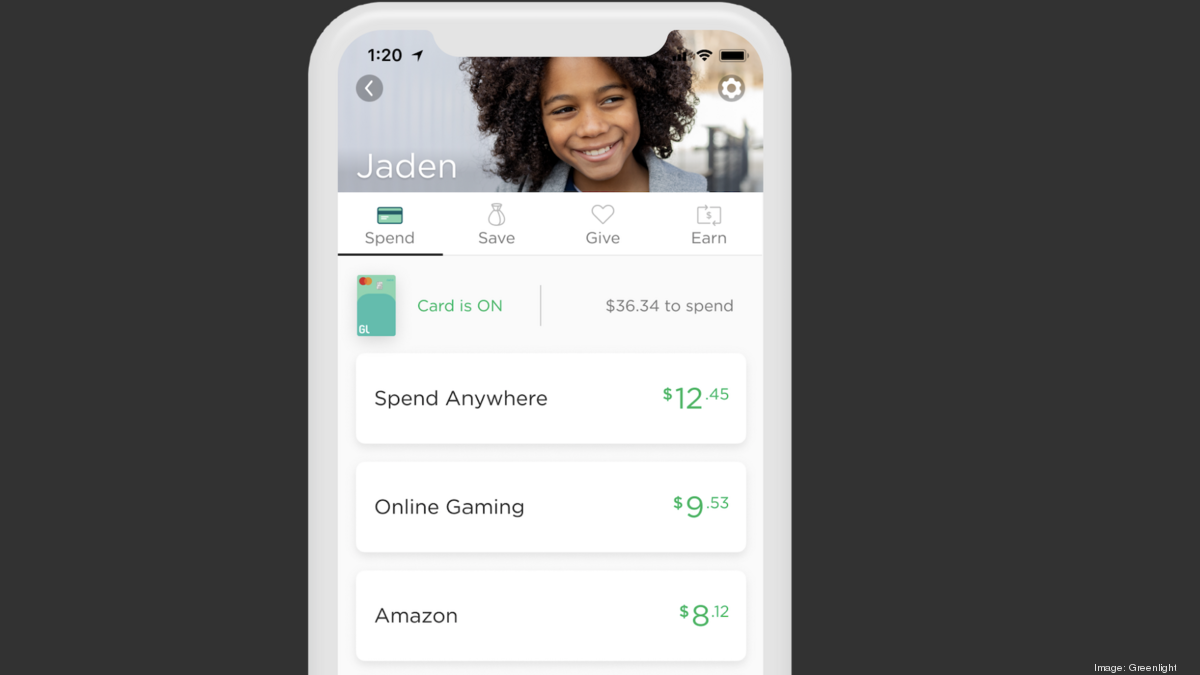

The companys smart debit card helps parents to pick the exact stores where their kids can spend freeze the card if lost or stolen receive instant spending alerts and automate allowances enabling parents to track and monitor their. Greenlight Financial Technology Inc.

Fintech Startup Greenlight Raises 215m Valuation Exceeds 1b Atlanta Business Chronicle

Fintech Startup Greenlight Raises 215m Valuation Exceeds 1b Atlanta Business Chronicle

March 2020 Greenlight Customer Satisfaction Survey.

Greenlight financial technology inc. Financial Services Mobile Apps Prepaid Credit Cards. - Weve made updates to improve your Greenlight experience including the ability to order a replacement card right from your app. 24 2020 PRNewswire -- Greenlight Financial Technology Inc.

Company offers the following services. Company profile page for Greenlight Financial Technology Inc including stock price company news press releases executives board members and contact information. Greenlight Financial Technology Inc.

Greenlight kids set their own goals make tradeoff decisions and learn the power of saving. It is classified as operating in the Custom Computer Programming Software Development Services industry. Greenlight is a debit card and app for managing family finances.

Developer of a smart debit card designed to help parents monitor their childs spending habits. Greenlight Financial Technology has raised 29250 m in total funding. Greenlight the fintech company on a mission to help parents raise financially-smart kids today announced Greenlight Max the first educational investing platform designed for kids.

Give a gift with Greenlight Send money from your phone to theirs. Download apps by Greenlight Financial Technology Inc. Greenlight the fintech company on a mission to help parents raise financially-smart kids today announces the close of 260 million in Series D funding.

It empowers parents with convenient controls to safely manage family finances and create teachable moments around earning spending saving and giving. 14 2021 PRNewswire -- Greenlight Financial Technology Inc. See insights on Greenlight Financial Technology including office locations competitors revenue financials executives subsidiaries and more at Craft.

Greenlight is the bold idea that by shining a light on the world of money we can help kids grow up to become financially healthy and happy adults. Greenlight Financial Technology General Information Description. Greenlight the fintech company on a mission to help parents.

Greenlight Financial Technology has 221 employees at their 1 location and 2925 m in total funding. Greenlight Financial Technology valuation is 12 b. Greenlight Financial Technology Inc.

Greenlight Financial Technology Inc an Atlanta GA-based fintech company focused on helping parents raise financially-smart kids closed a. Greenlight Financial Technology is an Atlanta-based fintech company committed to empowering parents to raise financially-smart kids. Learn more about how to give money to Greenlight kids.

Raised a 260 million Series D round according to a company announcement. Greenlight Financial Technology is a financial services company that specializes in the fields of debit cards for kids and mobile apps. Greenlight Financial Technology Financial Services Atlanta GA 5559 followers Greenlight helps parents raise financially-smart kids.

Greenlight is bigger than a debit card or an app despite how excited we get about both. View Greenlight Financial Technology stock share price financials funding rounds investors and more at Craft. Greenlight Introduces First Educational Investing Platform For Kids ATLANTA Jan.

The funding brings the fintech startups valuation to 23 billion padding its. 89 of their parents said Greenlight has helped teach them financial responsibility. Greenlight Financial Technology Inc.

With the Greenlight app kids and parents. Its groundbreaking family finance product Greenlight is a. Greenlight Debit Card for Kids.

Greenlight Financial Technologys annual revenues are 10-50 million see exact revenue data and has 10-100 employees.