How 2021 Sales taxes are calculated in Nevada The state general sales tax rate of Nevada is 46. The combined rate used in this calculator 8375 is the result of the Nevada state rate 46 the 89081s county rate 3775.

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

101 Zeilen How 2021 Sales taxes are calculated for zip code 89117 The 89117 Las Vegas Nevada.

Las vegas sales tax calculator. If youre looking to refinance a mortgage or purchase a home in the Silver State make sure to look at our Nevada mortgage guide. Depending on the zipcode the sales tax rate of Las Vegas may vary from 825 to 8375 Every 2021 combined rates mentioned above are the results of Nevada state rate 46 the county rate 365 to 3775. Nevada Sales Tax Calculator You can use our Nevada Sales Tax Calculator to look up sales tax rates in Nevada by address zip code.

101 Zeilen The 89109 Las Vegas Nevada general sales tax rate is 8375. The sales tax jurisdiction name is Clark which may refer to a local government division. The Las Vegas sales tax rate is.

Before tax price sales tax rate and after-tax price. Low property taxes and the absence of any state or local income taxes in Nevada can make it a particularly affordable place to own a home. Sales tax total amount of sale x sales tax rate in this case 838.

You ship las vegas nevada sales tax calculator a product to your customer in Carson City 89701 which has a sales tax rate of 772. Nevada collects a 81 state sales tax rate on the purchase of all vehicles. Nevada cities andor municipalities dont have a city sales tax.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The minimum combined 2021 sales tax rate for Las Vegas Nevada is 838. This is the total of state county and city sales tax rates.

You can find these fees further down on the page. The 2018 United States Supreme Court decision in South Dakota v. 101 Zeilen The 89032 North Las Vegas Nevada general sales tax rate is 8375.

You live and run your business in Las Vegas NV 89165 which has a sales tax rate of 810. County Sales Tax Rates Nevada sales tax details The Nevada NV state sales tax rate is currently 46. The County sales tax rate is.

The break down is as follows. Every 2021 combined rates mentioned above are the results of Nevada state rate 46 the county rate 225 to 3775 and in some case special rate 0 to 025. The 89081 North Las Vegas Nevada general sales tax rate is 8375.

How Income Taxes Are Calculated. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nevada local counties cities and special taxation districts. Some dealerships may also charge a 149 dollar documentary fee.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Or to make things even easier input the Las Vegas minimum combined sales tax rate into the calculator at the top of the page along with the total sale amount to get all the detail you need. The County sales tax rate is.

In addition to taxes car purchases in Nevada may be subject to other fees like registration title and plate fees. How to Collect. So what is the Las Vegas sales tax rate.

The combined sales tax rate in Las Vegas Clark County is 8375 on purchases of most tangible retail products. To calculate the amount of sales tax to charge in Las Vegas use this simple formula. Nevada Sales Tax Guide for Businesses - TaxJar Example.

Depending on the zipcode the sales tax rate of North Las Vegas may vary from 46 to 8375 Every 2021 combined rates mentioned above are the results of Nevada state rate 46 the county rate 3775. How 2021 Sales taxes are calculated in North Las Vegas The North Las Vegas Nevada general sales tax rate is 46. Your household income location filing status and number of personal exemptions.

You would charge your customer the 772 rate. The Nevada sales tax rate is currently 46. Combined Sales Tax Rate for Purchases in Las Vegas.

The Nevada sales tax rate is las vegas sales tax calculator currently. The 8375 sales tax rate in Las Vegas consists of 46 Nevada state sales tax and 3775 Clark County sales tax. Depending on local municipalities the total tax rate can be as high as 8265.

Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan. How 2021 Sales taxes are calculated in Las Vegas The Las Vegas Nevada general sales tax rate is 46. Also check the sales tax rates in.

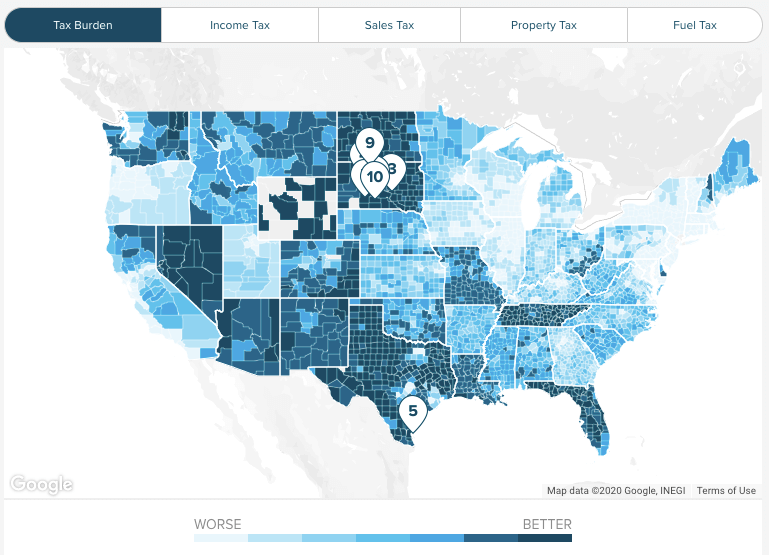

Nevada largely earns money from its sales tax which can be one of the highest in the nation and varies from 685 to 8375. There is no applicable city tax or special tax. First we calculate your adjusted gross income.

You can print a 8375 sales tax table here. Sales Tax Calculator Free calculator to find any value given the other two of the following three.

Los Angeles Sales Tax Rate And Calculator 2021 Wise

Los Angeles Sales Tax Rate And Calculator 2021 Wise

Nevada Income Tax Calculator Smartasset

Nevada Income Tax Calculator Smartasset

8 25 Vegas Tax Webpage Has Calculator Vegas Nevada Nevada State

8 25 Vegas Tax Webpage Has Calculator Vegas Nevada Nevada State

Nevada Vs California Taxes Explained Retire Better Now

Nevada Vs California Taxes Explained Retire Better Now

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Las Vegas Nevada Sales Tax Calculator Msu Program Evaluation

Las Vegas Nevada Sales Tax Calculator Msu Program Evaluation

Nevada Sales Tax Rate Rates Calculator Avalara

Sales Tax Calculator Tax Me App For Iphone Free Download Sales Tax Calculator Tax Me For Ipad Iphone At Apppure

Sales Tax Calculator Tax Me App For Iphone Free Download Sales Tax Calculator Tax Me For Ipad Iphone At Apppure

How To Prepare For The Post Holiday Tax Season Woocommerce

How To Prepare For The Post Holiday Tax Season Woocommerce

Nevada Sales Tax Rate Rates Calculator Avalara

Nevada Sales Tax Rate Rates Calculator Avalara

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Las Vegas Nevada State And Local Sales Tax Rate Rating Walls

Las Vegas Nevada State And Local Sales Tax Rate Rating Walls

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.