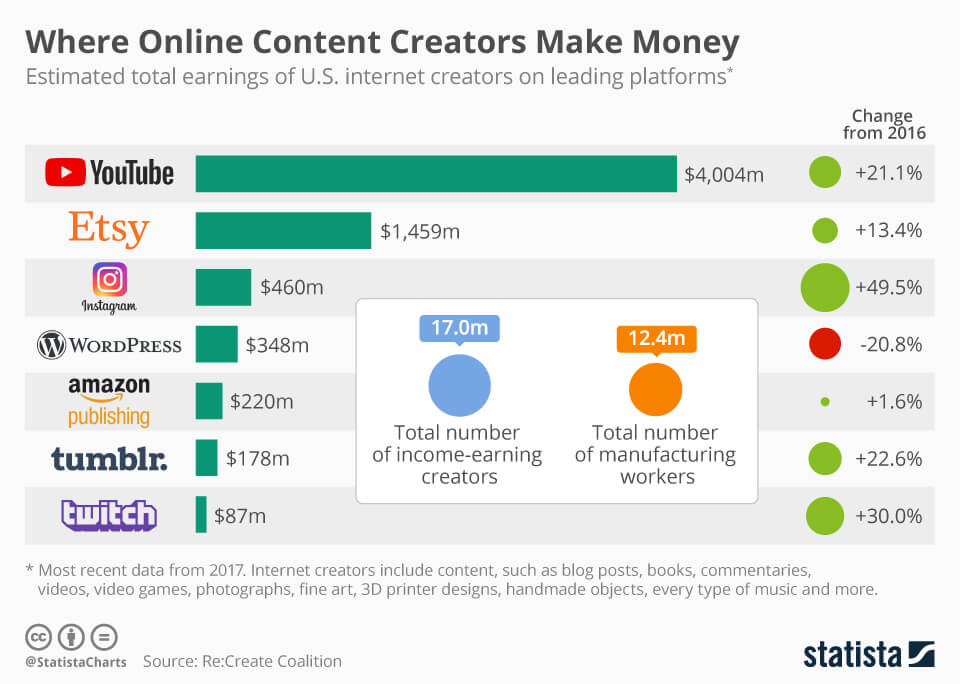

The 401k contribution limit is 19500 in 2021. Must the employers contribution be in cash.

Historical 401k Contribution Limits Employer Profit Sharing Is Important

Historical 401k Contribution Limits Employer Profit Sharing Is Important

For most people the biggest factor in the size of your 401k balance at retirement isnt your rate of return but the amount you save.

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)

How to contribute to 401k. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit. How much you can annually contribute to a Roth 401k is the same as it is for a traditional 401k. If you contribute 6 of your annual earnings 6000 your employer would contribute an additional 50 of that amount.

If your solo 401k is a traditional 401k then you will be required to take distributions from the account in retirement. In 2020 and 2021 you can contribute up to 19500 to a 401k including pre-tax and designated Roth contributions. Workers age 50 and older can contribute an additional 6500 in 2021.

If youre 50 or older you can make catch-up contributions up to 6500 If you can max out your 401k contributions through. The maximum catch-up contribution. So for example say you make 100000 a year baller and your employer offers a 401k matching of 50 up to the first 6 you elect to contribute.

In general distributions prior to age 59½ will be hit with a 10 penalty and income taxes. 1 day agoThe benefit to a 401k is that it is contributed to with pre-tax dollars before you pay income taxes. The other contributes 8 percent.

Rather theres a limit on the total yours and the employers contribution each year. Once you contribute to a 401k you should consider that money locked up for retirement. But its not the only one.

Employees age 50 and older can make additional catch-up contributions of up to 6500 for a maximum possible Roth 401k contribution of 26000. In this guide we explain 401k contribution limits for the calendar year. Can you contribute to your 401k after you quit or leave your job.

As a reminder the contribution limit is 19500. The IRS limits how much you can contribute to a 401k in a given year. Theres no specific limit on the employer contribution.

One contributes 5 percent of his salary each year. No the employer can contribute stock or cash. If your plan rules allow the new law gives you the opportunity to make catch-up contributions to your retirement plan.

A 401k is a special type of retirement account that allows employees to set aside a portion of their salary for long-term investing. In any case if your company offers a 401 k matching contribution you should put in at least enough to get the maximum amount. Consider two employees who each earn 100000 a year get 3 percent raises each year and earn 5 percent on their 401k plan.

For 2021 its 58000 or 100 of your salary whichever is less. How much can my employer contribute. The short answer is no A 401k is designed to make it easier for employers to.

A 401k is eligible for certain tax benefits from the IRS as its considered a defined-contribution. These distributions become mandatory when you reach 72 years of age and they are taxed as income. In some cases you can even benefit from a company match up to a certain amount.

A 401k is an important tool for maximizing your retirement savings. If your solo 401k is a Roth 401k then unlike employer-sponsored plans the same required minimum distribution rules. We break down how much you should contribute to your 401k how much should go to other vehicles like IRAs and how to balance retirement savings with other priorities like paying down debt.

A typical match might be 3 of salary or 50 of the first 6 of the. Depending on your age cash balance plan contribution limits are as high as 288000 each year. The Roth 401k contribution limit is 19500 in 2021.

That tax though will simply just be deferred to when you begin to draw on the funds. In the current tax laws the benefit of a cash balance plan is that it allows far higher contributions than a 401k which are limited to 19500 per year 26000 if over 50. Qualifying for a 401k match is the fastest way to build wealth for retirement.

The 401k contribution deadline is Dec. 401ks and 403bs operate on a calendar-year schedule so the last day to make those contributions for 2020 is Dec.