A charge off occurs when a lender decides that you probably wont pay back the money that you owe and sell your debt to a collection agency such as MRS Associates or Portfolio Recovery. Charge off means that the credit grantor wrote your account off of their receivables as a loss and it is closed to future charges.

What Is A Charge Off How To Remove Charge Offs Youtube

What Is A Charge Off How To Remove Charge Offs Youtube

When you have any type of debt payments to make you could potentially end up with an unpaid charge if your account becomes delinquent.

Whats a charge off on credit report. Its a big deal. A charge-off is one of the worst items you can have on your credit report. A charge-off means the creditor has written off your account as a loss and closed it to future charges.

A charge-off is when you are so late on your credit card or other loan payment that your lender gives up trying to collect the balance and writes your account off as a loss. Despite what its name may imply a charged off account doesnt actually go. The term charge-off can be confusing.

A charged off account on your credit report will devastate your FICO score. A charge-off on your credit report signals to potential lenders that youre a risky borrower so getting a charge-off removed from your credit report could help you qualify or get better rates on. A charge-off means a lender or creditor has written the account off as a loss and the account is closed to future charges.

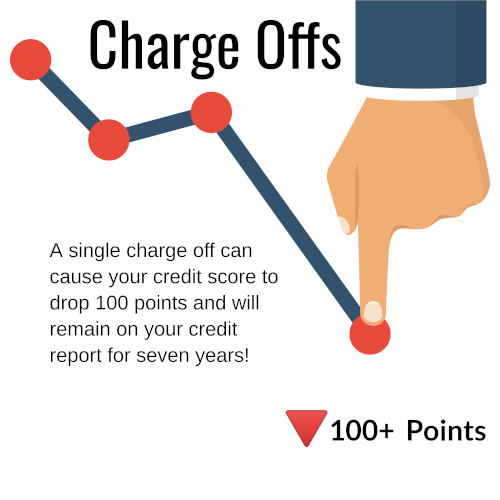

A charge-off is considered a derogatory entry in your credit filea serious negative eventand it can adversely affect your credit scores and your ability to borrow additional funds. The Original Creditor May Not Own Your Charged Off Debt. A single charge off can cause your credit score to drop 100 points or more.

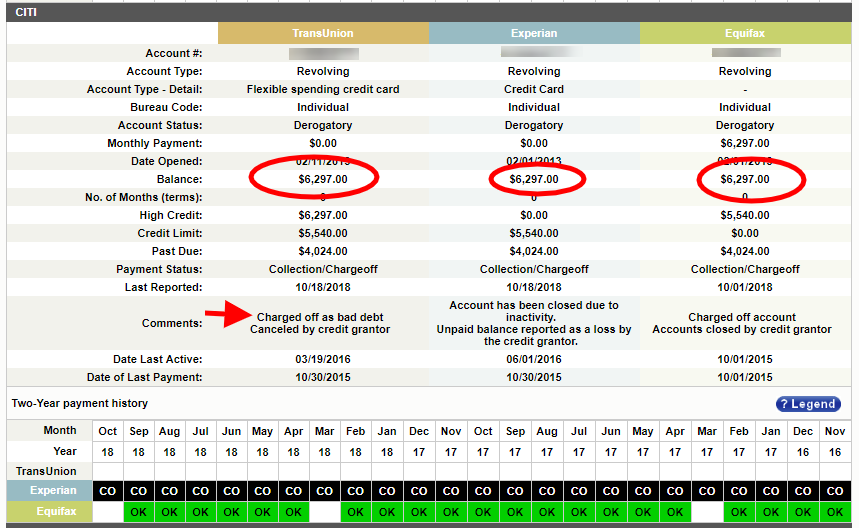

When an account displays a status of charge off it means the account is closed to future use although the debt is still owed. What Is a Charge-Off. The charge-off status goes on your credit report and stays for seven years.

Once an account has been marked a. A charge-off is what happens when you fail to make your credit card payment for several monthsusually six months in a row. If you see the term charge off on your credit report its time brace yourself and take direct action to protect your credit score.

A charge-off is a debt for example on a credit card that is deemed unlikely to be collected by the creditor because the borrower has become substantially delinquent after a period of time. A charge-off happens if your credit card is 180 days or six months past due. A charge-off is a debt that a creditor has given up trying to collect on after the debtor the person who borrowed the money has missed payments for several months.

Once an account becomes a charge-off it may be transferred by the lender or creditor to a collection agency. Find out how long before a charge off on your account happens and in turn what this actually means including how long it can stay on your credit report an. Before we jump into how to remove a charge off yourself from your credit report lets go over what exactly is a charge off.

Depending on the types of credit accounts you have this may happen 120 or 180 days after you stop making payments. A Charge Off Means Your Debt is Overdue. A charge-off is a black mark on your credit score that can haunt you long after the debt is paid in full.

6 Facts Credit Report Charge Off Meaning How to Remove It 1. A charge-off is an entry on your credit report that indicates a creditor after trying and failing to get you to make good on a debt has given up hope of getting payment and closed your account. Lenders rarely extend credit to people with even one charge off on their credit report.

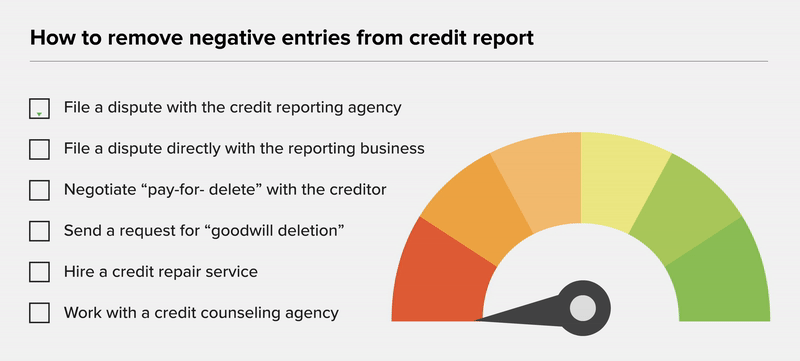

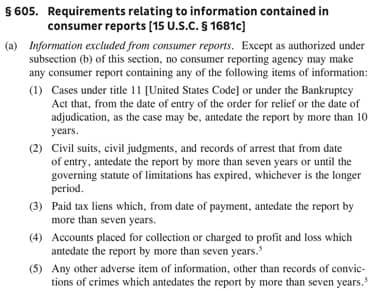

But if a charge-off is incorrect or contains questionable information it may be possible to get it removed from your report much sooner. You wont be able to use your credit card or make minimum payments toward the balance. The Fair Credit Reporting Act FCRA allows legitimate charge-offs to remain on your credit reports for up to seven years.

The Fair Credit Reporting Act states that charged-off accounts stay on your credit report for seven years before they must be removed. Charge-offs can be extremely damaging to your credit score and they can remain on your. The credit grantor may continue to report the past due amount and the balance owed.

On the contrary a credit card charge off means you are more than 180 days late on your payment and the credit issuer considers the debt uncollectible. In addition to your credit score dropping youre also going to have a really difficult time getting approved for any new credit cards mortgages or auto loans. As for having to pay it back youre not.

From Credit Experts How To Remove Charge Offs Yourself Badcredit Org

From Credit Experts How To Remove Charge Offs Yourself Badcredit Org

How To Remove Items From Your Credit Report Money

How To Remove Items From Your Credit Report Money

Removing Closed Accounts From Credit Report Bankrate

Removing Closed Accounts From Credit Report Bankrate

What Is A Charge Off Creditrepair Com

What Is A Charge Off Creditrepair Com

How To Dispute A Charge Off Us Credit Advocate

How To Dispute A Charge Off Us Credit Advocate

/how-to-remove-a-charge-off-from-your-credit-report-960360_FINAL-d54108d9603a45aa853c03dbbae765bb.png) How To Remove A Charge Off From Your Credit Report

How To Remove A Charge Off From Your Credit Report

What Is A Charge Off And How Do I Pay It Off Credit Karma

What Is A Charge Off And How Do I Pay It Off Credit Karma

/remove-debt-collections-from-your-credit-report-960376_FINAL-5ae6517517024613885ec46df1e58ecd.png) Remove Debt Collections From Your Credit Report

Remove Debt Collections From Your Credit Report

6 Facts Credit Report Charge Off Meaning How To Remove It Badcredit Org

6 Facts Credit Report Charge Off Meaning How To Remove It Badcredit Org

3 Easy Ways To Remove A Charge Off From Your Credit Report

3 Easy Ways To Remove A Charge Off From Your Credit Report

3 Easy Ways To Remove A Charge Off From Your Credit Report

3 Easy Ways To Remove A Charge Off From Your Credit Report

6 Facts Credit Report Charge Off Meaning How To Remove It Badcredit Org

6 Facts Credit Report Charge Off Meaning How To Remove It Badcredit Org

What Does Charged Off Mean For Your Credit Score

What Does Charged Off Mean For Your Credit Score

:max_bytes(150000):strip_icc()/credit-report-157681670-5b740d0246e0fb00502fd857.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.