Once you have met the requirement you could be well on your way to enjoying both the rate and a host of features to better. The investing account is free to set up but youll have to pay a 3 monthly fee for balances between 10000 and 49999.

Fidelity Removes Commissions On Stocks Etfs Options Plus Automatic Sweep To High Yield Account Doctor Of Credit

Fidelity Removes Commissions On Stocks Etfs Options Plus Automatic Sweep To High Yield Account Doctor Of Credit

Youll be responsible for a 035 annual fee if youve got more than.

Fidelity high yield savings account. Contact Us About Us. For example the best high yield savings account currently has a 075 APY annual percentage yield that is essentially 75 times what you can get with a money market fund. It Adds Up Faster Than You Might Think A common goal is having a months take-home pay in savings.

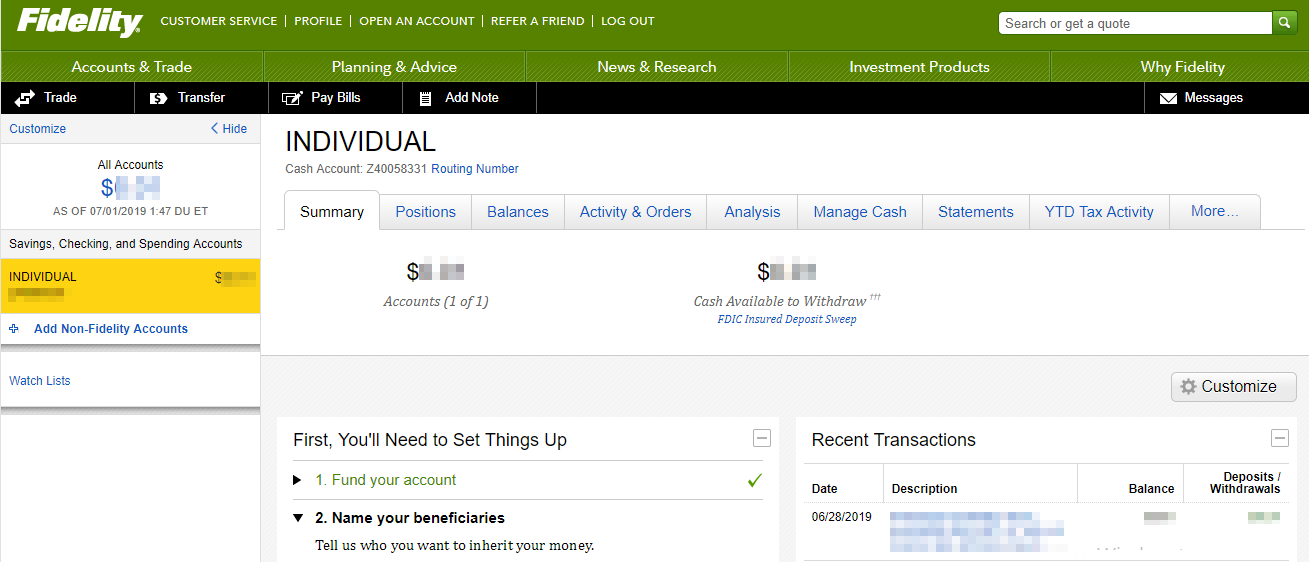

The Fidelity Cash Management Accounts uninvested cash balance is swept to one or more program banks where it earns a variable rate of interest and is eligible for FDIC insurance. Abeg try contact your account officer or their customer care - Trueservefidelitybankng 01-448-5252 or Whatsapp. Its as simple as that.

Make a deposit now or come back and do it later. The Fidelity High Yield Savings Account offers you a great investment opportunity to make your money grow in the long term. 2500 minimum opening deposit.

That means you can access your savings. Open Now View Rates. 541pm On Jun 09 2020.

Some brokerage firms offer cash management accounts which automatically move cash in their clients accounts into bank savings accounts which provide them with FDIC protection. The Annual Percentage Yield APY takes into account the effect of monthly compounding of the interest posted to your account. You need to understand.

Please note that there may be a foreign transaction fee of 1 that is not waived which will be included in the amount charged to your account. 0 up to 035 for automated accounts Fees. And thanks to the FDIC insurance on these accounts the money is as safe or even more so than it.

The Fidelity Cash Management Account is a brokerage account designed for spending and cash management. Customers interested in securities trading should consider a Fidelity Account. Secured Real Estate Investments.

Invest Short Term 6-12 Months in SFR TH Projects. 0 - 9999 10000 10 monthly fee if balance falls below 2500. With a high-yield savings account from Fidelity Bank Direct an initial deposit of 500 and contributions of just 100 a month that goal is within reach.

The reimbursement will be credited to the account the same day the ATM fee is debited from the account. Opening a high-yield Online Savings Account couldnt be simpler. High interest savings Enjoy the flexibility of our high interest savings accounts for businesses.

High-yield savings accounts are a type of deposit account that can be found at both online and brick-and-mortar institutions. Fidelity Bank is currently offering residents a generous 115 APY when you sign up and open a new High Yield Savings Account. Savings accounts at banks offer flexibility and insurance from the Federal Deposit Insurance Corporation FDIC.

Earn a higher rate than traditional savings accounts while maintaining easy access to. If the number of available banks changes or you elect not to use andor have existing assets at one or more of the available banks the actual amount could be higher. 0 25000 for Fidelity Personalized Planning and Advice Account minimum.

It is referred to as the 7-day yield. Features Open account with any amount. At a minimum there are five banks available to accept these deposits making customers eligible for nearly 1250000 of FDIC insurance.

Your account will automatically be reimbursed for all ATM fees charged by other institutions while using a Fidelity Debit Card linked to your Fidelity Cash Management Account at any ATM displaying the Visa Plus or Star logos. Fidelity Bank High Yield Savings Account Is A Scam by BankNaija. These financial tools typically pay a higher interest rate than.

Just give us a few basics like address and Social Security number and well get the ball rolling for you. 0 0 to 30 for automated accounts Account minimum. It is not intended to serve as your main account for securities trading.

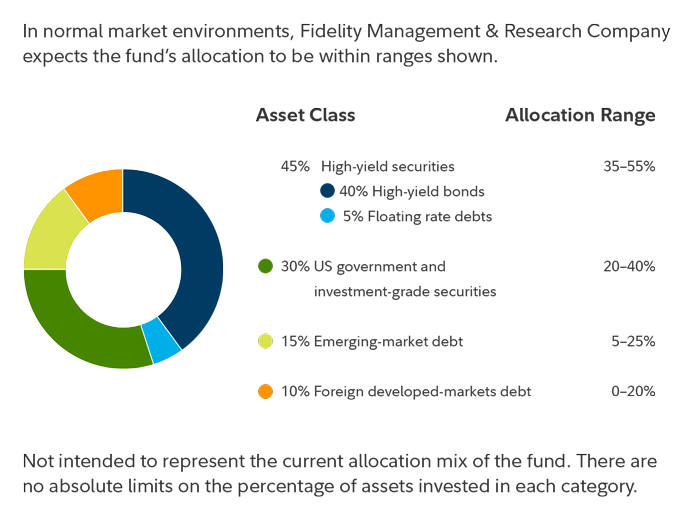

The rate of return of a money market fund is typically shown for a seven-day period as is the case with Fidelity Government Money Market Fund and Fidelity Government Cash Reserves displayed above but is expressed as an annual percentage rate. These accounts include a Fidelity brokerage account or a Fidelity margin account. ATM access is available.

Open a High Interest Savings account online in minutes. The account earns just 001 APY for balances under 100000. Fidelity High Yield Savings Account Results from Microsoft.

To qualify for this rather attractive rate all you would have to do is deposit 1000000 into your new account. Savings accounts are liquid. Earn a higher rate for each tier.

Why Vanguard And Fidelity Money Market Funds Are A Money Losing Proposition Go For A High Yield Savings Account Instead Aving To Invest

Why Vanguard And Fidelity Money Market Funds Are A Money Losing Proposition Go For A High Yield Savings Account Instead Aving To Invest

Where To Park Cash In Fidelity Bogleheads Org

Where To Park Cash In Fidelity Bogleheads Org

Benefits Of The Fidelity Bank High Yield Savings Account Hysa Mntrends

Benefits Of The Fidelity Bank High Yield Savings Account Hysa Mntrends

Fidelity Bank High Yield Savings Account Review 1 15 Apy Texas Only

Fidelity Bank High Yield Savings Account Review 1 15 Apy Texas Only

Aura Cool On Twitter Grow Little By Little Grow Change By Change Grow With A Savings Account That Has High Yield Interest Grow With Fidelity Bank S Hysa High Yield Savings Account Fidelitysavingschallenge Https T Co Jj3qnar69f

Aura Cool On Twitter Grow Little By Little Grow Change By Change Grow With A Savings Account That Has High Yield Interest Grow With Fidelity Bank S Hysa High Yield Savings Account Fidelitysavingschallenge Https T Co Jj3qnar69f

Savings Account Fidelity Bank Plc Fidelity Bank Savings Account

Savings Account Fidelity Bank Plc Fidelity Bank Savings Account

Best High Interest Savings Accounts In Nigeria In 2021 Bank Naija

Best High Interest Savings Accounts In Nigeria In 2021 Bank Naija

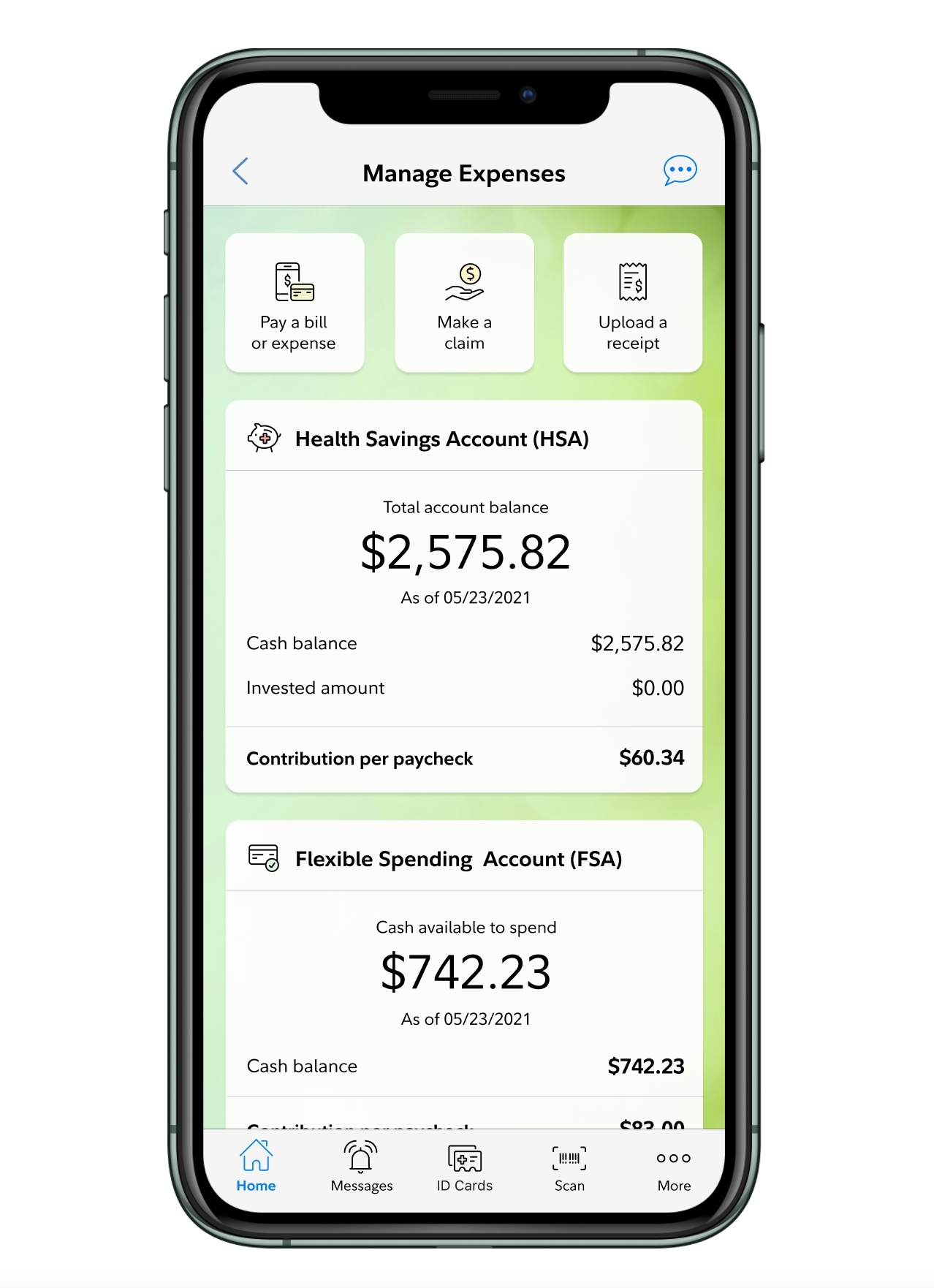

Fidelity Surpasses 10 Billion In Health Savings Account Assets Business Wire

Fidelity Surpasses 10 Billion In Health Savings Account Assets Business Wire

Fidelity Bank Reduces Savings Interest Rates Business Post Nigeria

Fidelity Bank Reduces Savings Interest Rates Business Post Nigeria

Gbenga On Twitter Best High Yield Savings Accounts In Nigeria In 2020 Https T Co 1ey6ueabqs

Gbenga On Twitter Best High Yield Savings Accounts In Nigeria In 2020 Https T Co 1ey6ueabqs

Fidelity Bank High Yield Savings Account Is A Scam Business Nigeria

Fidelity Review 2021 Pros And Cons Uncovered

Fidelity Review 2021 Pros And Cons Uncovered

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.