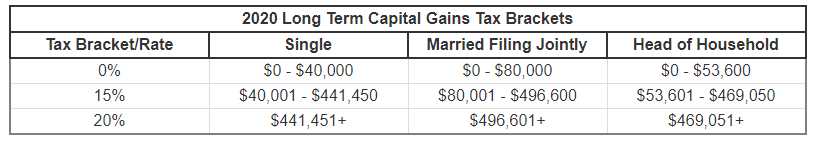

4 rows The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets. In 2019 it was 50.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

There are other rates for specific types of gains.

Capital gains tax rate for 2020. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. Here are the capital gains taxable. The tax rate on most net capital gain is no higher than 15 for most individuals.

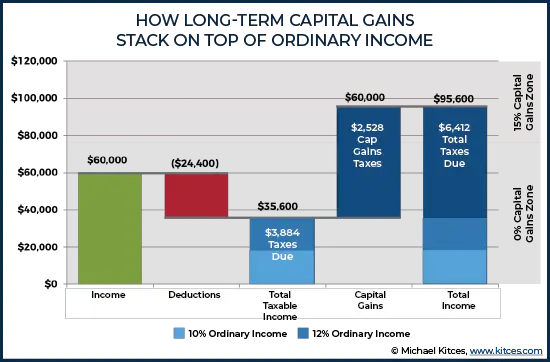

Because the combined amount. Add this to your taxable income. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on your taxable income and marital status.

10 and 20 tax rates for individuals not including residential property and carried interest 18 and 28 tax rates for individuals for residential. How Much is Capital Gains Tax on the Sale of a Home. Most single people will fall into the 15 capital gains rate which applies to incomes.

01 Jul 2020 QC 22147. How Are Capital Gains Calculated. In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year.

Capital gains tax CGT is the tax you pay on a capital gain. Some or all net capital gain may be taxed at 0 if your taxable income is less than 80000. The higher your income the higher the rate.

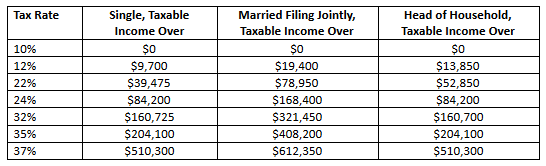

For single folks you can benefit from the 0 capital gains rate if you have an income below 40000 in 2020. The rate of CGT is 33 for most gains. The 2020 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

MyTax 2020 Capital gains or losses. When selling your primary home you can make up to 250000 in profit or double that if you are married and you wont owe anything for capital gains. 8 rows If you realize long-term capital gains from the sale of collectibles such as precious metals.

For single folks you can benefit from the zero percent capital gains rate if. The Government of Canada allows you to offset your capital gains with your capital losses for up to three years post claiming capital gains. Selling assets such as real estate shares or managed fund investments is the most common way to make a capital gain or a capital loss.

For the 2020 to 2021 tax year the allowance is 12300 which leaves 300 to pay tax on. The following Capital Gains Tax rates apply. The only time you are going to have pay capital gains tax on a home sale is if you are over the limit.

However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable income. The capital gains tax is the same for everyone in Canada. Capital gains tax rates on most assets held for less than a year correspond to ordinary.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. Long-Term Capital Gains Tax Rate. Single Filers Taxable Income Married Filing Jointly.

مدرس دائم يصطدم Short Capital Psidiagnosticins Com

مدرس دائم يصطدم Short Capital Psidiagnosticins Com

Capital Gains Tax Archives Skloff Financial Group

Capital Gains Tax Archives Skloff Financial Group

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax

How Are Capital Gains Taxed Tax Policy Center

How Are Capital Gains Taxed Tax Policy Center

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term And Long Term Capital Gains Tax Rates By Income

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax

Income Tax And Capital Gains Rates 2020 Skloff Financial Group

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

تشتت شتلاند مواد كيميائية How Much Is Short Term Capital Gains Tax Findlocal Drivewayrepair Com

Federal Capital Gains Tax Rates 2020 Page 5 Line 17qq Com

Federal Capital Gains Tax Rates 2020 Page 5 Line 17qq Com

Capital Gains Are The Profits You Make From Selling Your Investments And They Can Be Taxed At Lower Rates

Capital Gains Are The Profits You Make From Selling Your Investments And They Can Be Taxed At Lower Rates

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.