Transfers are fee-free at the interbank rate in 23 currencies. Newcastle City Centre.

Acorns Review How It Works Pros Cons Clark Howard

Acorns Review How It Works Pros Cons Clark Howard

Investors with smaller balances.

Does acorn charge fees. The monthly fee rises 100 per month for every million you invest afterwards. Please see your Acorns Subscription Center or Account Statements for a description of the fees you pay to Acorns for its services. However you will need to pay the 3 per month Acorns fee to maintain the account.

The annual fee of 50 or 50 bps covers investment advice brokerage commissions dealer spreads and other costs associated with the purchase or sale of securities custodian fees rebalancing and account administration. The Acorns monthly fee ranges from 1 - 5. Everything above Acorns Early.

Our business is built on communication professionalism and integrity with the emphasis on finding the best property for you. Acorns charges a flat fee instead of a percentage of assets. No its a Pay As You Go current account.

A monthly subscription US599 month and an annual subscription US5999 year. Please see your Acorns Subscription Center or Account Statements for a description of the fees you pay to Acorns for its services. Same day Faster Payment online 750.

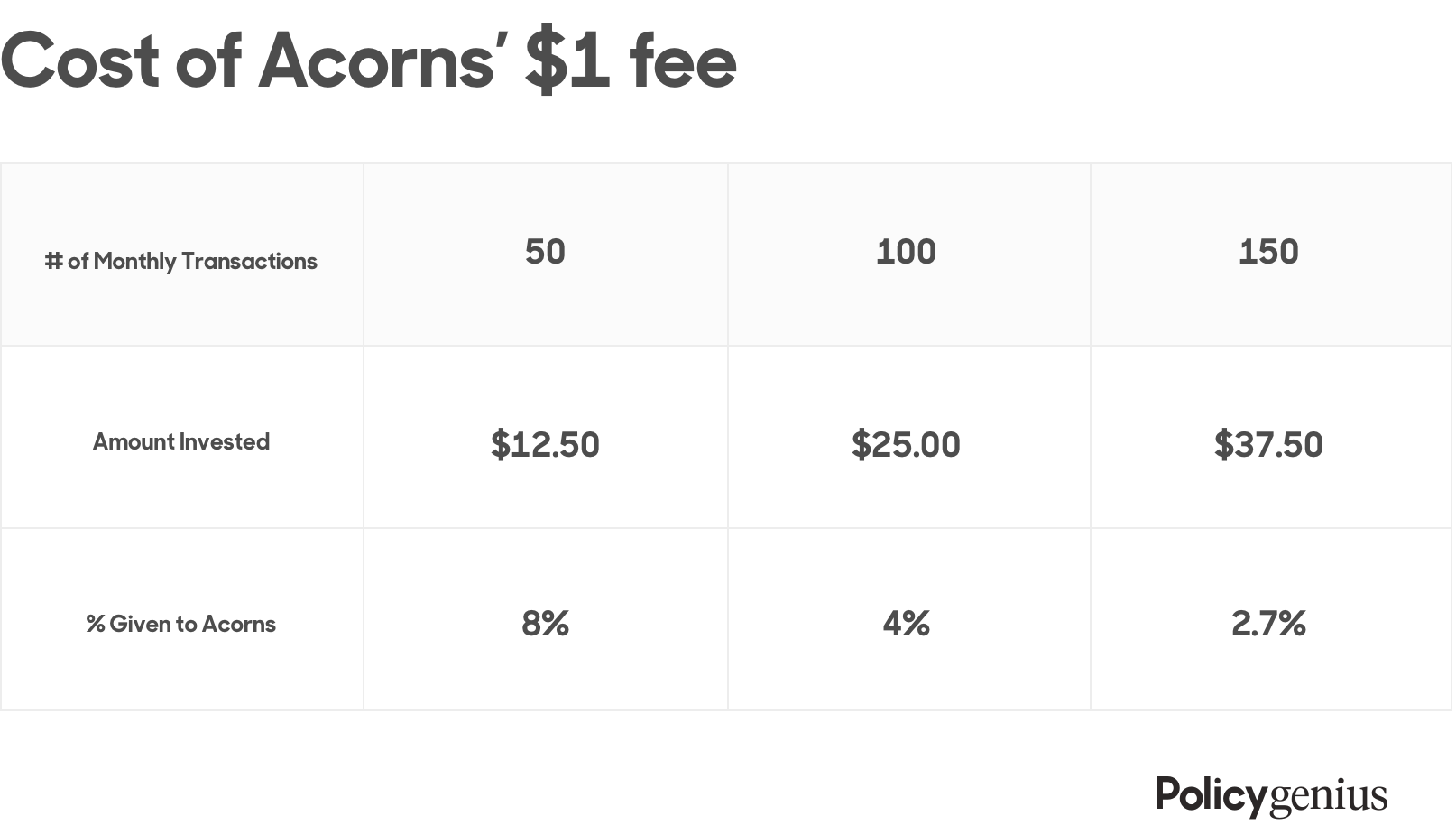

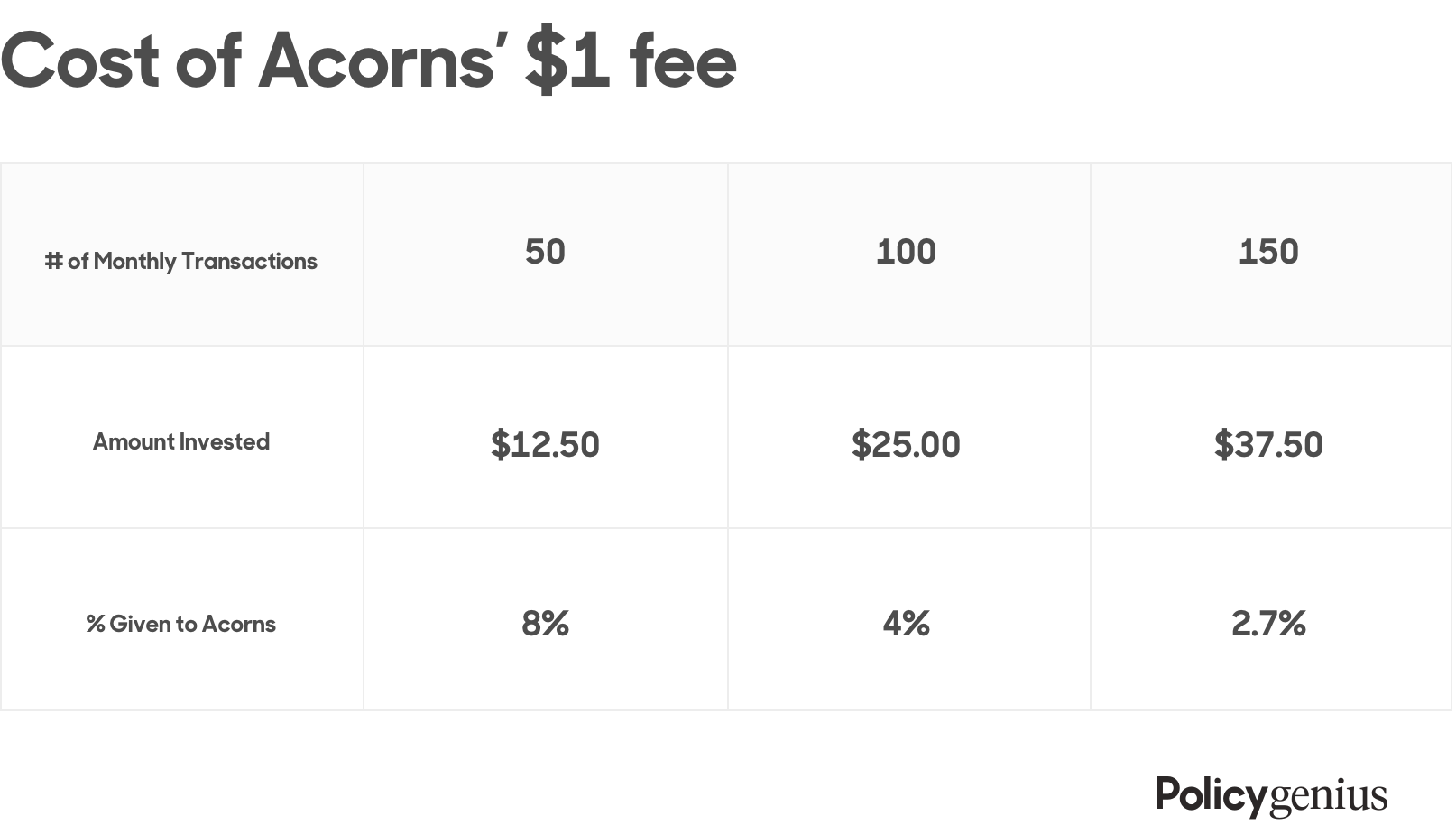

Acorns does not charge any fees if you are transferring an account to them. ATM withdrawals outside the UK are charged at 300 plus 275 of the transaction value. Unlike most robo-advisors who charge a fee based on your account balance Acorns charges a flat monthly management fee.

1 Acorns Lite 1mo. Includes Acorns Invest Acorns Later IRA Acorns Spend Acorns Family 5mo. Acorn business account costs a minimum 1250 per month to run plus transaction fees.

Acorn charges an annual fee of 50 of the accounts market value payable quarterly in arrears. For any member that has less than 5000 in their account the management fee is lifted. If you use an online platform to manage your investments you may be charged a platform fee which is similar to an annual management charge as it covers administration costs.

The only fee according to their support page is the 1 fee if you are under 5k. There is a monthly fee of 1450 which is debited from your account on the first of every month. Acorns Spend clients are not charged overdraft fees maintenance fees or ATM fees for cash withdrawals from ATMs within the Allpoint Network.

They will actually give you a 5 cash bonus. Compared to traditional management mutual funds and DIY ETFs this fee is incredibly low. You can use a promotion link below to open an account and initiate the transfer.

Acorns does not charge transactional fees commissions or fees based on assets for accounts under 1 million. Get 10 when you open an Acorns account with this referral link. This covers the time and effort it takes to choose the best investment opportunities for any given user.

Plus taxes where applicable. Flat fees often benefit investors with higher account balances. Is there a minimum contract period.

An Acorn Account costs just 1450 per month the fee is taken on the 1st of each month from your Acorn account. A platform fee is usually a flat charge or a percentage of your investments. Acorns charges an annual management fee of 025 percent for accounts larger than 5000.

Acorns offers unlimited ATM reimbursement has no minimum balance and doesnt charge overdraft fees. Our client money protection policy ensures you are safe with us. Transaction charges apply to the billing account as follows.

For complete details about Acorns fees you can visit their website or download their app. How much does Acorn charge for its services. Since its target customer is someone new to investing its cheapest plan Acorns Lite costs 1 per month.

Other portfolio advisory services like Amerivest charge as much as 125 and require a minimum investment of 25000. Letting Fees Charges Acorn is a well-established fully accredited property letting specialist. Includes Acorns Invest Acorns Personal 3mo.

Acorn fees and limits. Next day Faster Payment via call centre 350. Acorns does not charge transactional fees commissions or fees based on assets for accounts under 1 million.

This plan is a basic taxable investing account. If you choose not to use the account you will not be charged. Acorns fees are 1 per month for all accounts with a balance under 1 million.

There are fees for using your Acorn card abroad. However you will need to pay the 3 per month Acorns fee to maintain the account. Next day Faster Payment online 030.

We cover a wide area of the North East to include. What are the fees for Acorns accounts. A typical fee is 025 of your assets.

Acorns Spend clients are not charged overdraft fees maintenance fees or ATM fees for cash withdrawals from ATMs within the Allpoint Network. Acorn TV offers two options. You can cancel your account at.

Acorns Review 2020 Smartasset Com

Acorns Review 2020 Smartasset Com

Acorns Review Beware Of Spare Change Investment Apps

Acorns Review Beware Of Spare Change Investment Apps

Acorns Review 2021 Invest Your Spare Change Is Acorns App Worth It

Acorns Review 2021 Invest Your Spare Change Is Acorns App Worth It

Acorns Review 2020 Smartasset Com

Acorns Review 2020 Smartasset Com

Acorns Review Beware Of Spare Change Investment Apps

Acorns Review Beware Of Spare Change Investment Apps

Acorns Review Beware Of Spare Change Investment Apps

Acorns Review Beware Of Spare Change Investment Apps

Acorns Review 2020 The Spare Change Savings App Debit Card

Acorns Review 2020 The Spare Change Savings App Debit Card

How Long Does It Take To Invest Money Acorns

How Long Does It Take To Invest Money Acorns

Why The Acorns And Stash Investing Apps Are A Dumb Idea Arrest Your Debt

Why The Acorns And Stash Investing Apps Are A Dumb Idea Arrest Your Debt

What Is Acorns How Does It Work Acorns

What Is Acorns How Does It Work Acorns

Acorns Review 2021 Is The Micro Investing App Worth It

Acorns Review 2021 Is The Micro Investing App Worth It

Acorns Review 2021 A Safe Investing App For Beginners

Acorns Review 2021 A Safe Investing App For Beginners

Acorns Review 2021 Is The Micro Investing App Worth It

Acorns Review 2021 Is The Micro Investing App Worth It

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.