Download the Form MO-1040 for the year of the tax return you are amending from the DOR website or obtain one. Change or Amend Your Tax Return for the current or previous Tax Year with Form 1040XN.

How To File An Amended Tax Return

How To File An Amended Tax Return

Your amended return must include all schedules filed with the original return even if there are no changes to those schedules.

How to amend state tax return. How to file an amended tax return To file an amended federal return youll need to fill out the three-column Form 1040X. Follow these steps to amend your tax return. There you will have a list of instructions on how to amend your return.

In either case make sure to indicate that its an amended return before filling it out. Amending Your State Return From within your TaxAct return Online or Desktop print a copy of your original federal and state returns. Open your state return in the HR Block Tax Software program.

Answer the questions about your federal return even if they dont apply. Click Print Center and then click Return in the window that appears. In the State Taxes there is a screen to indicate that you want to amend your state tax return.

Click My Return in the upper right-hand corner. For tax years 2016 and after youll find a new Amended return oval at the top of the form. For earlier tax years you can write Amended return at the top of your Form 1 or Form 1-NRPY.

You will simply need to submit a revised tax return. Select the reason youre amending and continue. Filers who arent sure if they need to amend a state tax return should check with their tax preparers or contact their states tax division.

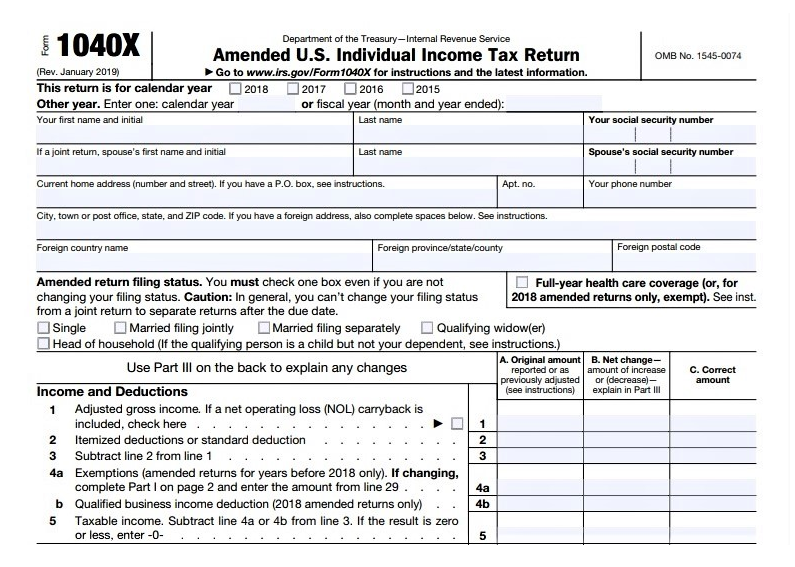

First fill out an amended federal income tax return Form 1040X. For paper returns mark the oval labeled Amended Return. Contact your states Department of Revenue to obtain the correct form to amend your state tax return.

To Amend Your State Return From within your TaxAct return Online or Desktop print a copy of your original federal and state returns. If youre not changing your tax liability income credits deductions etc. Select 2020 and select Amend change return then Amend using TurboTax Online.

Additionally you must indicate that it is an amended return by checking the box at the top of page 1. Desktop users click File then click. For Prior year Amended returns select the Prior Years tab and select the tax year you wish to amend.

Next to Amended Return choose Go To. Like the IRS states typically use a special form for an amended return. Click Print Center and then click Return.

Second get the proper form from your state and use the information from Form 1040X to help you fill it out. You can amend just your state tax return using Turbo Tax and leave the Federal as is. To amend your HR Block state return.

Review your adjusted Returns and complete your State Tax Amendment. Youll eventually get to the screen Lets get started on your state taxes. You can file your amended return electronically or on paper.

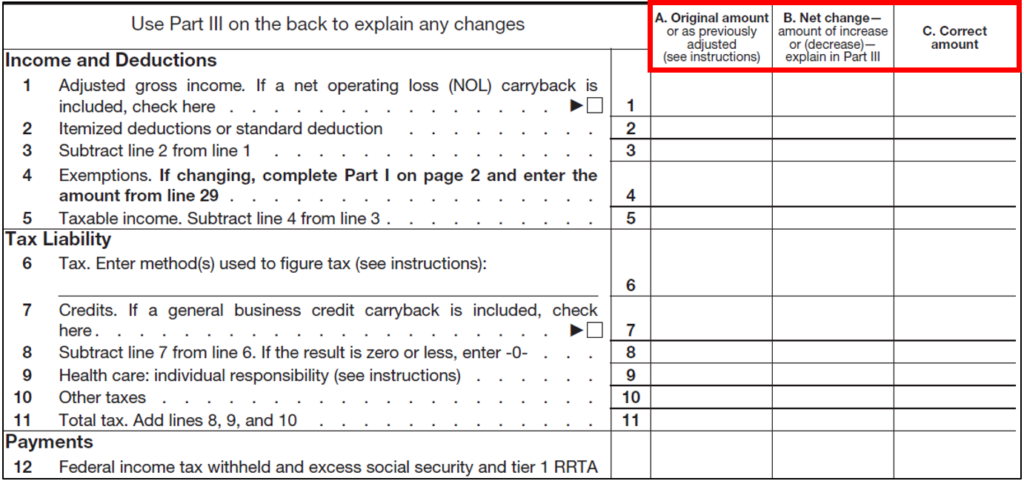

How to Amend a Missouri State Tax Return Step 1. On the forms taxpayers typically copy line items from their original return noting which should be corrected and the net change. This link allows you to obtain the form you need.

Enter the number of copies to print and then click the Print button. You can amend your state tax return in two simple steps. Make a copy of the Form MO-1040 you originally filed your federal tax return and all other supporting.

My Account - 2020 Tax Return - shown with an e-file date. Enclose a copy of Schedule AR Explanation of Amended Return with your amended return. You can not file an amended return electronically.

All amended returns have to be printed and mailed in. For the current year program log into the account and click the Continue then select 2020 Amended Return from the left side of the screen on the navigation bar. The federal IRS website provides a link to each states Department of Revenue.

To amend the IT 1040 or SD 100 you should file a new return reflecting all the proposed changes. Keep going and well present you with the option to amend. If you file electronically follow the instructions for your software provider.

It is near the end of the return. Each state has its own version which you can obtain through its tax departments website. Full-year residents of Wisconsin should amend a 2017 return by filing Form WI-Z Form 1A or Form 1 and a 2018 2019 or 2020 return by filing Form 1 and placing a checkmark where indicated at the top of the form to designate it as an amended return.

Through your tax representative or tax preparation software Mail Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001 Businesses. Be sure to list your current mailing address on the amended return. Click the Misc tab.

Where S My Amended Tax Return Don T Mess With Taxes

Wondering How To Amend Your Tax Return Picnic S Blog

Wondering How To Amend Your Tax Return Picnic S Blog

Will I Get Audited If I File An Amended Return H R Block

Will I Get Audited If I File An Amended Return H R Block

Guide To Tax Amendments The 1040x Liberty Tax Service

Guide To Tax Amendments The 1040x Liberty Tax Service

Wondering How To Amend Your Tax Return Picnic S Blog

Wondering How To Amend Your Tax Return Picnic S Blog

How To Amend An Incorrect Tax Return You Already Filed

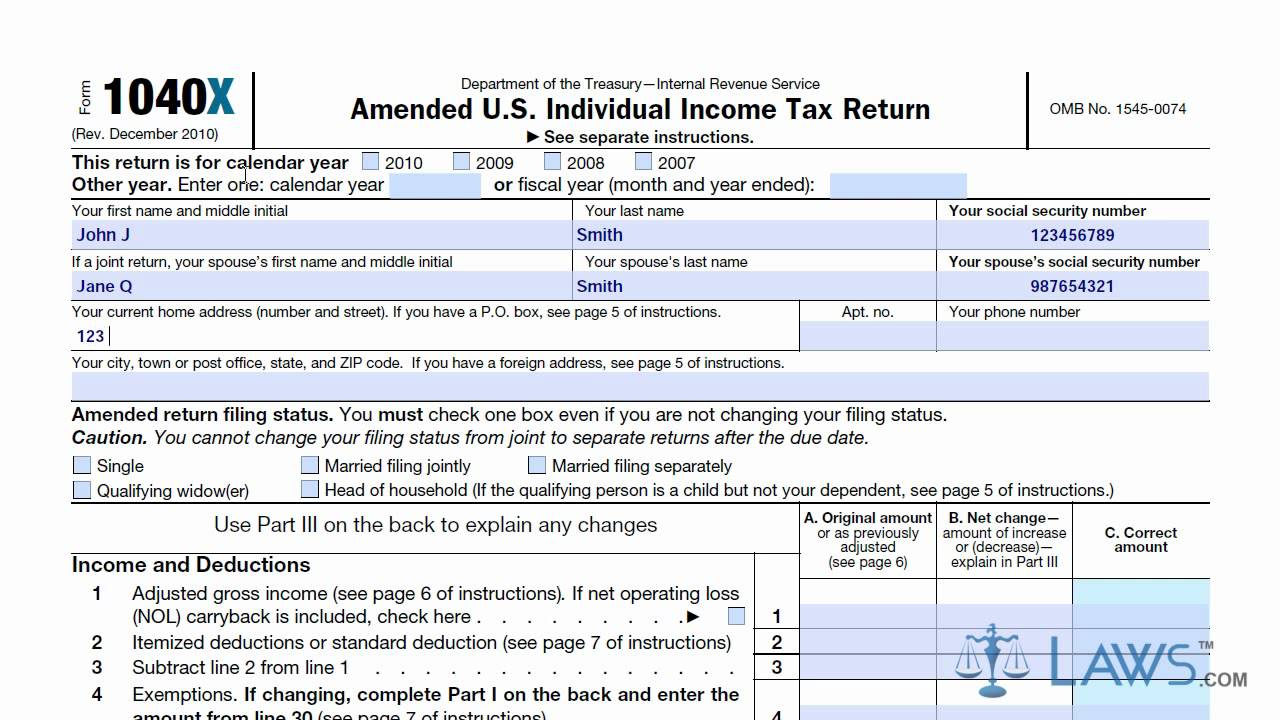

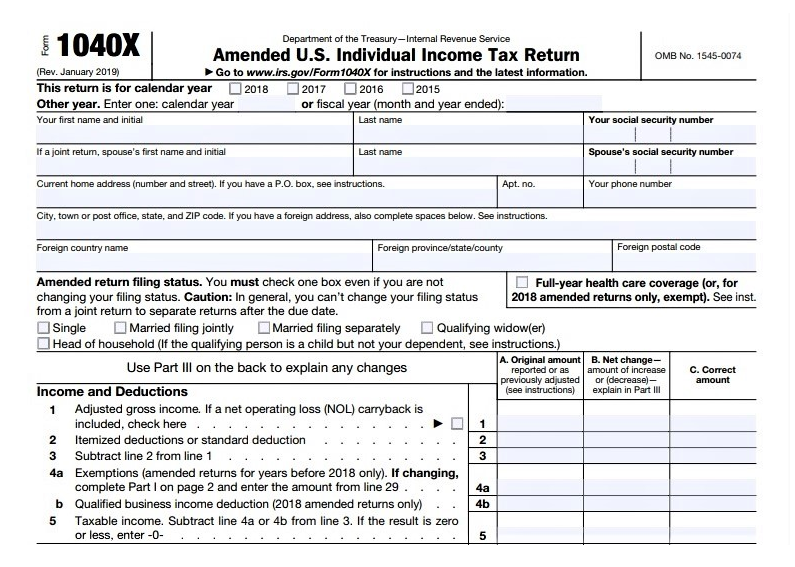

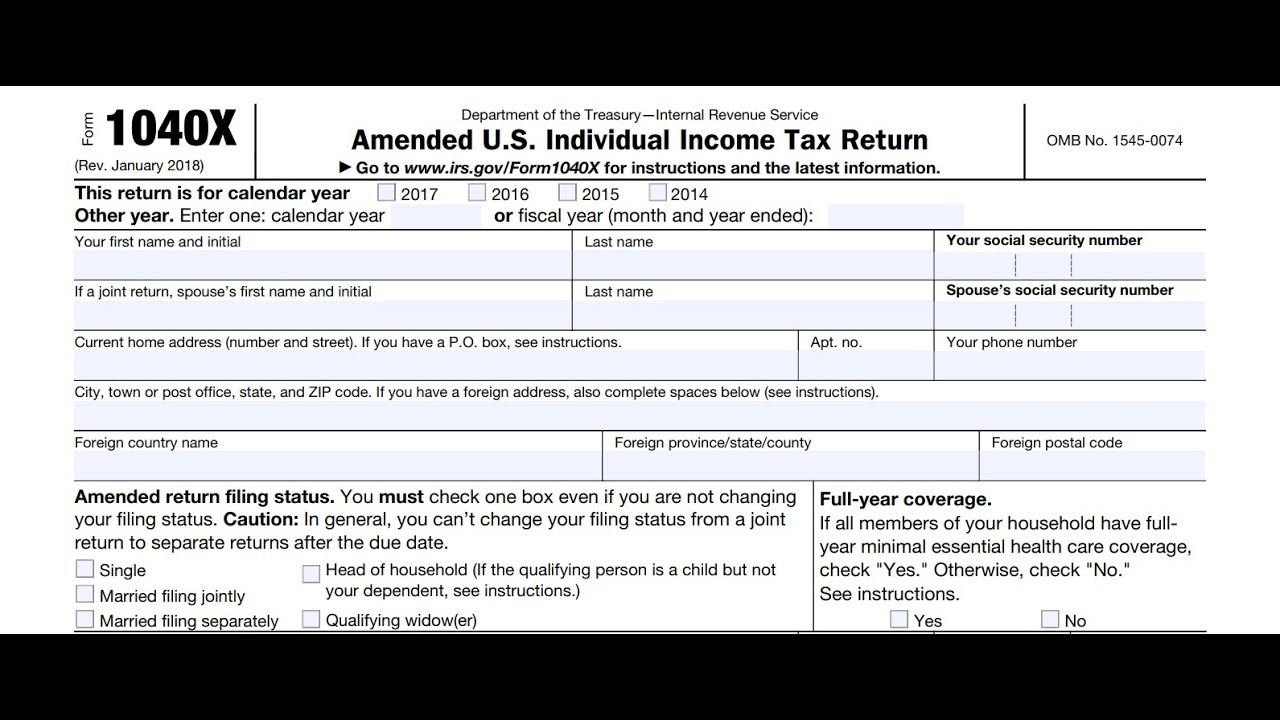

Learn How To Fill The Form 1040x Amended U S Individual Income Tax Return Youtube

Learn How To Fill The Form 1040x Amended U S Individual Income Tax Return Youtube

Unemployment 10 200 Tax Break Some States Require Amended Returns

Unemployment 10 200 Tax Break Some States Require Amended Returns

Tips For Taxpayers Who May Need To Amend Their Tax Return

Tips For Taxpayers Who May Need To Amend Their Tax Return

How To Amend Your Tax Return With Sprintax Youtube

How To Amend Your Tax Return With Sprintax Youtube

How To Amend A State Tax Return For The 10 200 Unemployment Tax Break

How To Amend A State Tax Return For The 10 200 Unemployment Tax Break

Prepare And File 1040 X Income Tax Return Amendment

Prepare And File 1040 X Income Tax Return Amendment

Where S My Amended Refund Irs Where S My Amended Return 1040x

How To Amend A Tax Return Liberty Tax

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.