Dem states get stiffed by the Republican Majority on their fair share of the tax revenues we pay to the fed. How much taxpayer money goes toward covering an average federal inmate.

Want To See Where Your Taxes Go Otherwords

Want To See Where Your Taxes Go Otherwords

Of direction based upon the state you reside in will confirm what of taxes withheld.

How much of my paycheck goes to taxes. What Small Business Owners Need to Know for Payroll All of the information above can apply to both business owners and employees. Any income exceeding that amount will not be taxed. Compare that to Republican states not one of whom gets less than 134 and up to.

FICA taxes consist of Social Security and Medicare taxes. Additional amounts may be deducted from each paycheck for federal withholding or for state fees such as unemployment insurance. The Medicare tax rate is 145.

Annual wage bases and tax rates vary by state. Social Security withholding is 62 of your income while Medicare withholding is 145 of your income each pay period. One ballpark figure used by many is 25 to 30 percent of your total income and there are a couple ways you can do it.

That means that 48-51 pay NO federal income taxes. That means that your net pay will be 49258 per year or 4105 per month. Taxpayers with a traditional salary pay 62 percent of each paycheck as taxes for social security and 145 percent for Medicare according to the California Tax Service Station.

For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Just look for the Medicare Tax section on your pay stub to see how much you pay. However the 62 that you pay only applies to income up to the Social Security tax cap which for 2021 is 142800 up from 137700 in 2020. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax.

In 2018 the Bureau of Prisons reported that the average cost for a federal inmate was 3629925 per year or 9945 per day. Go to irsgov and query circular E Find the table that matches you look at what gross you are expecting and see how much will be withheld depending on your W-4 status. As of July 9 there are 159692 federal inmates.

Michaela BegsteigerGetty Images Most US. Your employer will match these percentages so that the total FICA contribution is double what you pay. Use this amount to determine your tax bracket.

Currently depending on where the information comes from only 48-51 percent of people pay federal income taxes. The total tax for the Medicare system is 29 percent but as an employee you pay only half this amount. That means 145 percent of your gross pay goes to the Medicare tax.

Your employer withholds 145 of your gross income from your paycheck. Combined the FICA tax rate is 153 of the employees wages. Dem states get an average of 55 cents for the 1 we pay in federal taxes.

If you make 65000 a year living in the region of New York USA you will be taxed 15742. For example as of 2011 Alaskas withholding rate is 058 percent of the first 34600 paid to the employee New Jerseys withholding rate is 0985 percent of the first 29600 paid to the employee and Pennsylvanias. Your employer pays an additional 145 the employer part of the Medicare tax.

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. You pay the tax on only the first 137700 of your earnings in 2020.

With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent. You can see the impact of this tax each time you receive your paycheck. Then also take out.

For 2021 employees will pay 62 in Social Security on the first 142800 of wages. Nipitpon Singad EyeEmEyeEmGetty Images One option is. Your average tax rate is 2422 and your marginal tax rate is 3598.

Bypass on your states information superhighway web site and you will get the withholding tax possibilities for weekly bi-weekly etc. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

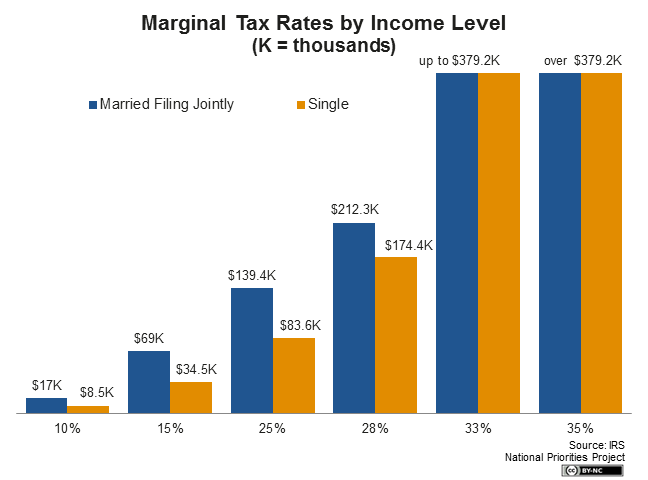

FICA contributions are shared between the employee and the employer. You might be interested. Before looking at the above tax brackets subtract either 12000 for single filers or 24000 for married filers from your income.

How The Biggest Chunk Of Your Hard Earned Tax Goes On Welfare Daily Mail Online

If I Live In Georgia How Much Of My Paycheck Goes To Lazy People Who Won T Get A Job By Glenn Stovall Medium

If I Live In Georgia How Much Of My Paycheck Goes To Lazy People Who Won T Get A Job By Glenn Stovall Medium

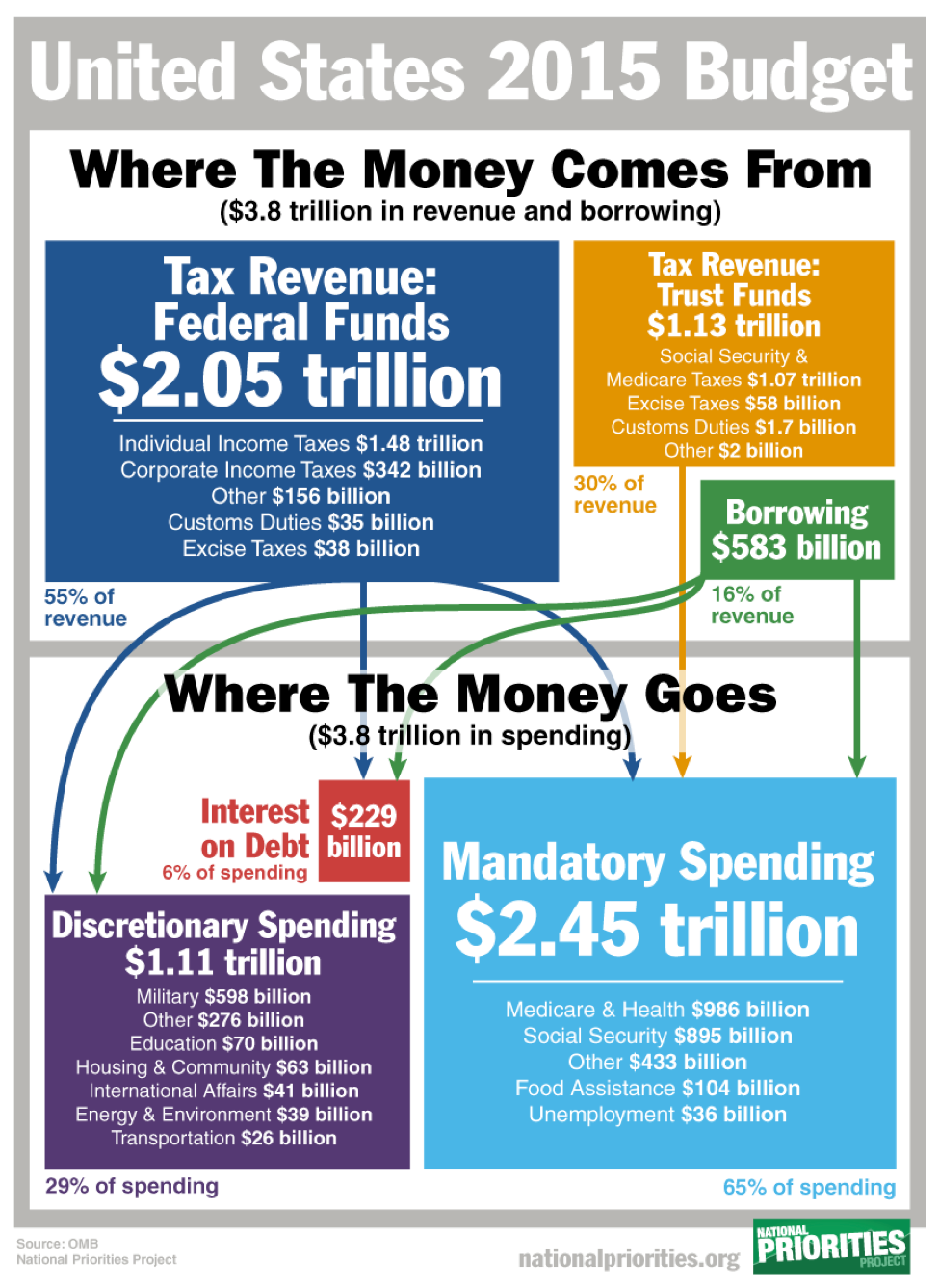

Here S Where Your Federal Income Tax Dollars Go

How Much Of My Paycheck Goes To Taxes

How Much Of My Paycheck Goes To Taxes

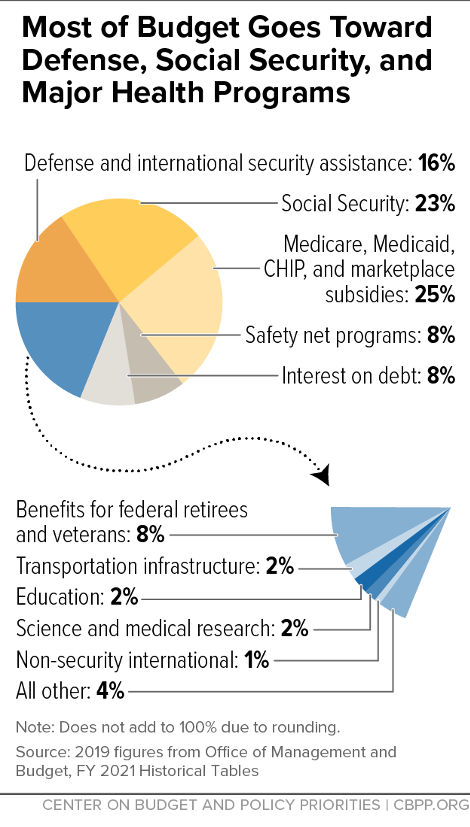

Policy Basics Where Do Our Federal Tax Dollars Go Center On Budget And Policy Priorities

Policy Basics Where Do Our Federal Tax Dollars Go Center On Budget And Policy Priorities

How Much Of My Paycheck Goes To Taxes

How Much Of My Paycheck Goes To Taxes

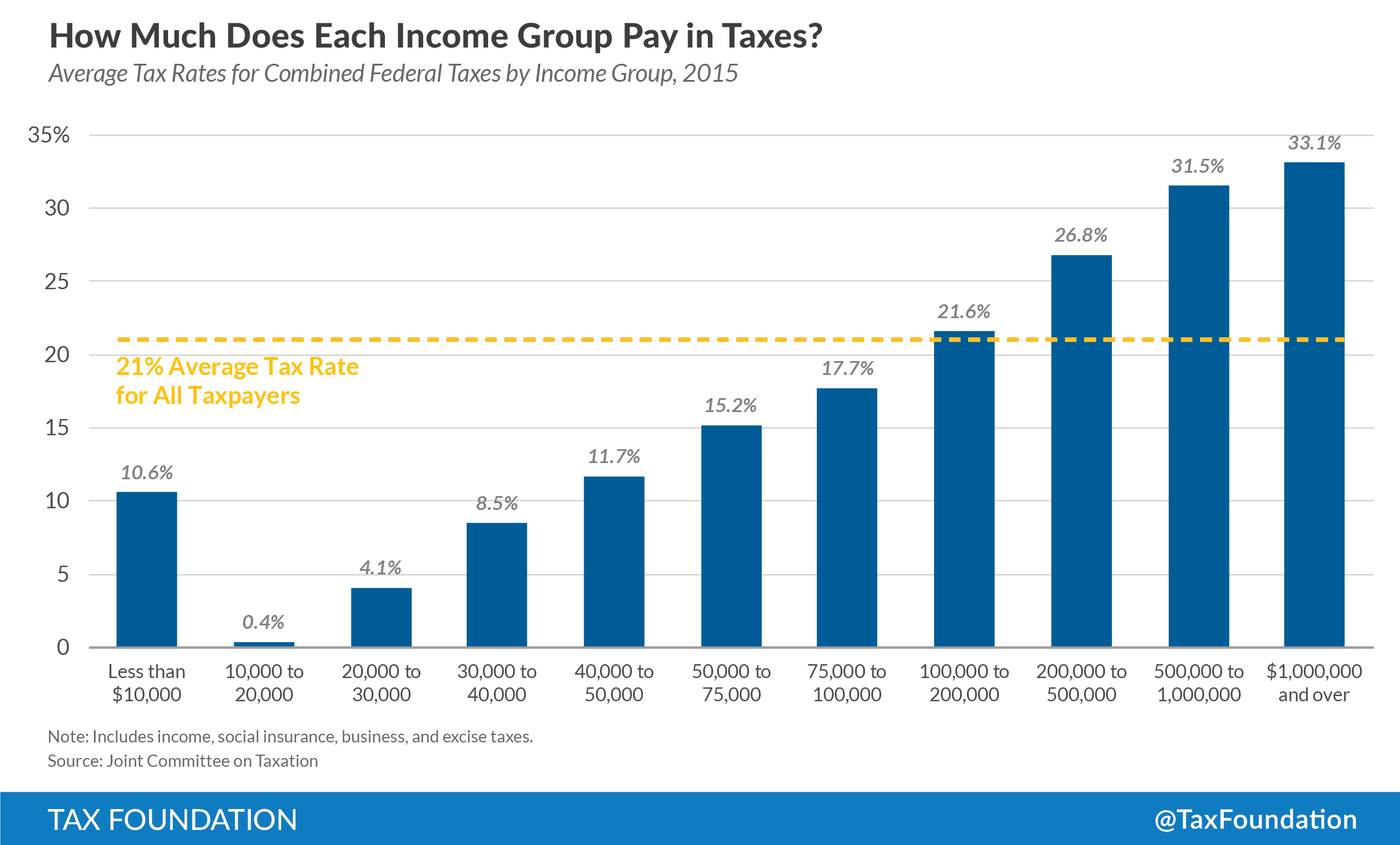

How Much Do People Pay In Taxes Tax Foundation

How Much Do People Pay In Taxes Tax Foundation

Who Owns Your Paycheck Life And My Finances

Who Owns Your Paycheck Life And My Finances

How Much Of My Paycheck Goes To Taxes

How Much Of My Paycheck Goes To Taxes

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Free Paycheck Calculator Hourly Salary Smartasset

Free Paycheck Calculator Hourly Salary Smartasset

Here S Where Your Federal Income Tax Dollars Go

Here S Where Your Federal Income Tax Dollars Go

New Tax Law Take Home Pay Calculator For 75 000 Salary

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.