With mobile check deposits savers can deposit a. The Discover Online Savings accounts low fees and ease of use are both must-have features especially online.

Discover Bank Online Savings Account Review Frugal Rules

Discover Bank Online Savings Account Review Frugal Rules

Open a new Discover Online Savings Account online or by phone.

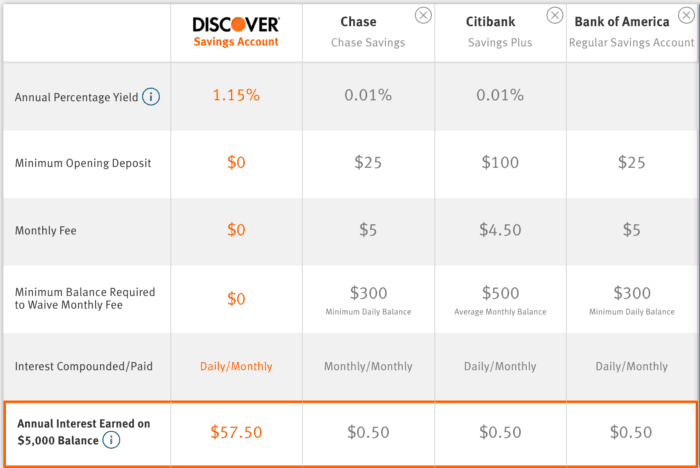

Open discover savings account. Discover Online Savings 040 APY. Soft Pull via ChexSystems. Thats steep but the online bank also offers some of the best savings.

Open a Discover Online Savings account in six steps. They may ask your to verify some information on your credit report such as old addresses or loans. Earn high interest rate of.

Verify your information and electronically sign your application. Not only are the accounts easy to open its simple to log in and review your account information and. Choose Open an Account and select whether youre a new or returning customer.

Well cover these details and more in this in-depth Discover Online Savings account. How do I open a Discover Online Savings Account. Make a deposit now or come back and do it later.

Just give us a few basics like address and Social Security number and well get the ball rolling for you. Lee also helped Maddie open an online bank account where she can deposit paychecks and is discussing using multiple accounts to emulate their envelope system. Person be at least 18 years old have a valid Taxpayer Identification Number have a valid physical US.

Also yes since it is FDIC insured your cash is protected up to 250000 by the federal government. The choice to open a savings account online versus in-person will depend on your personal preferences. Youll have to open an account with the bank and deposit at least 15000.

Click here for more information and to open an account online. Opening an online bank account couldnt be simpler. 10 rows Open a Discover Online Savings Account for all these features.

Additionally you can call our US-based Banking Specialists 247 at 1-800-347-7000 to open an account over the phone. How do I open a Discover Online Savings Account. Citizen or other US.

Opening a savings account online to reach your financial goals. Earn high interest rate of 040 APY. The Discover Online Savings Account offers customers easy on-the-go access to your money and accounts.

Earn 040 APY on your funds. To open an account you must be a US. From Discover Banks website click All Products.

Select Online Banking and click on Online Savings Account. Discover makes you open an online account and tells you that if for any reason someone accesses your account you are SOL unless you are aware it is being tapped. Its 500000 of protection if you open a joint account with a spouse.

Learn more about online savings or see how a savings account calculator can help you reach your financial goals. Is a Discover savings account safe. Opening a savings account online can be a great move for your short- or long-term financial goals.

As children start to get into a savings groove some parents encourage the behavior by offering to contribute the equivalent of a high interest rate to their kids savings funds. Address and provide an electronic consent and signature. Whatever makes it easier for you to get going on your goals.

Learn more about how CDs grow savings safely or open a CD account today and lock in a great rate with terms ranging from 3 months to 10 years. You can absolutely open a savings account without. Open a high-interest no-monthly fee online savings account.

Just open a Discover Savings Account with a minimum opening balance of only 500 to get started and earn a 150 APY on all balances. So much for putting the responsibility on the account holder shoulder 100.