The seller can contribute up to 4 percent of your closing costs. Navy Federal Credit Union Mortgage helps with closing costs in several ways.

Closing Documents Makingcents Navy Federal Credit Union

Closing Documents Makingcents Navy Federal Credit Union

VA loan Get a 10- to 30-year VA loan with no money down.

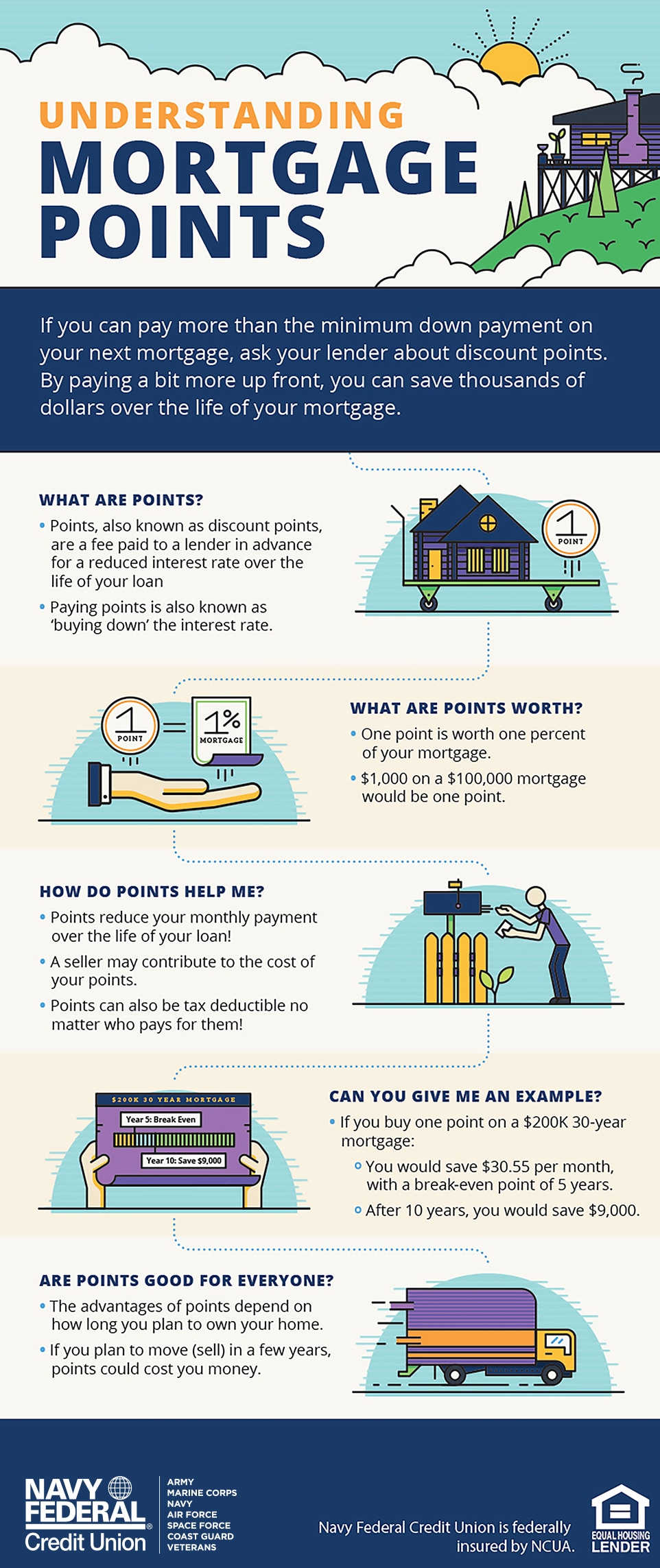

Navy federal refinance closing costs. What will my closing costs be. One point amounts to 1 of the loan amount and is paid at closing. For example Military Choice Loans include a funding fee of 175 of the loan amount that can be financed into the loan or waived for a 0375 interest rate.

Navy Federal doesnt appear to charge the majority of fees other banks and lenders might. You should compare your refinancing costs to the savings youll enjoy from a lower interest rate. AND THEY WERE RIGHT.

This loan requires no application or origination fee and you get the entire amount at closing. Theres no PMI required and sellers can contribute up to 6. You can use the 2500 towards closing costs or as a credit for fees paid outside of.

Navy Federal will pay most of the closing costs on both types of loans. Your total estimated closing costs will be 3417 Your total estimated closing costs will be 3417. You wont pay a fee for underwriting documents or applying for most loans.

PRNewswire-USNewswire -- Navy Federal Credit Union is delighted to announce that for a limited time only we will pay up to 2500 towards members closing. Navy Federal Will Pay Up to 2500. LTV restrictions apply to refinance loans.

To estimate your closing costs earlier use our Closing Costs. Currently Navy Federal charges a 50 percent. This funding fee can be financed into the loan up to a maximum of 10175 LTV or the fee can be waived for a 0375 increase in the interest rate.

The 1 mortgage origination fee can be rolled into the loan so that you are responsible for less out-of-pocket closing. Terms fees and discounts on Navy Federal Credit Union mortgages depend on the product. An exception is the 100 financing 0 down Choice line of loans which require a 1 origination fee and 175 funding fee.

Be prepared to have closing costs available up to 2 days before your closing date. I closed with NFCU in March and they estimated 15K closing cost on 325K but they did tell me up front that they always estimate on the high side. This is a good option for borrowers who want to purchase a home but are not eligible for first-time home buyer programs such as an FHA or VA loan.

Navy Federal Credit Unions home loan options include. Within 3 days of submitting your application well send you a Loan Estimate that provides important information about your loan including the estimated interest rate your monthly payment estimate and expected closing costs. Navy Federal offers two types of home equity loans that allow homeowners to tap the equity in their home for remodeling and other needs.

Navy Federal does not charge application fees. Purchase loans require no down payment. Points dont always have to be round numbers.

After you review it call or email your loan officer within 10 days to confirm that youd like to proceed with your application. Rates displayed are the as low as rates for purchase loans and refinances of existing Navy Federal loans. Navy Federal Credit Union 2500 Towards Closing Costs Navy Federal Credit Union which consistently offers some of the lowest mortgage rates today is also offering 2500 towards closing costs.

Other fees are listed on your loan estimate and can include origination fees or funding fees. Navy Federal Credit Union is currently offering its members 500 off mortgage loan closing costs. All Choice loans are subject to a funding fee of 175 of the loan amount.

USAA offers no fee IRRRL and a lower origination fee. Typically these equal about 3 of your loan amount and can be paid through a wire transaction or cashiers check. Costs and fees.

The Navy Federal Homebuyers Choice mortgage offers up to 100 financing with fixed rates and terms from 16 30 years. About three days before closing youll receive your Closing Disclosure which will list your closing costs. For closing costs under 1000 a personal check may be accepted.

Closing costs for a refinance are typically three to six percent of the loan amount. Purchasing 15 points would cost 3000 on a 200000 mortgage. A fixed-rate equity loan allows you to borrow 100 of your equity between 10000 and 500000.

The Mortgage Refinance Process Navy Federal Credit Union

The Mortgage Refinance Process Navy Federal Credit Union

Navy Federal Will Pay Up To 2 500 Towards Closing Costs

Closing Cost Calculator Navy Federal Credit Union

The Mortgage Refinance Process Navy Federal Credit Union

100 Financing Mortgages Navy Federal Credit Union

100 Financing Mortgages Navy Federal Credit Union

Navy Federal Credit Union Mortgage Review 2021

San Diego Mortgage And Real Estate Why San Diego Veterans Choose Me Over Navy Federal Credit Union For Va Home Loans

San Diego Mortgage And Real Estate Why San Diego Veterans Choose Me Over Navy Federal Credit Union For Va Home Loans

Closing Cost Calculator Navy Federal Credit Union

The Mortgage Refinance Process Navy Federal Credit Union

What Are The Typical Closing Costs On A Refinance The Simple Dollar

What Are The Typical Closing Costs On A Refinance The Simple Dollar

How Do Mortgage Points Work Navy Federal Credit Union

How Do Mortgage Points Work Navy Federal Credit Union

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.