A trust is the transfer of assets to a trustee to manage during or after the death of the maker. What is a trust fund.

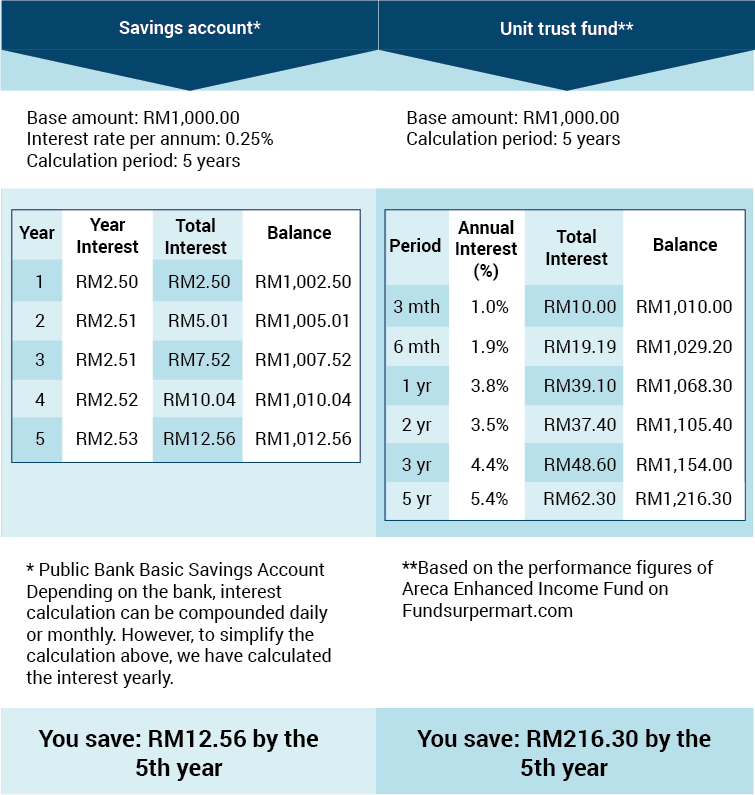

Are Unit Trust Funds Better Than Savings Accounts Imoney

Are Unit Trust Funds Better Than Savings Accounts Imoney

The term trust fund refers to assets that are held in a trust.

What is a trust fund account. Parents may set trust funds for their children which may pay out money at set intervals or for specific expenses with the bulk of the money remaining in the fund until the children reach a certain age. At its most basic level Trust Accounting is simply bookkeeping of trust accounts in accordance with state requirements. A trust fund allows you to govern how your children receive the assets which can prevent them from squandering the money.

Therefore a trust account or an in-trust account is one that you would open for your daughter for example to manage the money deposited into that account on her behalf. The attorney trust account ensures the separation and security of client funds and helps law firms avoid accidently comingling client funds with law firm funds. A trustee savings account is an account where money is held in trust on behalf of a beneficiary.

A revocable trust account is a deposit account owned by one or more people that designates one or more beneficiaries who will receive the deposits upon the death of the owner s. Maintain a single account to hold all client funds that is separate from the law firms operating money. Here are some of the main features of a trust.

A trust fund is a legal entity that determines how assets will be managed and distributed to beneficiaries usually upon the death of the grantor the person who sets up the trust What is a trust fund. A trust fund is a special type of legal entity that holds property for the benefit of another person group or organization. If you set up a trust through your will you could also be called the testator or decedent.

Trust accounts are financial accounts that are managed by someone on behalf of someone else. Breaking down a trust account The basic idea of a trust account is to designate another party to hold on to your assets and possibly manage them too. The trustee must manage the property to reap the most benefits for the named beneficiaries or heirs within the control of the trust.

You can set up a trust to give your children a certain portion of the. The beneficiary may be an individual or a group. Their primary use is to save money for a long period of time.

What Is Trust Accounting. Trust accounts and in-trust accounts allow you to deposit manage and withdraw the money of a third party. If you are the person whos creating a trust youre called the grantor trustor settlor or trust maker.

A trust fund sets rules for how assets can be passed on to beneficiaries. There are several types of trust accounts designed for a variety of different financial planning purposes. Setting up a trust fund sometimes referred to as a trust means there is an arrangement where a person or group of people have control over assets or money.

One of the main benefits of a trust account is that it allows the trusts creator called the grantor to establish their own terms for how they want their assets managed and distributed to the beneficiaries. Anytime a law firm or attorney holds funds in a trust account it must be accounted for which is where Trust Accounting comes in to play. Generally speaking there are two guidelines law firms should abide by.

Although trust funds are often seen as something only the very wealthy have theyve become a way for people who arent necessarily high earners to manage how assets. The creator of the trust is known as a grantor or settlor. Trust funds can be revocable or irrevocable.

There are three parties involved in a trust fund. A trust fund is a legal entity that can hold property on behalf of someone or some group. A revocable trust can be revoked terminated or changed at any time at the discretion of the owner s.

The grantor the trustee and the beneficiary. Trust funds are designed to allow a persons money to continue to be used in specific ways after they pass away and to avoid their estate going through probate court a time-consuming and. What is a trust fund.

What Is Trust Accounting. A trust account is a legal arrangement through which funds or assets are held by a third party the trustee for the benefit of another party the beneficiary. A trust account allows a person or entity to control the accounts assets on behalf of a third party or beneficiary such as setting up a college tuition fund or paying property taxes.

What Is A Trust Fund How It Works Types How To Set One Up

What Is A Trust Fund How It Works Types How To Set One Up

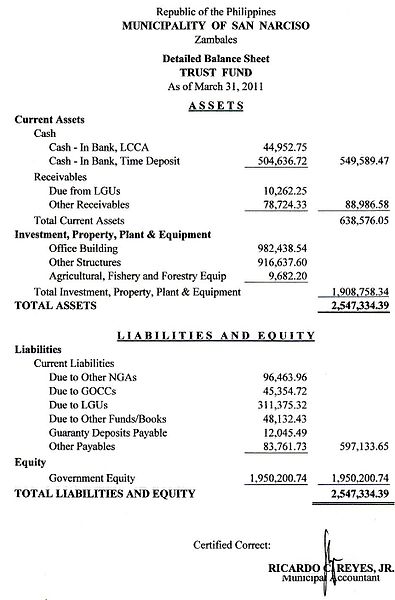

What Is A Fund Balance Writework

What Is A Fund Balance Writework

Trust Fund Invoicing Bigtime Iq Enterprise User Manual

Trust Fund Invoicing Bigtime Iq Enterprise User Manual

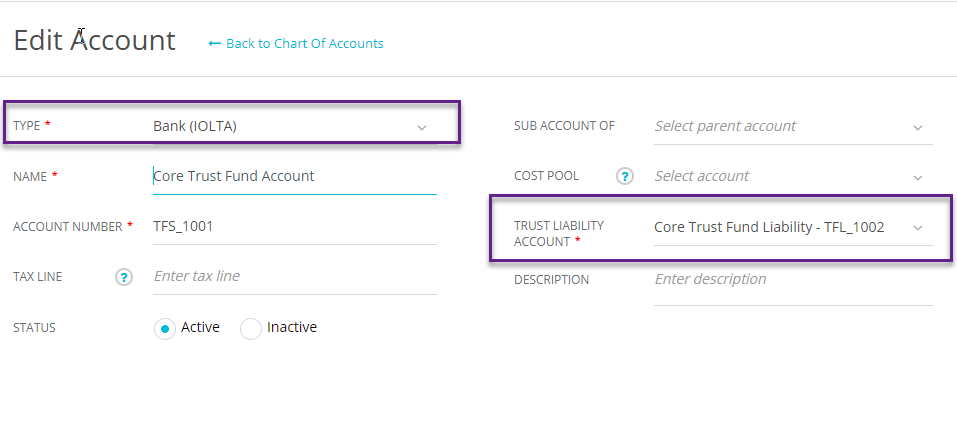

Trust Fund Accounting In Core Core Help Center

Trust Fund Accounting In Core Core Help Center

Trust Fund Report In Quickbooks Bigtime Iq Enterprise User Manual

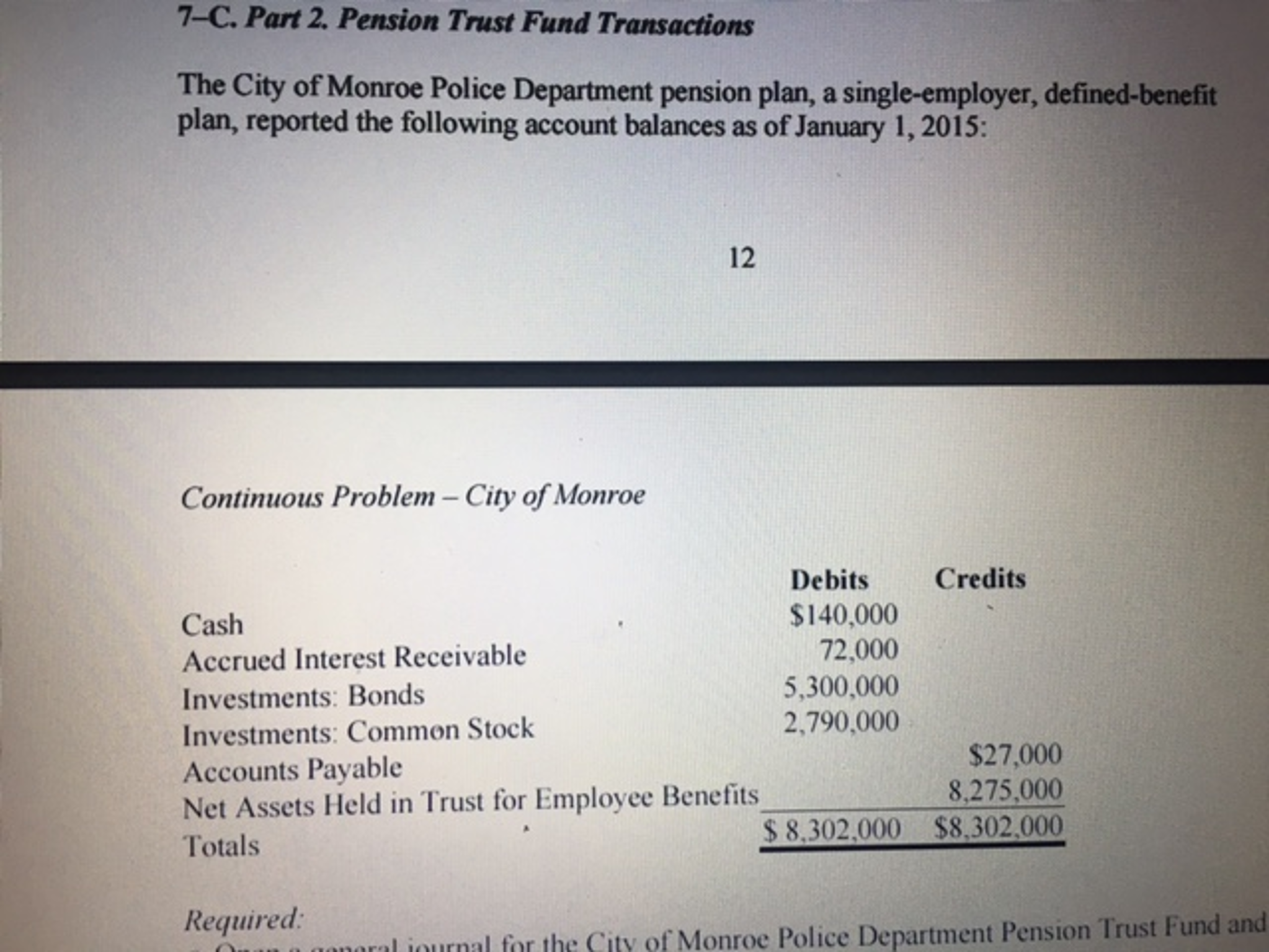

Solved 7 C Part 1 Private Purpose Trust Fund Transactio Chegg Com

Solved 7 C Part 1 Private Purpose Trust Fund Transactio Chegg Com

Set Up Trust Fund Invoicing Bigtime Iq Enterprise User Manual

First Nations Trust Fund As Of March 31 2009 Information From Aandc Web Site Media Knet Ca

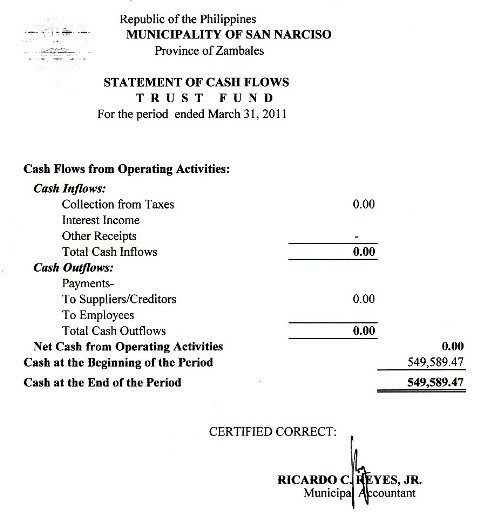

File 02 Statement Cash Flows Trust Funds Jpg Wikipedia

File 02 Statement Cash Flows Trust Funds Jpg Wikipedia

Are Unit Trust Funds Better Than Savings Accounts Imoney

Are Unit Trust Funds Better Than Savings Accounts Imoney

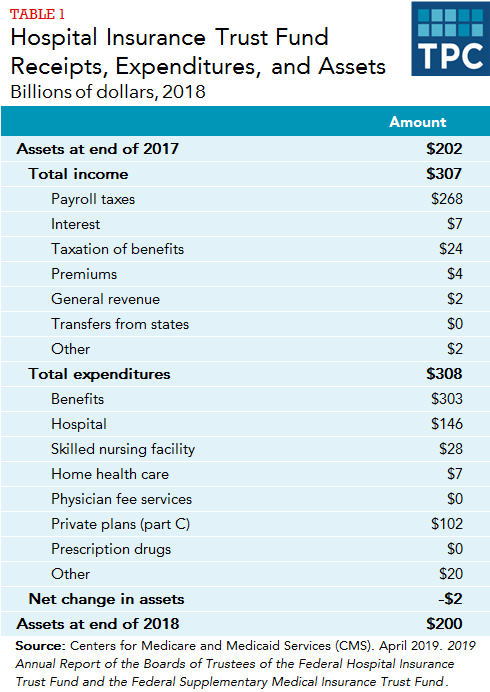

What Is The Medicare Trust Fund And How Is It Financed Tax Policy Center

What Is The Medicare Trust Fund And How Is It Financed Tax Policy Center

/what-is-a-trust-fund-357254_final1-5b3e687ac9e77c00370bae43-72eaa014efbf46a9a42fd1b90a5251b9.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.