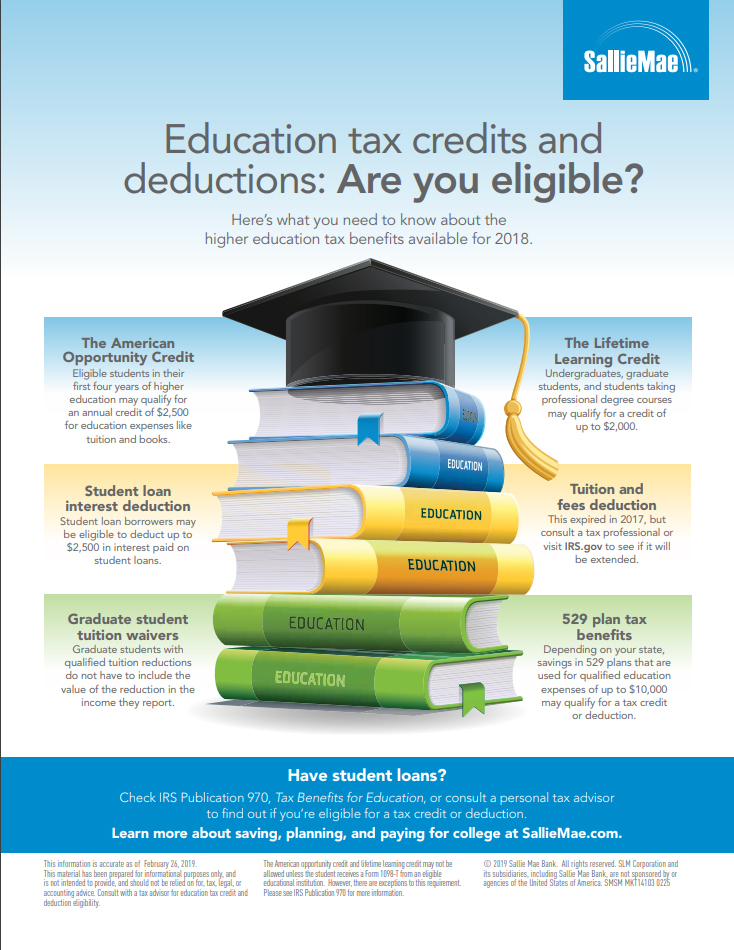

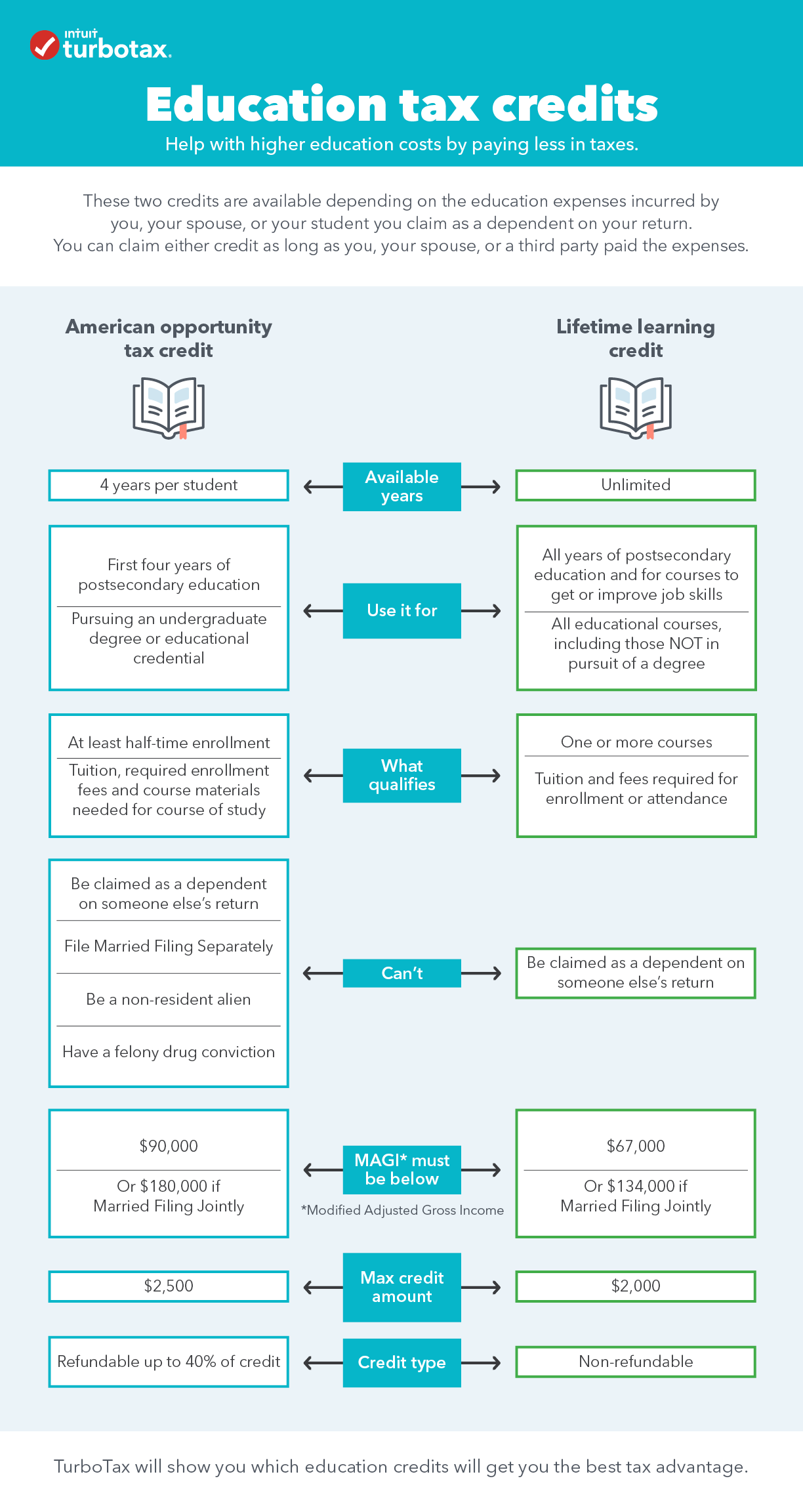

Tax credit can be received for 100 of the first 2000 plus 25 of the next 2000 that has been paid during the taxable year. Additionally the Lifetime Learning credit can also help cover the cost of graduate school and of courses taken to maintain or improve job skills.

How To Use Your 1098 T To Claim An Education Credit Money For College Project

It is refundable up to 1000 which means you can get money back even if you do not owe any taxes.

College student tax credit. If you exceed the income threshold your child could still be eligible for the credit as long as you dont claim them as your dependent. Also 40 of the credit up to 1000 is refundable. I went to school for two terms in 2010 but withdrew in order to transfer to another school.

This means if the credit brings the amount. 160000 and 180000 for joint filers. Available college student tax credits.

If you want to claim working tax credit you will need to do paid work in addition to your studies. The American Opportunity Credit and the Lifetime Learning Credit. The childs gross income income thats not exempt from tax is.

Your family might also miss out on the American Opportunity Tax Credit AOTC worth an annual maximum of 2500 per eligible student and the lifetime learning credit LLC worth up to 2000 per. Worth a maximum benefit up to 2500 per eligible student. Can I Claim My College Student as a Dependent if They Dont Meet the Above Tests.

College student tax credit. Will my old school still send one out since i went for two terms. For 2020 the phaseout range is between 80000 and 90000 of MAGI for single filers.

For students pursuing a degree or other recognized education credential. With the American opportunity tax credit AOTC taxpayers are eligible to claim a credit of up to 2500 for the first four years of post-secondary education for tuition and fees course-related. The Lifetime Learning tax credit can help cover undergraduate costs for a student who is not eligible for the American Opportunity credit because theyre carrying a limited course load or already have four years of college credit.

Lets dive into the details of each college student tax credit. Students who are in graduate school or who arent attending school at least half time may be eligible for the lifetime learning credit which is worth. Any time spent working which is part of your studies will not count as remunerative work.

The student tax deduction Student Loan Interest Deduction. Im still not enrolled in my future school yet. Will i still get the tax form i need in order to be claimed as a dependent.

American Opportunity Tax Credit This tax credit is worth up to 2500 annually for eligible students. Only for the first four years at an eligible college or vocational school. If you claim your college student as a dependent you may be eligible for education tax credits like the American Opportunity Credit or the Lifetime Learning Credit.

However the American Opportunity credit can only be claimed during the students first four years of higher education. You can claim the AOTC for every eligible student in your. This means if the credit brings.

This means you can get it even if you owe no tax. The American opportunity tax credit is. However there are income thresholds for these benefits.

Tax credits are frequently more valuable than tax deductions because credits reduce your tax bill dollar-for-dollar while deductions only reduce your taxable income. Credit Amount for 20202021. The AOTC is a tax credit worth up to 2500 per year for an eligible college student.

You can claim tax credits while you are a student provided you meet the qualifying rules. The AOTC is a partially refundable credit. 40 of the tax credit is refundable.

You provide more than half of the childs support. It is a tax credit of up to 2500 of the cost of tuition fees and course materials paid during the taxable year. You may claim this credit a maximum of four times per eligible college student.

If youre a recent college graduate you may. The American Opportunity Tax Credit AOTC provides a tax credit to offset the cost of tuition required fees and course materials needed for attendance. What student tax credit can I claim for my education expenses.

There are two major education tax credits available to students to help offset the costs of higher education. Up to 2500 of the cost of tuition fees and course materials paid during the taxable year per eligible student. If you do not have any children and do not have a disability you will need to be aged at least 25 and work at.

Its worth up to 100 of the first 2000 of qualified education expenses and 25 for the next 2000 of those expenses for a maximum credit of 2500 per eligible student. If your child doesnt meet these tests your college student can still be your dependent if.

Tax Planning For Parents Of College Students

Tax Planning For Parents Of College Students

Ecsi Student Loan Tax Incentives

Ecsi Student Loan Tax Incentives

Tax Planning For Parents Of College Students

Tax Planning For Parents Of College Students

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

College Tax Planning Strategies

Higher Education Tax Benefits Do You Qualify Business Wire

Higher Education Tax Benefits Do You Qualify Business Wire

College Tuition Tax Credit A Consolation Prize To Big Tuition Bills Above The Canopy

Education Credits And Deductions Form 1098 T Support

Education Credits And Deductions Form 1098 T Support

Tax Breaks For College Costs Landsberg Bennett

Tax Breaks For College Costs Landsberg Bennett

Education Or Student Tax Credits You Could Apply On Your Taxes

Education Or Student Tax Credits You Could Apply On Your Taxes

Nontraditional College Students The Cpa Journal

Nontraditional College Students The Cpa Journal

What Education Tax Credits Are Available

What Education Tax Credits Are Available

Now Is The Time To Consider College Tax Credits For 2015 And Beyond

Now Is The Time To Consider College Tax Credits For 2015 And Beyond

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.