In this economy everybodys trying to save money. Day trading involves making dozens of trades in a single day while swing trading involves holding positions over a period of days or weeks.

Pros And Cons Of Day Trading Versus Long

Pros And Cons Of Day Trading Versus Long

How do Dividends Affect Trading.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

Day trading options vs stocks. Clearly plenty of traders have already caught on to the benefits of trading these derivatives. However options allow you to bet on a direction. Some investors may wonder what the difference is between trading ETFs and stocks.

October 31 2017 by Bret Kenwell. Day traders are in and out of trades within minutes during the same day. The biggest difference between options and stocks is that stocks represent shares of ownership in individual companies while options are contracts with other investors.

For those of you who are new Day Traders try this on Monday if the market is up again note. Your exposure to implied vol isnt even that straightforward they mightve bought some calls and are wondering why theyre losing money when the underlying is rallying not seeing that vol has dropped. Thats one of the great things for trading.

The names mentioned were the best day traders of all time and proved to the world that trading is not speculation but a highly calculative and strategic business. Is There a Big Difference. Alternatives To Day Trading Hold Trades Longer.

Or if theyre a little more advanced they might even be aware. In the US the minimum required starting capital to be a pattern day trader is 25000. While day trading stocks is more challenging than long term investing day trading options is even more risky.

And that can be accomplished with limited risk. The Balance does not provide tax investment or financial services and advice. You can buy stocks which represents ownership in a company.

For the educated option trader that is a good thing because option strategies can be designed to profit from a wide variety of stock market outcomes. When betting make sure youve mastered options trading. With a stock your only risk is the price with options its the underlying price the time youve got until expiry and the implied volatility to start.

Stocks give you a share of ownership in a company. Day trading means opening and closing trades in the same day but if you hold a stock for more than one day the Pattern Day Trader Rule doesnt apply. Trading Options on Stocks vs.

Here are some of the differences between day trading and investing. This question only grows more complicated when options are introduced. Like binary options traders day traders can go into a trade knowing the maximum gain or loss by using profit targets and stop losses.

Options trading is not stock trading. These are just suggestions not financial advice I am not a financial advisor etcetc. 3 If youre thinking of day trading stocks here are some key facts you should know.

Stocks and options can be used for day trading swing trading as well as investing. But if youre still on the fence about trying your hand at options read on and allow me to convince you. For example a day trader might enter a trade and set a.

A pattern day trader is someone who executes four or more day trades within five business days. If you really want to trade stocks or options but dont have 25000 theres another choice. Basics of Stocks vs Options.

Day trading is a skill that has made fortune for many well-known traders from Jesse Livermore to Steven Cohn. Investors are holding for the long term. 1 Options Are Cheaper Than Stocks.

So forgive me for pandering but its a fact that options are significantly less expensive than the securities on which. Always start out with a demo account or trade simulation. Most of my best trades actually come well into the trading day particularly since I have a sense of where the market is going and which stocks are strongweak relative to that market.

Make sure that you understand what you are doing here. In most cases the costs associated with trading stocks make them more expensive than forex for day traders although many online brokers now allow their clients to trade derivatives CFDs are tied to the stocks in major companies. Day traders look to scalp 010 050 per trade on average.

Options Trading 101 Tips Strategies To Get Started

Options Trading 101 Tips Strategies To Get Started

Amazon Com Investing Beginner S Guide An Introduction To Forex Trading Options Trading Stock Market Trading Swing Trading And Day Trading To Learn The Basics Of And Create Your Financial Freedom Ebook William

Amazon Com Investing Beginner S Guide An Introduction To Forex Trading Options Trading Stock Market Trading Swing Trading And Day Trading To Learn The Basics Of And Create Your Financial Freedom Ebook William

Options Vs Stocks What S The Difference Warrior Trading

Options Vs Stocks What S The Difference Warrior Trading

Binary Options Manual Trading Vs Auto Trading Infographic Stock Trading Strategies Trading Quotes Trading

Binary Options Manual Trading Vs Auto Trading Infographic Stock Trading Strategies Trading Quotes Trading

2 Ways To Day Trade Options Short Vs Long Term Ep 41 Tradersfly Options Trading Strategies Technical Trading Stock Trading Strategies

2 Ways To Day Trade Options Short Vs Long Term Ep 41 Tradersfly Options Trading Strategies Technical Trading Stock Trading Strategies

Day Trading Options For A Living By Odin Velez Audiobook Audible Com

Day Trading Options For A Living By Odin Velez Audiobook Audible Com

Forex Vs Stocks Which Is Better For Day Trading My Trading Skills

Forex Vs Stocks Which Is Better For Day Trading My Trading Skills

Stock Trading Vs Options Trading Options Trading For Beginners Youtube

Stock Trading Vs Options Trading Options Trading For Beginners Youtube

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg) Essential Options Trading Guide

Essential Options Trading Guide

Forex Trading Strategies Day Trading Stocks Trading Pins Pin Trading Day Trading For Beginners Trading Money Management Advice Business Money Finance Investing

Forex Trading Strategies Day Trading Stocks Trading Pins Pin Trading Day Trading For Beginners Trading Money Management Advice Business Money Finance Investing

Options Vs Equities Pros Cons In Trading

Options Vs Equities Pros Cons In Trading

Algo Trading Chicago Options Vs Stocks Day Trading

Algo Trading Chicago Options Vs Stocks Day Trading

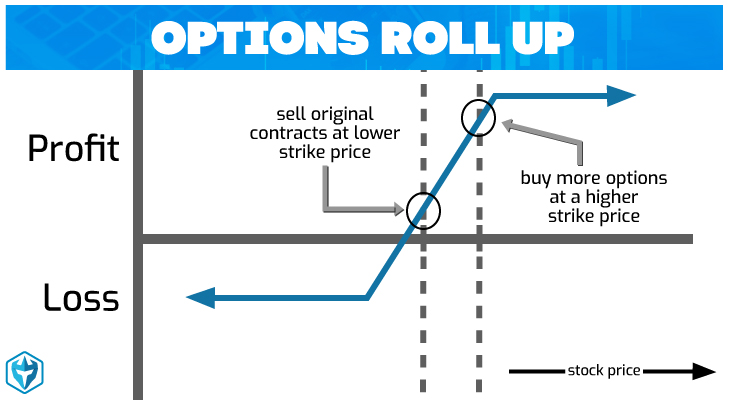

Options Roll Up Definition Day Trading Terminology Warrior Trading

Options Roll Up Definition Day Trading Terminology Warrior Trading

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.