Apple Card gives you unlimited 3 Daily Cash back on everything you buy from Apple whether its a new Mac an iPhone case games from the App Store or even a service like Apple Music or Apple TV. A better credit score means a higher credit limit and credit limit also increases over.

Apple Card The Credit Card From Apple Is Now Available Iphone J D

For example increasing your credit limit could improve your buying power and your credit score.

Apple credit card credit limit. Types of Credit. Then I was given an option to have Goldman Sachs review my application and approved with a 250 limit at 1299. Goldman Sachs will need your credit history with Apple Card to inform any request for credit limit increases on Apple Card.

With my 800 credit score I got 1000 usd credit limit not even enough for a new iPhone. Goldman Sachs will need your credit history with Apple Card to inform any request for credit limit increases on Apple Card and this can take six months or more. As with any other credit card there is a credit limit for Apple Card that will vary from person to person.

Reuters - Apple Inc AAPLO co-founder Steve Wozniak joined in the online debate over accusations of gender discrimination. While the Apple Cards financial health help page says you can request a credit limit increase after as little as four months other Apple Card documentation mentions establishing credit history for six months or more before you apply. In general the requirements to obtain a higher credit limit on a credit card are similar to what they are to get approved for the account in.

You may want to increase your limit for various reasons. Tell the Apple Card support rep youd like to request a credit limit increase As noted by Apple in a support document Goldman Sachs will need. We have no separate bank accounts or credit cards or assets of any kind.

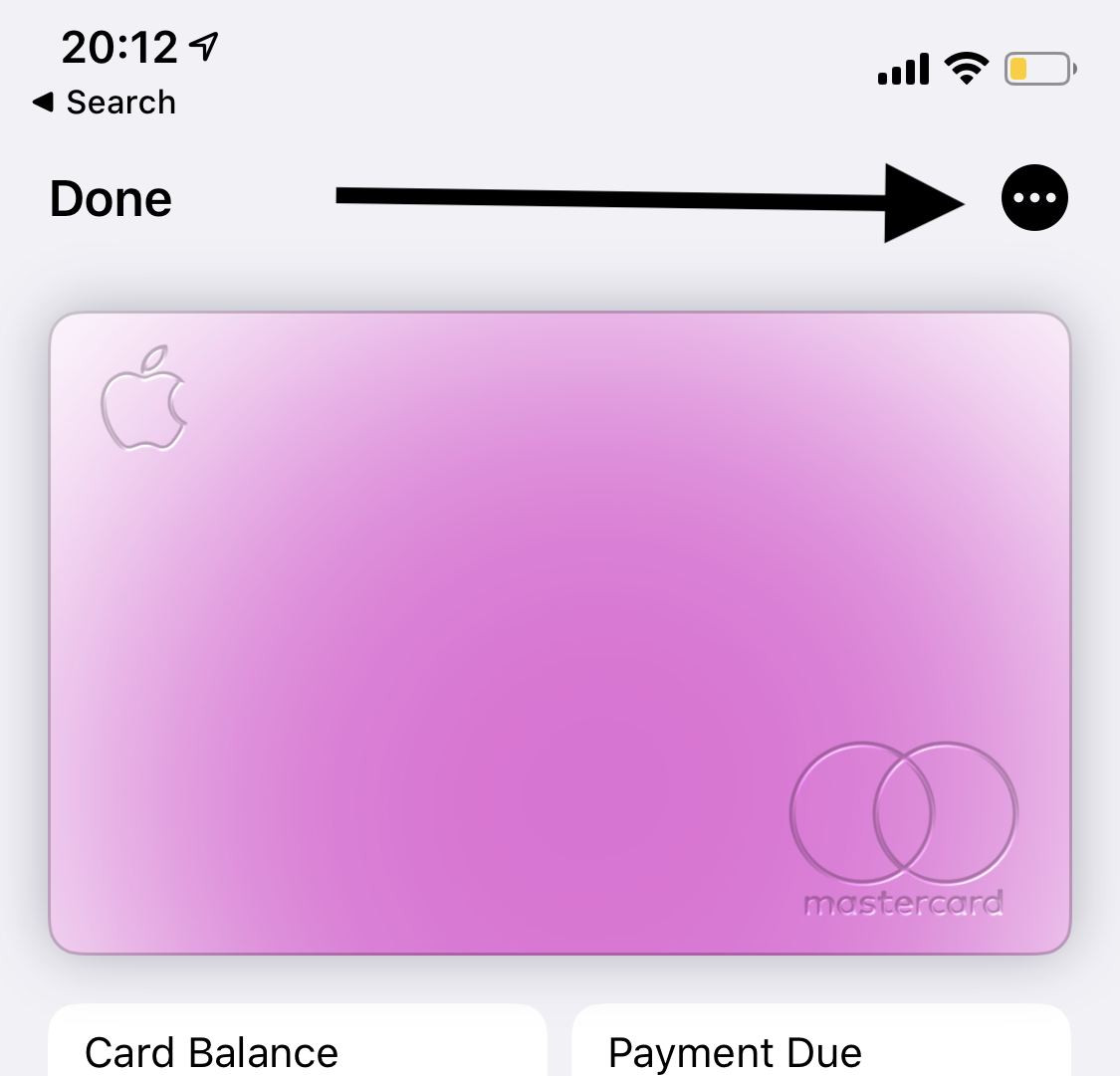

For additional assistance in managing your Apple Card. Goldman Sachs also looks at your income and the minimum payments tied to your existing debt. Scroll to Credit Details.

Apple Card Approval 40k limit at 1299 APR. This short article explains how you can increase your Apple Card credit limit. So excited I went thru days of troubleshooting.

Tap the more button. While he said the interest rate of about 24 was lower than the other card he carries its higher than the average for. We both have the same high limits on our cards including our AmEx Centurion card.

But 10x on the Apple Card. If youre interested in increasing your credit limit you can make a request after youve had your Apple. He got approved for Apple Card but he only got a credit limit of 750.

When you first apply for an Apple Card or any other credit card for that matter the cards issuer will calculate your debt-to-income ratio by comparing your. Apple co-founder says Apple Card algorithm gave wife lower credit limit. I was excited to get one of these.

Apple card approval EXTREME LOW Limit. Six months is a fairly standard time frame for demonstrating that youre a responsible cardholder but the longer youve held the Apple Card the. I just applied the Apple Card through my phone.

Why your application is pending or in review Goldman Sachs might need more time to review some applications or request more information to verify your identity. Your Apple Card limit is the maximum amount that you can spend using your card before you need to pay off some of your balance. And my card utilization will be so high that it hurts my credit score in the long run.

You can see your account Credit Limit Available Credit and APR. After Goldman Sachs approves your Apple Card application they assign your initial credit limit using many of the same factors that go into the approval process such as your credit score and existing credit. When I finally figured out the tech issue I got turned down at first.

To manage your Apple Card online we recommend using the latest version of Safari Firefox Microsoft Edge or Chrome. Wow I was mad and sad. How to Qualify for an Apple Card Credit Limit Increase.

I have declined the offer.