The borrower first needs to prove that their existing living conditions no longer can meet the needs of their growing family. But while you dont need to be a first-time homebuyer to qualify generally speaking you can only have one FHA loan at a time.

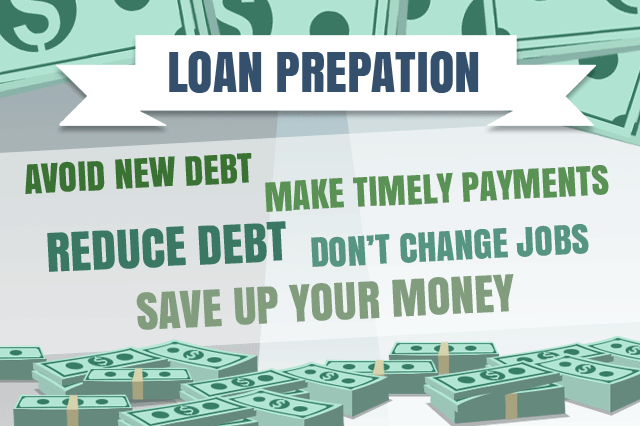

How To Prepare For An Fha Home Loan In 2020

How To Prepare For An Fha Home Loan In 2020

Those circumstances include job relocations changes in family size and situations where a co-borrower vacates the property with an existing FHA mortgage loan to purchase a home of their own.

Can you get an fha loan twice. In any case the lender is restricted on how and when a second appraisal may be ordered. Check todays refinance loan rates and see if you can cancel your FHA mortgage insurance. You must plan to live in the home with the new FHA-backed mortgage and you must not be in default on an earlier FHA loan or otherwise owe the FHA.

This prevents potential borrowers from using the loan program to buy investment properties. Once you have paid off enough of the loan that you owe 80 or less of the homes value you can refinance your FHA mortgage to a conventional mortgage and get. You can get multiple FHA loans in your lifetime.

FHA appraisals are ordered by the lender so the borrower cannot initiate any second appraisal requests. Learn whats involved in having multiple FHA loans at the same time and the limitations you may run into along the way. Second-time home buyers who are financially qualified can apply for an FHA mortgage and get approved for the mortgage even though they are not first-time buyers in financial need etc.

Specific Restrictions On Ordering Second Appraisals. Provided you have met all the rules and criteria you may take out an FHA loan as often as you wish. The good news is you can cancel your FHA mortgage insurance and you can start today.

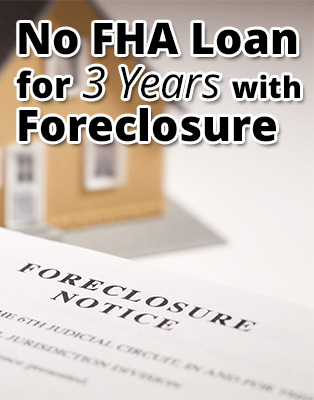

Another reason a borrower may be allowed to obtain a second FHA loan is if their family size has grown significantly since their first home purchase. In most cases a borrower cannot have two FHA loans at once with certain exceptions made for extenuating circumstances. Be absolutely certain that you are also working with an experienced FHA loan officer especially if you decide to pursue an FHA 203k Rehab loan.

A borrower may get a second FHA loan to purchase a primary residence located at least 100 miles away from their existing primary residence. Check your Loan Balance. You just have to follow the FHA rules that pertain to you even if it is your first time refinancing on the program.

If you have a need for a larger or smaller home or if you will move to a different area. Method 1 to Get Rid of FHA Mortgage Insurance. Second home loans are only permitted with written approval from the area FHA office after a determination that.

According to the FHA loan rulebook To prevent circumvention of the restrictions on FHA insured mortgages to investors FHA generally will not insure more than one mortgage for any borrower transactions in which an existing FHA mortgage is paid off and another FHA mortgage. The Borrower has no other Secondary Residence. Learn whats involved in having multiple FHA loans at the same time and the limitations you may run into along the way.

Luckily the answer is yes You can use it multiple times. There are a few restrictions with regard to earlier FHA loans. There are two methods for removing your FHA mortgage insurance commonly known as FHA MIP.

The long and short answer regarding whether you can use a USDA loan twice is that it depends on the situation. You may qualify for an FHA loan on a second home if you meet one of the FHA hardship exemptions. He or she can often spot issues that will be problematic and can direct you to further resources as needed.

The second FHA mortgage may be pursued after 12 months of on-time payments occurred with the first loan especially since you will legally have to occupy that previous property for a year. Work with an agent that has experience with FHA transactions. If you currently own a home then the answer is cut and dry you cannot use USDA financing again.

There must be a valid reason to purchase another home with FHA. The misconception about FHA mortgage loans is that they have an income limit are need-based and limited to those who have never owned a home before. The second home will not be a vacation home or be used primarily.

Youll need their help.

Fha Loan Guide Requirements Rates And Benefits 2021

Fha Loan Guide Requirements Rates And Benefits 2021

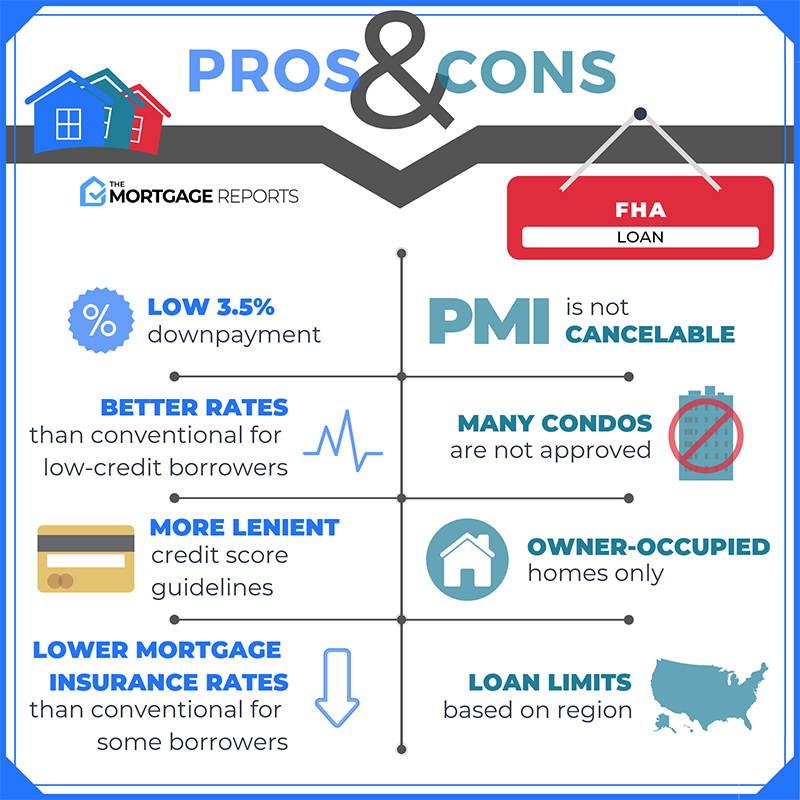

Fha Vs Conventional Which Low Down Payment Loan Is Best

Fha Vs Conventional Which Low Down Payment Loan Is Best

Can You Use The Fha Streamline Refinance Twice Fhastreamlinemortgage Com

How Many Times Can I Get An Fha Loan Experian

How Many Times Can I Get An Fha Loan Experian

Fha Criteria For 2012 Borrowers Can Expect More Of The Same

How Many Times In My Life Can I Get An Fha Loan Fha News And Views

How Many Times In My Life Can I Get An Fha Loan Fha News And Views

Fha Loans 2021 Loan Requirements Guidelines How To Qualify

Fha Loans 2021 Loan Requirements Guidelines How To Qualify

Fha Loan Rules For Second Home Purchases

Fha Loan Rules For Second Home Purchases

Should You Get An Fha Loan Arcus Va Mortgage

Should You Get An Fha Loan Arcus Va Mortgage

When Are You Eligible For A Second Fha Loan Federal Home Loan

When Are You Eligible For A Second Fha Loan Federal Home Loan

Fha Loans Everything You Need To Know The Truth About Mortgage

Fha Loans Everything You Need To Know The Truth About Mortgage

Fha Streamline Refinance Rates Requirements For 2021

Fha Streamline Refinance Rates Requirements For 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.