This model provides a strategy designed to fit the needs of investors with long term investment horizons. You can also use the American Funds asset allocation models as a guide when choosing your investments.

Https Www Capitalgroup Com Advisor Investments Model Psg F2 Htm

American Funds Moderate Growth and Income Portfolio Index Blend.

American funds model portfolios. We pick on financial advisors using American Funds because its still the most ubiquitous legal abuse in the business. This is the fund giants second range of model portfolios to make it onto the platform after the American Funds Retire Income Portfolios were added in January. The series available on the AMS fee-based platform includes five portfolios across a range of objectives from conservative to growth.

The Model Funds Composition may be updated during the quarterly update process prior to the Model Statistics and as such the stated as of dates between these data may vary. The American Funds Portfolio Series is designed to help investors pursue longterm investment success. Find the model designed for.

35 Bloomberg Barclays US. Purchase a diversified portfolio of American Funds in a single transaction. 40 American Funds Growth Fund of America AGTHX.

Aggregate 45 SP 500 and 20 MSCI All Country World ex USA Indexes. Allocations may not achieve investment objectives. 20 American Funds Smallcap World SMCWX.

American Funds Model Portfolios offer flexible options that align with your clients goals. Find the model designed for. The American Funds Model Portfolios provide access to mutual-fund investment portfolios constructed and monitored by American Funds whose low-cost mutual funds have been popular among investors and advisors for years.

US and foreign small-cap stocks. AMRMX 39814 38989 36747 6. The blend is rebalanced monthly.

Easily incorporate the funds into your investment portfolio based on common objectives. AWSHX 39981 41186 38818 4. This collection of sample portfolios was designed for investors based on their retirement time frames.

Model portfolios built with your clients in mind. Investments Model Portfolio Details American Funds Growth Model Portfolio Investors should carefully consider investment objectives risks charges and expenses. These portfolio blend asset classes investment managers and investment strategies to achieve diversification.

Model portfolios are a diversified group of assets designed to achieve an expected return with a corresponding risk. This and other important information is contained in the fund prospectuses and summary prospectuses which can be obtained from a financial professional and should be read carefully before investing. This is AKA benchmarking portfolios.

Instead model portfolios. Model statistics are based on the weighted Fund allocation within each model portfolio. American Funds Moderate Allocation Portfolio American Funds Balanced Allocation Portfolio American Funds Growth Allocation Portfolio Style Box Category American Funds Blue Chip Income and Growth Fund 80 80 100 Large Cap Value American Funds Fundamental Investors FundF 50 80 110 Large Cap Blend American Funds Growth-Income FundFCC.

Fund asset_builder redwall_no_load redwall_load 1. During these periods the Model Statistics are based on the prior reported Model Funds. Bond ratings for the American Funds Portfolio Series relate to the securities held by the portfolios underlying mutual funds and if agency ratings of those holdings differ the security will be considered to have received the highest of those ratings.

You can also use the American Funds asset allocation models as a guide when choosing your investments. The portfolios risks are directly related to the risks of the underlying funds. It can be used individually or in.

The fund categories shown growth growth-and-income equity-incomebalanced and bond are commonly found in retirement plans. This collection of sample portfolios was designed for investors based on their retirement time frames. The sum of these weighted Funds make up the respective model statistic.

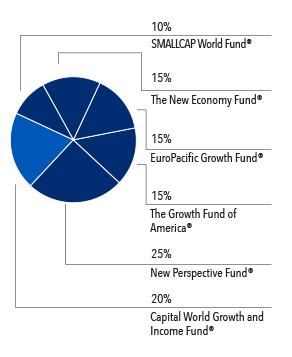

The American Funds Growth and Income Model Portfolio seeks to provide capital growth through a variety of stocks and income through dividend paying companies and fixed income securities. Now that we have a smart design for our portfolio of American Funds we can look at an example that can serve as a model to build your own portfolio. AGTHX 42402 43125 40646 2.

They are also built with the goal of remaining resilient through changing markets enabling efficiency for your growing practice. The American Funds Models are also for commission-based financial advisors that want to do better for their clients than using a few American Funds at random. The American Funds Moderate Growth and Income Portfolio Index Blend is a composite of the cumulative total returns for the following indexes with their respective weightings.

Model portfolios unlike mutual funds are not directly investable although some like American Funds Growth and Income model portfolios have matching mutual funds. Ideally each portfolio has a combination of managed investments based on extensive research. AMCPX 41827 42539 40093 3.

AIVSX 37125 37883 35705 5. Describes all of American Funds Managed Portfolios offerings including Portfolio Series and Target Dates and educates investors on the values of diversified actively managed holdings. Consider what these funds offer.

The fund categories shown growth growth-and-income equity-incomebalanced and bond are commonly found in retirement plans. American Funds Managed Portfolios. VTSAX 45112 43505 43505.

American Funds has landed its Growth Income model portfolios on Morgan Stanley Wealth Managements Select Unified Managed Accounts UMA platform.