This is especially true for longer-term CDs opened in low interest rate environments. ALA 254 37 - 48 Months.

ALA 258 49 - 60 Months 60 mo.

Secu cd interest rates. A Certificate of Deposit is a type of savings account that has a set interest rate and withdrawal date. Typically CD interest rates. Some banks pay interest monthly other semi-annually and others at the maturity of the CD.

Education and health savings accounts are available and offer tax incentives on saving money for school and medical costs. We offer a variety of terms and great fixed rates so saving is simple and secure. Learn more about a home loan with WECU.

25000 min ALA 271 73 -. 15000 min ALA 263 61 - 72 Months 72 mo. 18 month CD rates are also of the best rates available.

Loan Payment Calculator. Share Certificate Rate Bonus Conditions. SECU 60 Month CD.

Find the best CD rates by comparing national and local rates. Full Direct Deposit 010. SECU 1 Year CD.

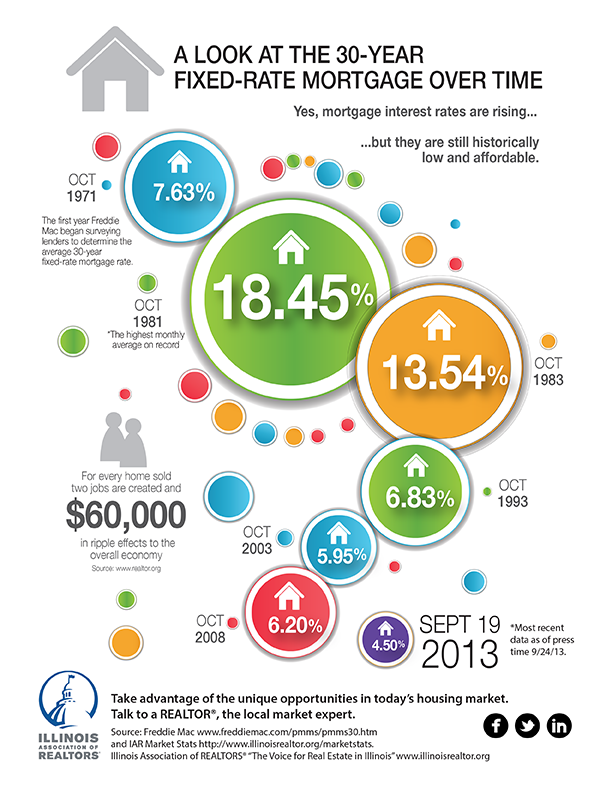

Todays 30-year fixed home loan rates are as low as 2909 APR Purchase and 3035 APR Refi. State Employees Credit Union Interest Rates. The overdraft and ATM fees with these accounts are reasonable there are a variety of different accounts that can really help people in financially-tricky situations and the credit union donates its.

SECUs basic savings account is called a share account and offers a competitive rate. The rate may vary based on credit value and term. Minimum deposit is 100K.

275 over Dividend Rate rate is fixed for term at time of loan closing SECU CD Secured. Active Consumer Loan 010. Minimum deposit is 500.

Current 18 month rates and yields are at 150. Share Secured Loan. Available terms are stated.

Active Checking Account 010. 275 over CD Rate. Find the highest CD rates at banks and credit unions by searching our rate lists here.

Your rate may differ from lowest quoted rate due to credit or collateral value. The minimum balance required to open this account is 1. How Interest is Paid.

Save more with great rates on CDs. Terms may be based on value and credit. These same rates are also available in Tradition Roth and Educational IRA certificates.

The method of distributing the interest earned on a CD varies by bank. As Low As Rate includes discounts for Auto Withdrawal 50 APR and SOCU Visa credit card 50 APR. Members have the option to open regular STCs with 6- to 60-month terms or a series.

Active SECU Credit Card 010. ALA 199 25 - 36 Months. Open an SCCU CD for as low as 500 6.

Even though State Employees Credit Union generally doesnt offer the highest of interest rates we do like its bank accounts especially for people who are interested in banking with a local credit union. You must maintain a minimum average daily balance of 1 in your SDCCU account to avoid a Primary savings account with less than 1 fee. The Rising Rate option is only available on certificate accounts with terms of 48 or 60 months and is not available during any renewal term.

SECU 2 Year CD. The most competitive include a 351 APY 18-month CD and a 400 APY 30-month CD. Theres also an attractive rate of 375 APY on the Jumbo 2-year CD.

The credit unions checking account offers a competitive interest rate and comes with a 1 per month maintenance fee that is automatically donated to the SECU Foundation. Certificate of deposits CDs allow you to grow your money with a locked-in rate of return and maximum security. Loan Disclosures APR is Annual Percentage Rate.

Current 12 month rates at SECU are also at 125 with a yield of 125. All rates are subject to change without notice. In addition theres an IRA-only 15-month CD with an.

One advantage of a branch-based bank is that a depositor can walk into the bank and receive their interest that day in the. A debit card online bill pay and 50 checks per statement are included for free with the checking account. SECU Credit Union has some competitive CD rates.

Rate APY 6 Month CD. State Employees Credit Union offers members the opportunity to earn a higher rate of interest on their savings if they invest their funds for a fixed period of time in one or more STCs. All Current NECU Loan Rates Savings Rates Northeast Credit Union.

Term of CD.