Check out this often-overlooked savings account. Only people with a qualifying high-deductible health plan are.

Investing in a Health Savings Account HSA Free Tracking Spreadsheet April 30 2021 in HSA Health Savings Account.

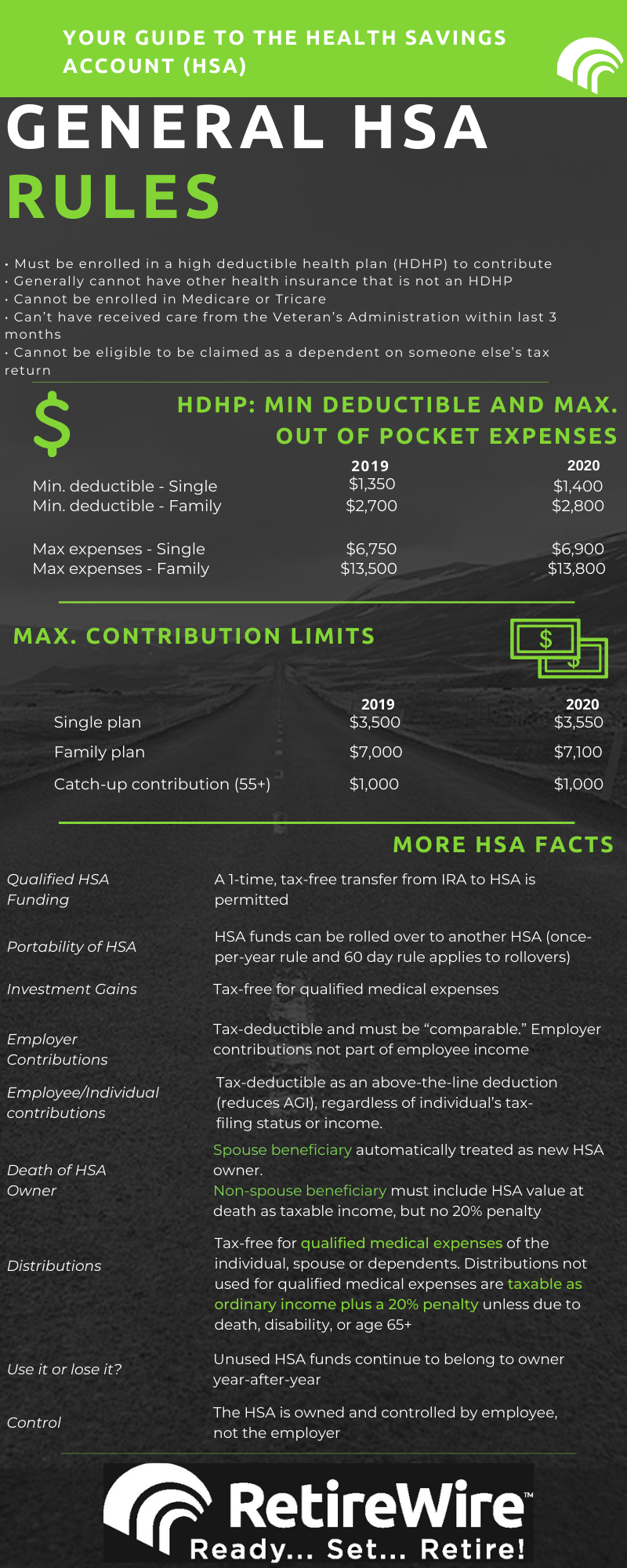

Is hsa tax free. A health savings account HSA is a tax-advantaged savings account available to people enrolled in a high-deductible health plan. It is a tax-free transfer of funds from an IRA to an HSA according to Sarah Brenner an IRA expert with Ed Slott Co. Health Savings Accounts HSAs A Health Savings Account HSA is a tax-exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur.

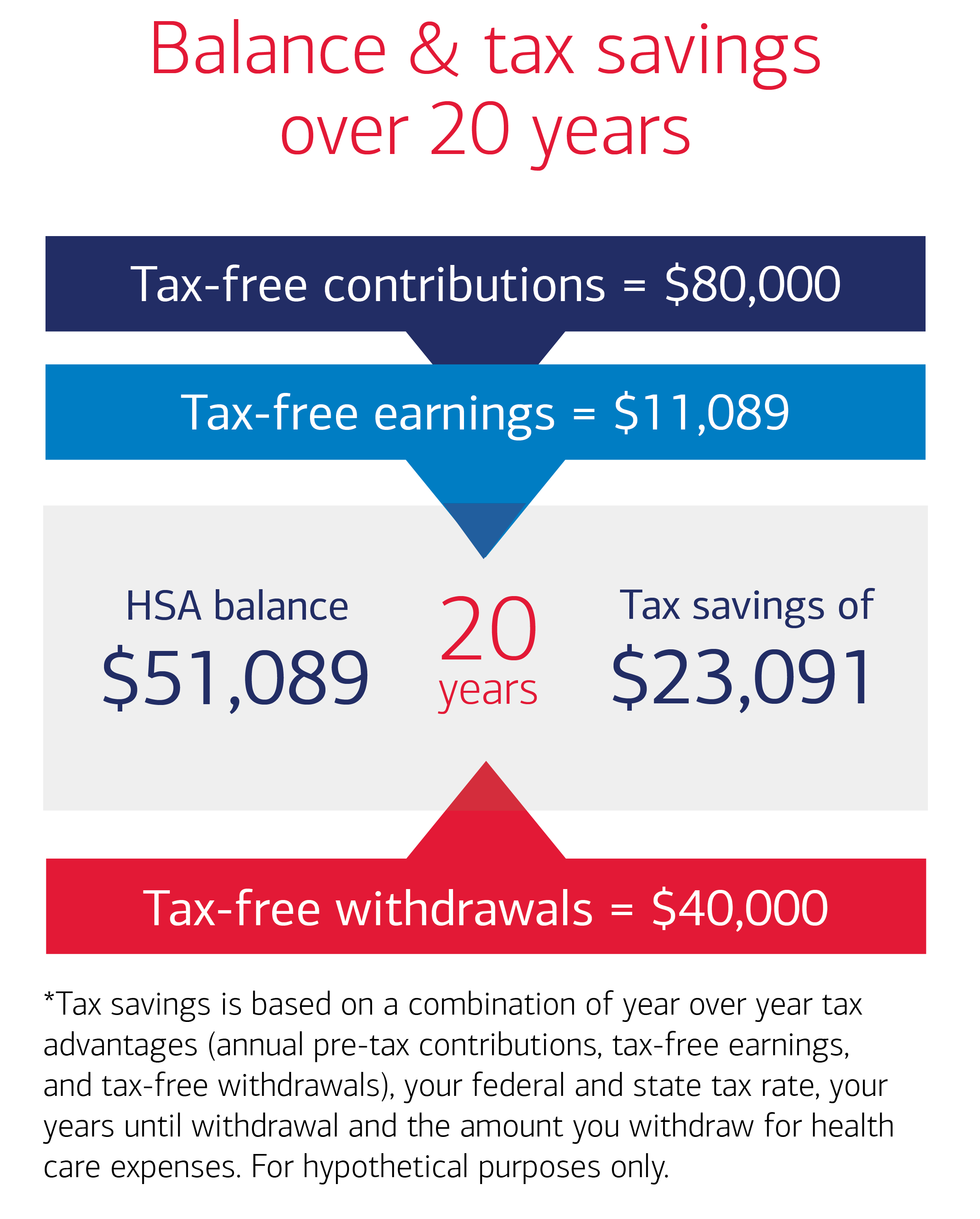

Withdrawals for qualified medical expenses are tax-free. Contributions are either pre-tax or tax-deductible interest grows tax-free and withdrawals for eligible medical expenses are also tax-free. The money deposited into the HSA is not subject to federal income tax at the time the deposit is made.

A Health Savings Account HSA is a triple tax-advantaged account. In addition to the tax benefits you can invest in it too. They are the only accounts that provide you with a tax deduction for contributions no taxes on earnings and tax-free.

You can add to your HSA straight from your paycheck by using a pretax payroll deduction. Any contributions your employer makes to your HSA do not have to be counted as part of your taxable income. HSAs work as a retirement savings plan because money can be withdrawn penalty-free for any purpose not just medical expenses after age 65.

Contributions to HSAs are not subject to federal income taxes. You your employer or both can contribute to an HSA. A health savings account HSA is an account you can use to pay a variety of medical costs.

They include most medical costs from birth control pills to guide dogs to surgery. Qualified expenses are detailed in IRS Publication 502 Medical and Dental Expenses. The triple tax savings with health savings accounts HSAs are unmatched.

Four Reasons to Consider an HSA. But with great benefit comes some responsibility. Once an HSA account holder turns 65 distributions not.

Medical care is a big part of retirement spending. Withdrawals from an HSA are tax-free as long you use the money to pay for qualified medical expenses. You must be an eligible individual to qualify for an HSA.

If you receive distributions for other reasons the amount you withdraw will be subject to income tax and may be subject to an additional 20 tax. That can happen in a couple of. These transactions are however subject to some restrictions.

There are three key tax benefits to a Health Savings Account HSA. One of the best perks of an HSA is that when you make a contribution youre adding money tax-free. 1 About Triple Tax Advantages.

Whether you contribute 50 or 7100 here are the three major tax advantages you get to enjoy with an HSA. No permission or authorization from the IRS is necessary to establish an HSA. If youre the only person your insurance covers you andor your employer could contribute up to 3550 annually.

But if you plan carefully HSAs can also be a valuable source of retirement savings providing a triple tax benefit that is even better than a 401 k. You never touch the money and it drops right into your HSA. You might find it beneficial to contribute to an HSA.

You can receive tax-free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA. Additionally HSA funds will accumulate year-to-year if the money is not spent. En español Most people know that health savings accounts HSAs are a source of tax-free money to pay out-of-pocket medical expenses.

There are maximums for allowable contributions. Investing options may be available potentially helping to grow your money. Tax deductible contributions or pre-tax in an employers plan no taxes on interest or dividends and tax-free withdrawals for qualified medical expenses.

Tax-Free Contributions One of the most attractive features of an HSA are the tax-free contributions. Money goes into and comes out of an HSA tax-free as long as funds are used to pay for qualified medical expenses. This is a key way in which an.

All contributions tax-free no income taxes or FICA Social Security and Medicare taxes. Health Savings Accounts can be fantastic planning tools.

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

Health Savings Accounts How Hsas Work And The Tax Advantages

Calnonprofits Insurance Serviceswhat Is An Hsa Calnonprofits Insurance Services

Calnonprofits Insurance Serviceswhat Is An Hsa Calnonprofits Insurance Services

Tap Into The Triple Tax Benefits Of An Hsa

Tap Into The Triple Tax Benefits Of An Hsa

Hsa And Medicare Can You Have Both Boomer Benefits

Hsa And Medicare Can You Have Both Boomer Benefits

Retirement Health Savings Account And Medicare

Retirement Health Savings Account And Medicare

Triple Tax Advantage Of Hsas Ascensus

Triple Tax Advantage Of Hsas Ascensus

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Triple Tax Advantage Of Hsas Ascensus

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.