It still shows the same story. In fact they pay much more.

Do The Rich Pay More Or Less In Taxes

Do The Rich Pay More Or Less In Taxes

The top 10 percent pays 533 percent of all federal taxes.

How much do the rich pay in taxes. And the rich the top 1 of earners taking home 387000 or more pay 237. The gap between how much the poor pay compared to the rich is wider with more regressive tax systems. Those making 10 million a year pay an average income tax rate of 19.

However after the estate tax. That much-maligned minority the richest percent of Americans pay 395 of all Federal Income Tax. But of that 525bn nearly a third of all tax raised.

Conversely a progressive tax system has taxpayers pay a higher tax rate as they make more money. 70-100 billion is the estimated tax revenue lost each year due to loopholes. Believe It or Not - the Richest Americans DO Pay Most of the Federal Income Tax Thank God for the 1.

Today the top rate is 434. There is broad support among millionaires for a wealth tax at the 50 million mark see above. - Top 10 States.

In a regressive tax system the average tax rate decreases as the taxable income increases. And the top 1 pay 373 of. When looking at just federal.

It takes years to compile data from tax returns to determine how much citizens paid and who paid the most and the least. The most recent IRS data from 2016 shows that the top 10 of income earners pay almost 70 of federal income taxes. The average annual income in Denmark is about 39000 euros nearly 43000 and as such the average Dane pays a total amount of 45 percent in income taxes.

And the top 1 pay 373 of the total. But that support decreases significantly if the wealth tax kicked in at 10 million and therefore impacted more people. But who exactly is paying all that money.

For example the top 1 already pay 29 of all income tax. With tax rises now almost surely on the horizon the question will be who should pay. Tax rates for those making 1 million level out at 24 then declines for those making 15 million.

Who Pays The Most Taxes. So how exactly do the super rich hide that much money from the government every year. Top earners pay a disproportionately large share of the federal tax burden.

The rich it is often claimed already contribute a large share of tax revenues. Whats more the tax falls only on wage income. Someone making an average of 75000 is paying a 197 rate.

And those are the ones that pay the middle-class. Theres not much scope for them to pay more. The average federal income tax rate of the richest 400 Americans was just 20 percent in 2009.

And these are institutions owned by the rich. In total we paid 174bn income tax in 2016-17 the latest year for which figures are available. High-Income Taxpayers Paid the Majority of Federal Income Taxes In 2017 the bottom 50 percent of taxpayers those with AGI below 41740 earned 113 percent of total AGI.

The top 1 percent of taxpayers paid roughly 615 billion or 401 percent of all income taxes while the bottom 90 percent paid about 440 billion or 286 percent of all income taxes Additionally the proportion of income taxes paid by the rich has been increasing over time. That is one of the most eye-catching figures in a study released by the Tax Foundation earlier this month. The richest 1 pay an effective federal income tax rate of 247 in 2014.

In most developed countries a larger percentage of taxes are paid by companies and corporations. The wealthiest taxpayers are taking the heat. Last October Bloomberg reported that the top half of taxpayers pay 97 of all federal income tax.

The last year for which concrete comprehensive statistics are available is 2017 when individual taxpayers paid 16 trillion in taxes. While middle-class earners in the fourth quintile with income of 58000 to 89000 for singles pay a rate of 67. This group of taxpayers paid 498 billion in taxes or roughly 3 percent of all federal individual income taxes in 2017.

The payroll taxes that finance Social Security are flat for the first 132900 that a person earns and then the rate drops to zero percent. Individuals in the top 1 percent of earners paid more than 538 billion in income taxes in 2016 more than the bottom 90 percent of payers combined. Those in the lowest income quintile earning up to 23000 for a single person actually get money back from the federal government.

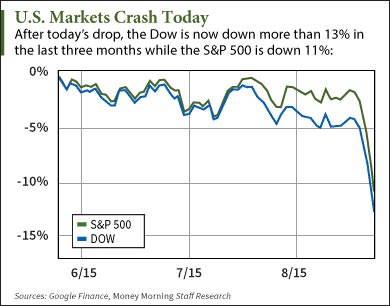

/stock-market-crash-examples-cause-impact-0bec595270e04e5797c442c3c21961b8.jpg)