For example such a score might put more emphasis on. Since revolving credit is less of a factor when it comes to mortgages the FICO 2 4.

How Fico Score 9 Is Different From Fico Score 8 To Boost Credit Rating

How Fico Score 9 Is Different From Fico Score 8 To Boost Credit Rating

Base FICO Scores such as FICO Score 8 are designed to predict the likelihood of not paying as agreed in the future on any credit obligation whether its a.

/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)

What is fico score 8 used for. This score tells the. 1 Your Fico score is only one of many factors considered for a new CC. Most credit card issuers on the other hand use FICO Bankcard Scores or FICO Score 8.

By comparing this information to the patterns in hundreds of thousands of past credit reports the FICO Score estimates. Nowadays the FICO score is a sophisticated piece of financial technology that businesses rely on to select the best possible loan candidates. FICO also offers industry-specific variations of its scoring models like for the auto credit card and mortgage-lending industries.

The FICO score is the most popular option for lenders especially for mortgages though it has reputable competitors like VantageScore. That FICO score is calculated by a mathematical equation that evaluates many types of information from your credit report at that agency. Its FICO score a measure of consumer credit risk has become a fixture of consumer lending in the United States.

FICO Bankcard Scores or FICO Score 8 are the score versions used by many credit card issuers. FICO Bankcard Scores 2 4 5 and 8. The FICO 8 model is known for being more critical of high balances on revolving credit lines.

It turns out that the most widely used FICO score is the FICO Score 8 according to Fair Isaac. With your utilization however it is important to see what cards you already have and what sort of balances. The model used to produce itlike FICO FICO 8 or FICO 9and.

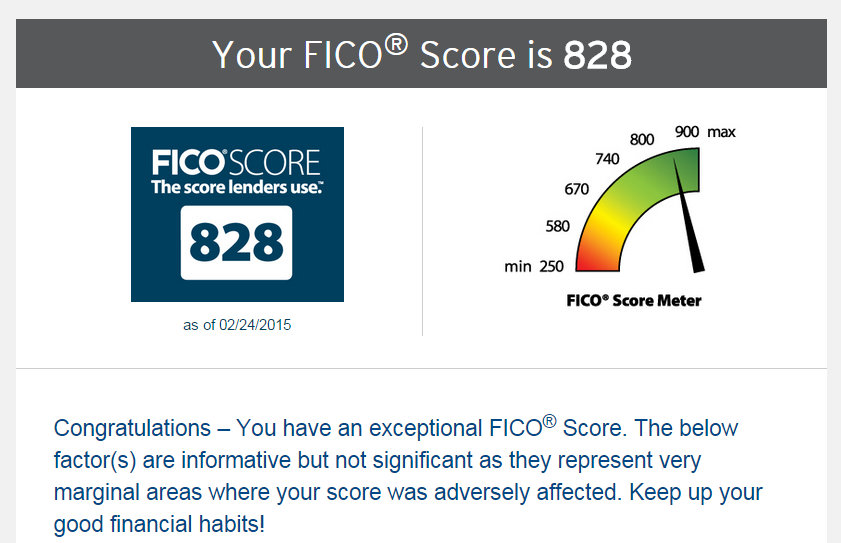

FICO Auto Scores 2 4 5. The Score The FICO score ranges between 300 and 850. This version can also be used in auto lending as well as for personal loan and credit card decisions.

Although FICO didnt create these models specifically for auto lenders they are widely used credit scores and auto lenders may use a base FICO Score when reviewing auto loan applications. Which FICO Score is Used for Mortgages Most lenders determine a borrowers creditworthiness based on FICO scores a Credit Score developed by Fair Isaac Corporation FICO. Your credit card issuer can pull your score from any or all three bureaus.

The higher your credit scores the more likely. FICO Score 8 and 9. Most widely used.

FICO Auto Scores. Fair Isaac Corporation originally F air I saac and Co mpany is a data analytics company based in San Jose California focused on credit scoring services. Which credit reporting agency provided the underlying credit report.

It was founded by Bill Fair and Earl Isaac in 1956. FICO scores are widely used by many types of creditors including lenders credit card issuers and insurance providers to gauge your credit risk that is how likely you are to repay the money loaned to you. Currently the most common FICO score is FICO 8.

These are the latest generic FICO scoring models. Since FICO 8 Bankcard Score is specifically designed for credit card lenders it uses credit criteria more conducive to that type of lending. The bank will pull your file info and apply whatever score model they use often one or two or all three of your listed FICO 8 scores with a HP.