Filing your small business taxes each year does not have to be stressful or painful. Originally written by Simon Thomas on Small Business Whats worse when youre self-employed.

Self Employment Tax For U S Citizens Abroad

Self Employment Tax For U S Citizens Abroad

You pay tax on the profits from your business and on any other income that you have.

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)

When do you have to pay self employment tax. Tax can be a bit of a. The main legal obligation when becoming self-employed is that you must register as a self-employed person with Revenue. In addition to the income tax youll need to pay self-employment taxes that support the.

If you make a late payment of any taxes due by you you will be charged interest from the due date to the date when your payment is received. Each estimated tax payment includes your income taxes and self-employment taxes Social Security and Medicare taxes. But you cant over-pay unless your employer has made a calculation error.

Use the calculation chart for instalment payments for 2021 PDF to determine your. You have to file an income tax return if your net earnings from self-employment were 400 or more. You may have to pay tax by instalments if your income does not have enough tax withheld or if you are self-employed have rental or investment income certain pension payments or have income from more than one job.

In general you have to pay self-employment tax if either of these things are true during the year. Not all 1099-NEC or 1099-MISC forms are from self-employment. HMRC must receive a paper tax return by 31 January.

You must pay self-employment tax on the net profit of your employment if you still owe these taxes after considering your total income for the year. You do not need to pay self-employment tax on income that you earn from an employer if the employer withheld. If your net earnings from self-employment were less than 400 you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR instructions PDF.

If youre self-employed youll need to fill in a self-assessment tax return each year and pay your tax bill either in one go by 31 January or using payment on account. Apply for a National Insurance number if you do not have one. However because youre self-employed you may need to make quarterly estimated tax payments to cover both.

Submit your online return by 30 December if you want HMRC to automatically collect tax you owe from your wages and pension. The IRS calls these quarterly tax payments estimated taxes. You had church employee income of 10828 or more.

You had 400 or more in net earnings from self-employment excluding anything you made as a. To pay tax youll need to register for Self Assessment. Your net earnings from self-employment excluding church employee income were 400 or more.

Tax will be taken at source if for example you are also employed as well as. If youre self-employed you ordinarily have to make tax payments to the IRS four times during the year. But due to the fallout of coronavirus if you have tax payments due in July 2020 under the self-assessment system you can defer them until January 2021.

That is once every quarter. But this doesnt mean you can wait until April 15 to pay all the tax you owe for the year. The tax year runs from 6.

As a rule you need to pay self-employment tax if your net earnings from self-employment are at least 400 over the tax year. The very latest you can register with HMRC is by 5 October after the end of the tax year during which you became self-employed. Your federal income tax return for any year is generally due on April 15 of the following tax year.

You must pay these taxes on your total income. You must pay self-employment tax and file Schedule SE Form 1040 or 1040-SR if either of the following applies. Heres what you need to know about estimated taxes.

You might need to. Self-employment has its perks but being your own boss can lead to headaches come tax season. Ordinarily the deadline for paying estimated taxes each year starts on April 15 first deadline June 15 second deadline September 15 third deadline and January 15.

You must be eligible. If your self-employment income is 400 or more after deducting expenses youll have to pay self-employment tax. When youre self-employed you must pay estimated taxes if you expect to owe at least 1000 in federal tax for the year.

When do I have to pay self-employment tax. Generally your net earnings from self-employment are subject to self-employment tax. This includes individuals who have their own business as well as independent contractors and freelancers.

You normally have to make a payment on account if your previous years bill excluding Class 2 NIC was over 1000 unless more than 80 of your previous years tax was taken off at source. Having to pay your tax bill or making a mistake and finding out youve overpaid. If you have a 1099 NEC or 1099-MISC This could be self-employment income and you would pay taxes on it on the conditions described above.

The dreaded self-employment tax The SE tax is the way the Feds collect Social Security and Medicare taxes on non-salary income from work-related activities. Register for Self Assessment. For example if you started your business in June 2020 you would need to register with HMRC by 5 October 2021.

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png) Tax Guide For Independent Contractors

Tax Guide For Independent Contractors

How Much Is Self Employment Tax How Do You Pay It

How Much Is Self Employment Tax How Do You Pay It

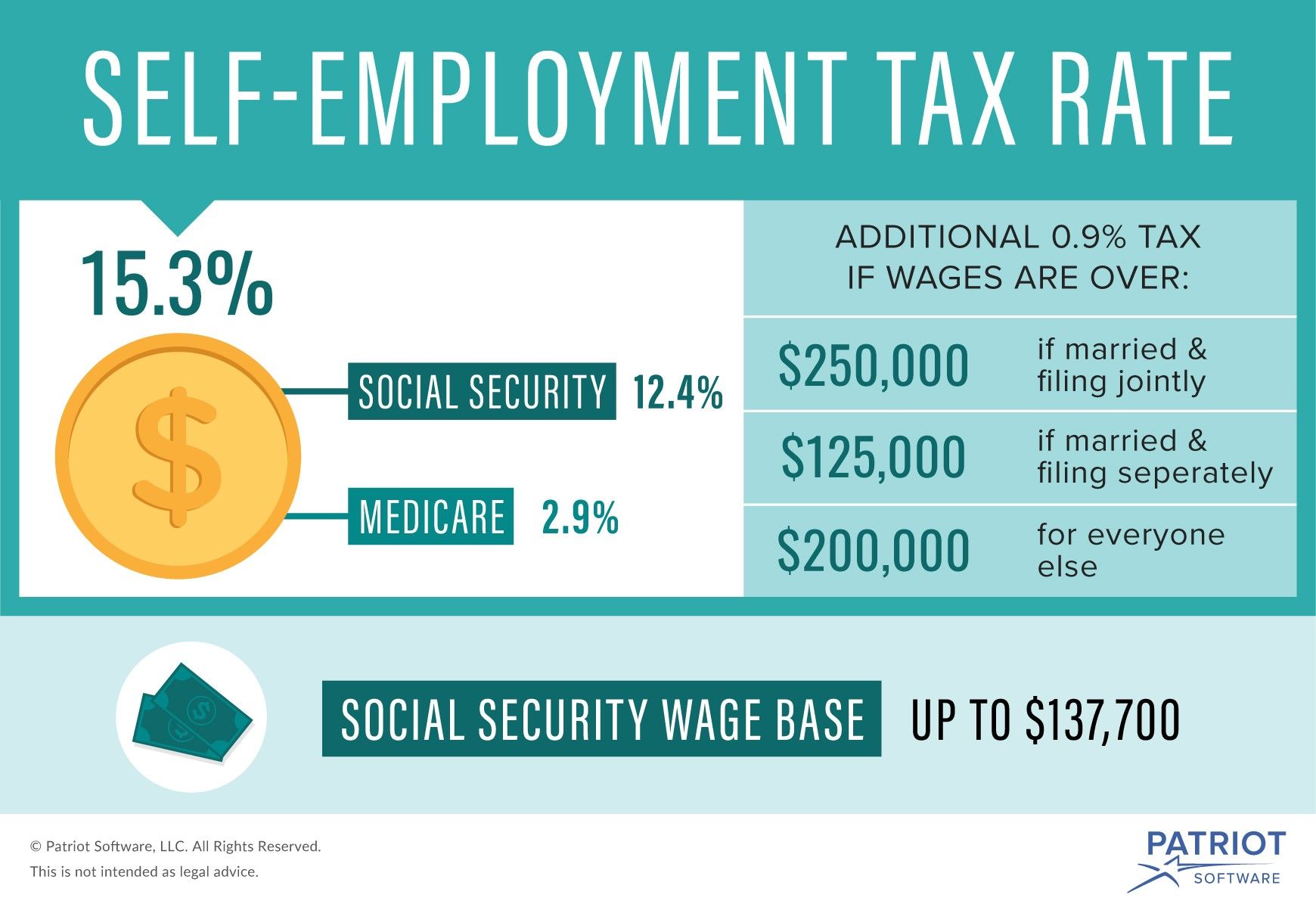

What Is Self Employment Tax Rate Calculations More

What Is Self Employment Tax Rate Calculations More

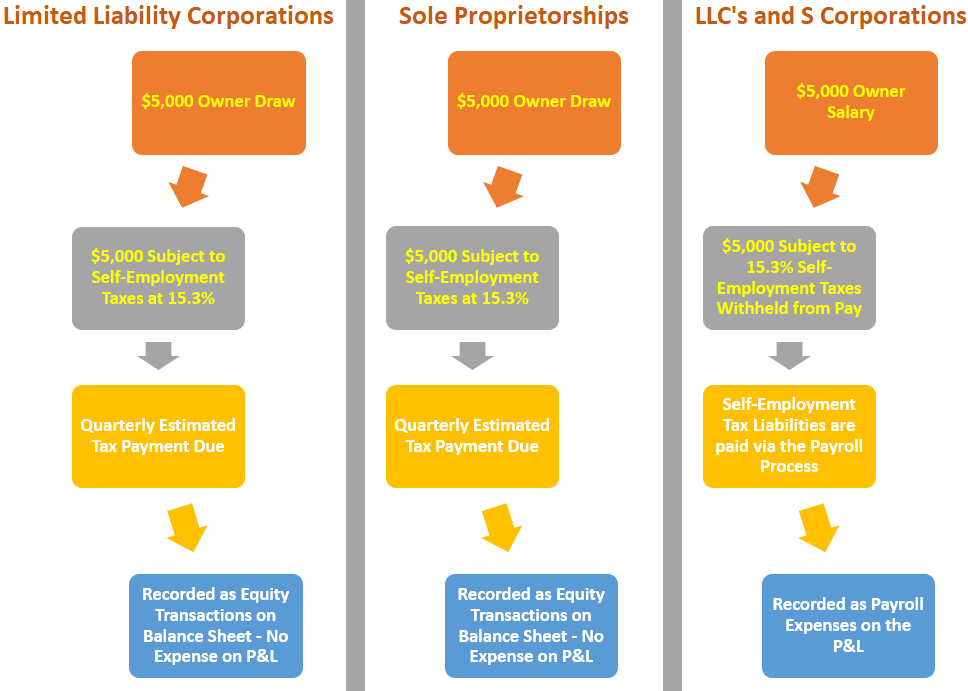

Understand How Small Business Owners Pay Themselves Track Self Employment Tax Liabilities Lend A Hand Accounting Llc

Understand How Small Business Owners Pay Themselves Track Self Employment Tax Liabilities Lend A Hand Accounting Llc

What Is Self Employment Tax Rate Calculations More

What Is Self Employment Tax Rate Calculations More

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png) How Much Should You Budget For Taxes As A Freelancer

How Much Should You Budget For Taxes As A Freelancer

Payroll Taxes Who Pays How Much And How If Self Employed Don T Mess With Taxes

Self Employed Tax Dummies Guide To Tax And Self Employement

Self Employed Tax Dummies Guide To Tax And Self Employement

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Reform 101 For Self Employed Tax Pro Center Intuit

Tax Reform 101 For Self Employed Tax Pro Center Intuit

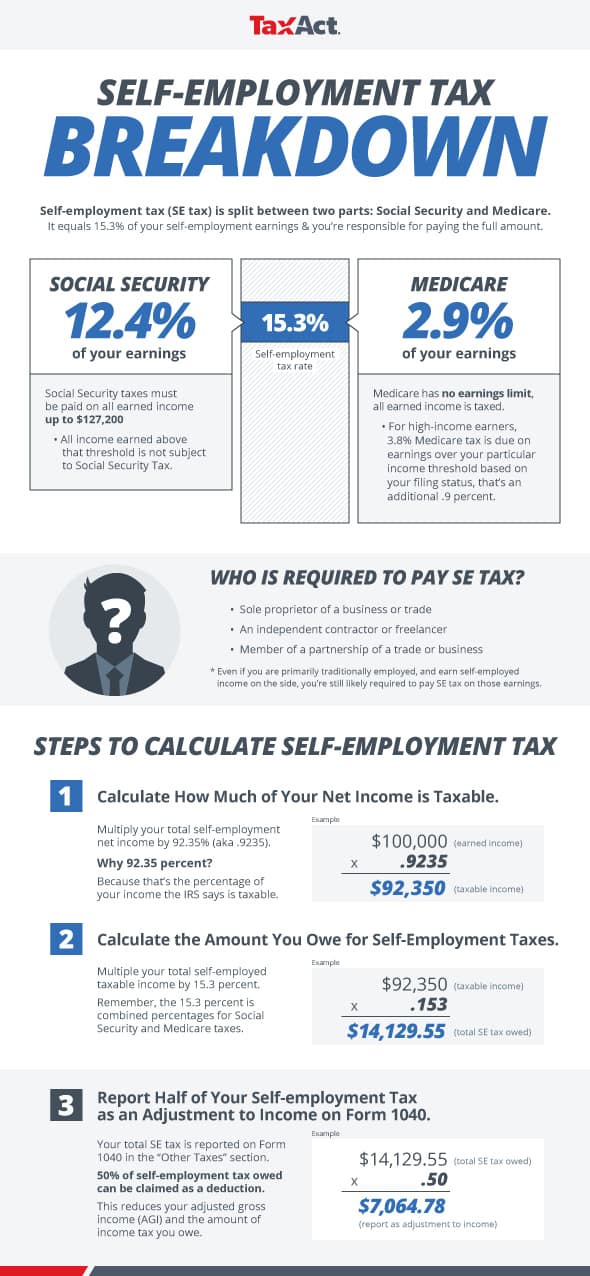

How Self Employment Is Tax Calculated Taxact Blog

How Self Employment Is Tax Calculated Taxact Blog

Self Employment Tax What Is The Self Employment Tax In 2019

Self Employment Tax What Is The Self Employment Tax In 2019

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.