Starting in 2021 taxpayers can use our new e-file portal to file statements. The payroll expense tax.

San Francisco City County Off The Grid

San Francisco City County Off The Grid

The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes.

San francisco business tax. The City collects taxes from San Francisco businesses including. Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax. Additionally businesses may be subject to up to four local San Francisco taxes.

San Francisco Business Owners are offered a more convenient way to file their Business Property Statement with our office. Businesses must file and pay taxes and fees on a regular basis. The San Francisco Gross Receipts Homelessness Gross Receipts Commercial Rents.

The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022. City and County of San Francisco 2000-2020. While this tax was originally scheduled to phase out completely during 2018 it was retained at 038 percent because GRT revenue was lower than expected.

The rate is adjusted periodically and for the 2018 tax year is 038 percent. A San Francisco ballot measure that approves sweeping business tax changes passed Tuesday night with results including a large number of mail-in. The City collects a tax on gross receipts Gross Receipts Tax from some businesses in San Francisco at a rate from 016 to 065 annually.

In 2014 the Office of the Treasurer and Tax Collector began implementing the Gross Receipts Tax and Business Registration Fees Ordinance. Under the ordinance the City will phase in a Gross Receipts Tax and reduce the Payroll Expense Tax over the next. Gross Receipts Tax Applicable to Private Education and Health Services.

To file your Statement please click the Access Tool button below. Under the proposal companies subject to the tax would pay an additional 01 to 06. Companies engaging in business in San Francisco the city must register in the city and pay an annual registration fee.

The administrative office tax. Administrative and Support Services. The gross receipts tax.

571-L business 571-R apartment 571-STR short term rental and 576-D vessel. The payroll expense tax applies to any business that pays compensation for work performed within the city. 311 is now the first point of contact for all inquiries to the Office of.

And The homelessness gross receipts tax Homelessness. San Francisco businesses are also subject to annual registration fees based on San Francisco gross receipts for the immediately preceding tax year. The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014.

The annual business registration fee. Business Registration and Tax Questions The Office of the Treasurer Tax Collector TTX has partnered with 311 to provide customer service to all San Francisco residents businesses and visitors. The Way It Is Now.

And Miscellaneous Business Activities. For lien year 2021 it is 11984 and the Office of Treasurer Tax Collector will mail tax bills for unsecured property to taxpayers in July 2021 and payments will be due by August 31 2021. When you file your business property statement in a timely manner you should receive your bill by the end of July.

Renew change or refile a Fictitious Business Name FBN Tell the City if you want to change your registered trade name address or ownership information. This measure would increase that tax as well to 147 in tax year 2022 154 in 2023 and 161 in 2024 and thereafter. Current city tax rates on businesses vary between 01 to 06 of their gross receipts.

Under the general rule the registration fee is 90 for businesses with less than 100000 in receipts which increases to 35000 for businesses with more than 200 million in gross receipts. The Way It Is Now. The message from the San Francisco Tax Collector which should have been delivered to San Francisco businesses by email on January 26 2021 is copied and pasted below for your convenience in case you missed it.

The early care and education commercial rents tax Child Care Tax. Digest by the Ballot Simplification Committee. Annual business registration fees.

2020 Annual Business Tax Returns. Businesses that operate only an administrative office in San Francisco currently pay a 14 payroll tax instead of a gross receipts tax. The Office of the Treasurer Tax Collector in the City and County of San Francisco have extended Business Tax and Fee Deadlines.

Businesses operating in San Francisco pay business taxes primarily based on gross receipts. Which was approved by voters in November 2012 Proposition E. San Francisco Gross Receipts Tax.

The tax would kick in.

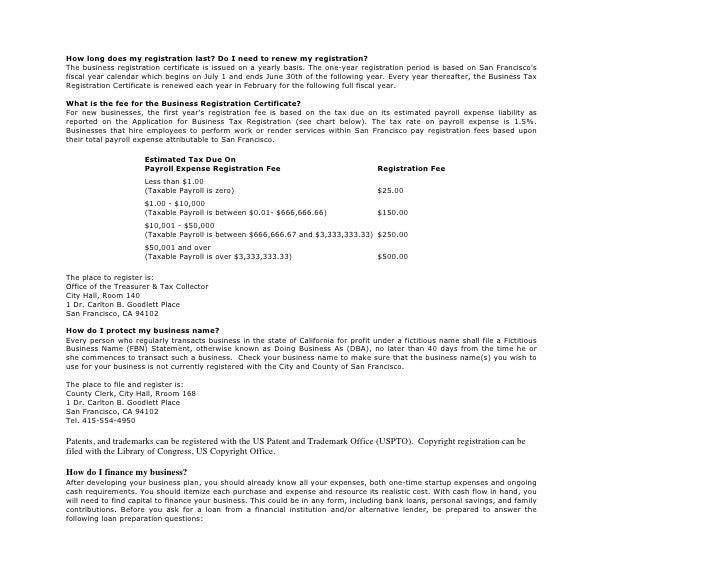

San Francisco Business Start Faq

San Francisco Business Start Faq

San Francisco Gross Receipts Tax Sfgov

San Francisco Gross Receipts Tax Sfgov

San Francisco S Business Tax Measures On The Ballot May Spur More Companies To Leave San Francisco Business Times

San Francisco S Business Tax Measures On The Ballot May Spur More Companies To Leave San Francisco Business Times

San Francisco Approves Business Tax To Fund Homeless Services The New York Times

San Francisco Approves Business Tax To Fund Homeless Services The New York Times

Https Www Sfcityattorney Org Wp Content Uploads 2015 07 Claim For Business Tax Refund 2018 04 Pdf

San Francisco Voters Approve Taxes On Ceos Big Businesses

San Francisco Voters Approve Taxes On Ceos Big Businesses

San Francisco City County Off The Grid

San Francisco City County Off The Grid

Annual Business Tax Returns 2020 Treasurer Tax Collector

Annual Business Tax Returns 2020 Treasurer Tax Collector

Annual Business Tax Return Treasurer Tax Collector

Annual Business Tax Return Treasurer Tax Collector

Jose Cisneros Treasurersf Twitter

Jose Cisneros Treasurersf Twitter

Annual Business Tax Returns 2019 Treasurer Tax Collector

Annual Business Tax Returns 2019 Treasurer Tax Collector

Annual Business Tax Return Treasurer Tax Collector

Annual Business Tax Return Treasurer Tax Collector

Annual Business Tax Returns 2019 Treasurer Tax Collector

Annual Business Tax Returns 2019 Treasurer Tax Collector

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.