Generally it comes down to the following. You Want to Buy a Car You Are Leasing.

Can You Refinance Your Car Aspire Federal Credit Union

Can You Refinance Your Car Aspire Federal Credit Union

You Have a Dealer Loan.

Steps to refinance a car. Heres a step-by-step guide to evaluate your current loan and submit an application to refinance your car. How to refinance a car loan in 6 simple steps To get started with refinancing a car loan follow these steps. Step 4 Apply for a vehicle refinance loan with a reputable bank.

Step 5 Pay off the balance of your original loan. In order to know how much car you can afford first take a look at your income and expenses. Decrease your monthly payments.

However it can take some leg work to find a. If your current car loan has high prepayment penalties it might not make sense to consider a refinance. Review your current loan.

4 Car Refinance Steps. It will come handy when negotiating the best auto loan rate. Locate the Ideal Auto Refinance Loan.

Set Goals and Expectations. Step 3 Find out if you qualify for refinancing. However before getting your heart set on driving a certain vehicle first create a car budget.

Here are three steps to take to refinance your car loan. Reduce your interest rate. We all have dreams of the car we want to drive someday.

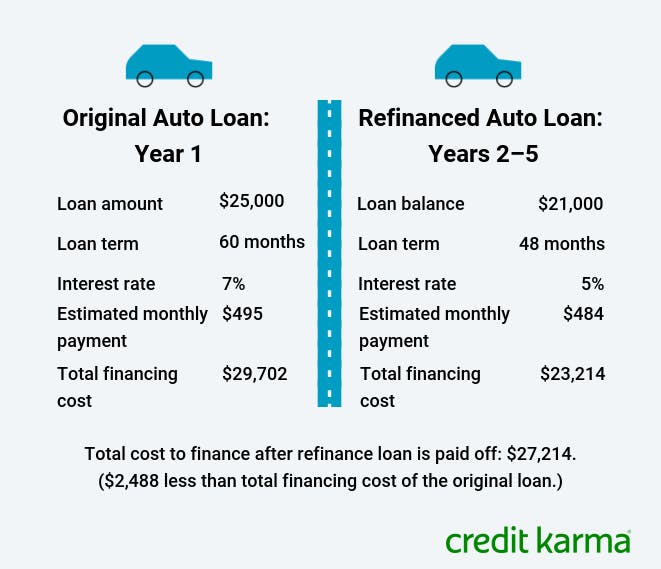

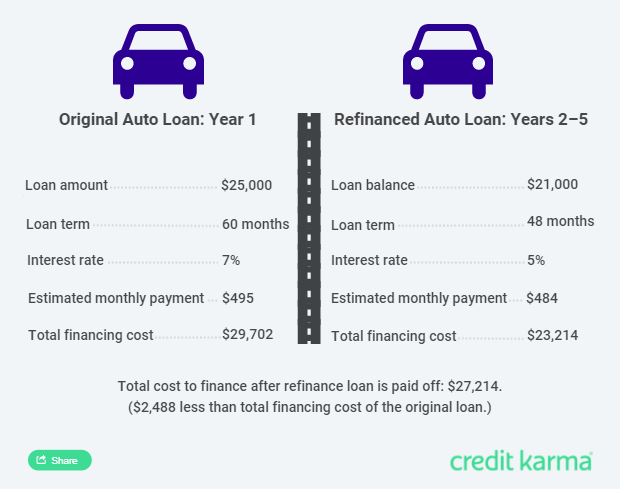

If your loan balance is around 15000 you will save 600 every year 50 every month when you lower your rate by 4. Ensure all of the details on your closing disclosure are correct and make sure your closing costs havent dramatically increased from the loan estimate. This is to help the lender make back some of the money its losing from lost interest payments.

Once you have decided that you would like to move forward with a car loan refinance gather all your pertinent documents for the vehicle your personal finances and the existing loan. A new loan with better terms or pricing than your existing auto loan Details about your current loan including the current lender your account number and your loan balance Information about your vehicle including the make model year and VIN. Know Your Cars Value.

1- Check your Credit. Interest Rates Are Falling. Most of these loans are secured by a car and paid off in fixed monthly payments over a predetermined period of time usually a few years.

Determine if a refinance makes sense Collect your documents. Step 1 Be 100 sure that vehicle refinancing is the right decision. It will give you new terms and could help you save money making your car payment more affordable.

If you know your score that will help speed up the process to refinance a car. Refinancing a car loan involves taking on a new loan to pay off the balance of your existing car loan. Step 2 Collect the documents you need to refinance your car.

Understand Your Credit Score and Credit History. The interest to refinance a car will be based almost solely on your credit score. Get your credit score.

Choosing the best auto refinance to meet your needs. What Happens When You Refinance A Car. To refinance an existing loan you need the following.

Its no secret that your auto loan depends largely on your credit score and the higher the credit score the better your loan rate will be. Find Your Auto Refinance Lender. Step-by-step guide to refinancing your car.

There are various factors that determine what happens when you refinance a car. While you can sometimes work with your current car loan lender to refinance your car you usually need to find a new lender if you want to refinance. To help you find out how to refinance a car loan weve put together six steps you can follow to make your refinance a success.

Close on your home refinance. Create a Car Budget. Set Goals and Expectations.

List all of these in a document and you can see what your overall household budget is month to month. When you first decide youd like to start the auto refinance. If you have not already gotten a free copy of your credit score one is available each year to everyone in the country.

You might be eligible for a lower interest rate. Here are a few anyone looking to refinance should consider. Check your credit score.

Why Should I Refinance My Car. 4 Car Refinance Steps 1. You can reduce your cash outflow each month by refinancing a car loan for a longer term.

Lower my monthly payment and click on Apply Now. Your Financial Situation Has Changed.

How Does Refinancing A Auto Loan Work

How Does Refinancing A Auto Loan Work

How To Refinance A Car Loan In 5 Steps Credit Karma

How To Refinance A Car Loan In 5 Steps Credit Karma

Steps In Refinancing A Car Loan Page 1 Line 17qq Com

Steps In Refinancing A Car Loan Page 1 Line 17qq Com

When Does Refinancing A Car Loan Make Sense Credit Karma

When Does Refinancing A Car Loan Make Sense Credit Karma

/when-can-i-refinance-my-car-315100-v1-7b5d435f0460419ca707f6d53ca45c6b.png) When To Refinance A Car Loan And How To Avoid Mistakes

When To Refinance A Car Loan And How To Avoid Mistakes

How To Refinance A Car 3 Quick Simple Steps Badcredit Org

How To Refinance A Car 3 Quick Simple Steps Badcredit Org

Faq Refinance Auto Loan Ilendingdirect

Faq Refinance Auto Loan Ilendingdirect

The Pandemic S Effect On Car Loans Is It Time To Refinance

The Pandemic S Effect On Car Loans Is It Time To Refinance

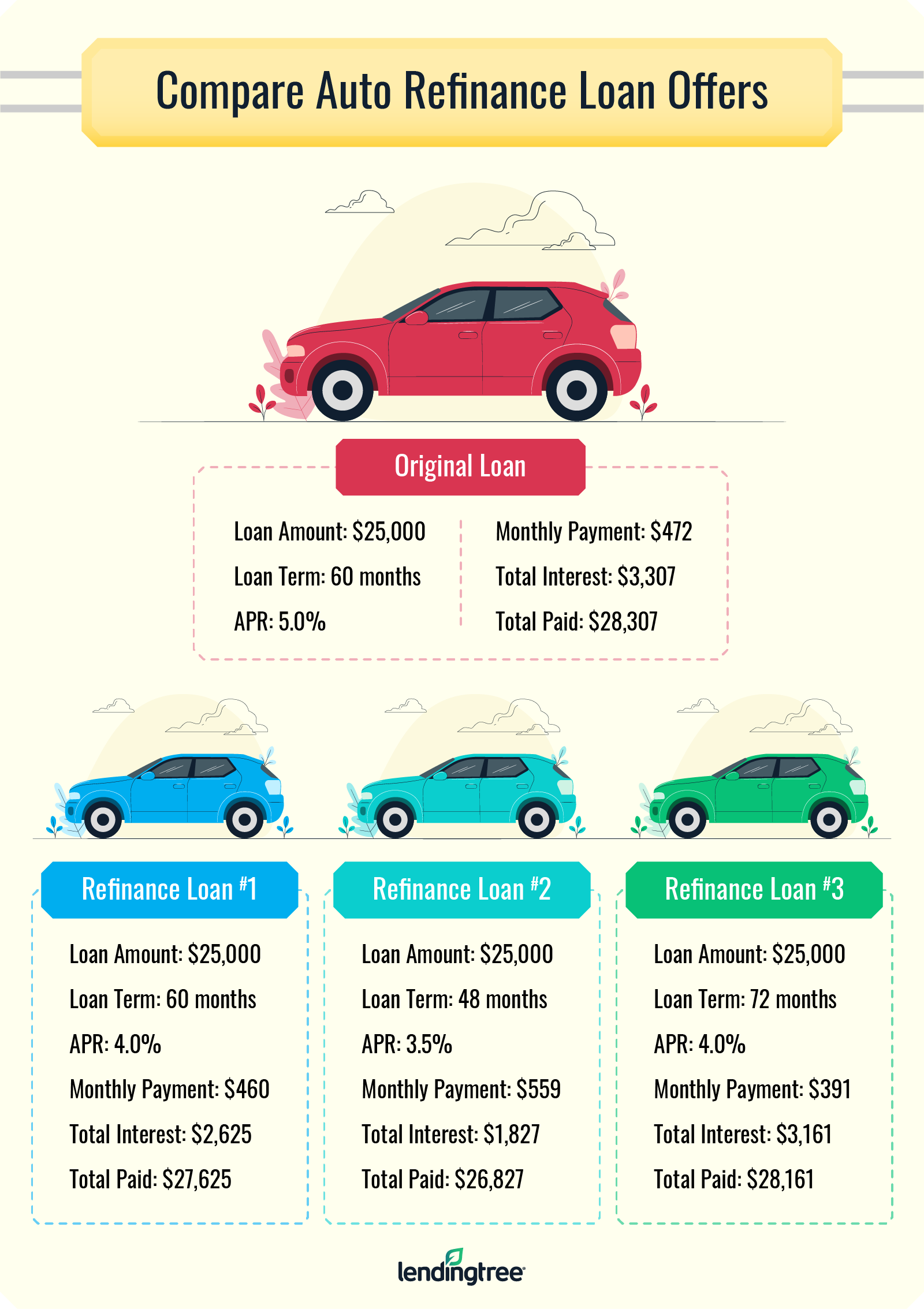

How To Refinance A Car Loan In 6 Steps Lendingtree

How To Refinance A Car Loan In 6 Steps Lendingtree

How Does Refinancing A Car Work Could It Benefit Me

How Does Refinancing A Car Work Could It Benefit Me

Steps To Refinance A Car Loan Latest News Articles Videos Blogs About Steps To Refinance A Car Loan

Steps To Refinance A Car Loan Latest News Articles Videos Blogs About Steps To Refinance A Car Loan

How To Refinance Your Car Loanfivecentnickel Com

How To Refinance Your Car Loanfivecentnickel Com

How To Refinance An Auto Loan 15 Steps With Pictures Wikihow

How To Refinance An Auto Loan 15 Steps With Pictures Wikihow

Can You Refinance An Auto Loan

Can You Refinance An Auto Loan

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.