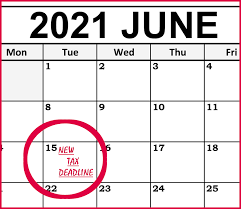

The Texas Comptroller did match the IRSs. Due to severe winter storms the IRS has also extended the tax deadline for residents of Texas Oklahoma and Louisiana to June 15 2021.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

No additional forms are needed to file.

Texas tax filing deadline. 25 which is Christmas day and a legal holiday. - Texas Oklahoma Louisiana What is the tax return filing deadline in 2021. WASHINGTONThe Internal Revenue Service extended the April 15 tax-filing and payment deadline to June 15 for all residents and businesses in Texas.

To date the Texas Comptroller has not extended the normal May 15 2021 due date for Texas franchise tax returns and the accompanying Texas franchise tax. For example for reports normally due on the 25th of the month a taxpayer files Dec. When a reporting due date happens to fall on Saturday Sunday or a legal holiday the reporting due date becomes the next business day.

Texans in all of the states 254 counties will automatically be given the extra two months to file and pay their individual and business taxes. The extensions apply to tax filing and payment deadlines that occurred starting on February 11. To date the Texas Comptroller has not extended the normal May 15 2021 due date for Texas franchise tax returns and the accompanying Texas franchise tax.

The normal filing deadline is April 15. It also applies to tax-exempt organizations operating on a calendar-year basis that have a 2020 return due on May 17. TEXAS Victims of winter storms that began February 11 2021 now have until June 15 2021 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today.

Texans will now have until June 15 to file their 2020 returns instead of the regular deadline of April 15 the tax agency said on Monday. This also extends the time to pay outstanding income taxes for the 2020 tax period to May 17. Taxpayers in the rest of the country must still meet the April 15 deadline even though some lawmakers want to change that.

There may be scenarios where someone will qualify for the deadline. The Internal Revenue Service is extending tax season for Texas residents because of winter storms. Texas Comptroller Glenn Hegar announced his agency is extending the 2021 franchise tax reports due date from May 15 to June 15.

Instead of April 15 the tax deadline for individuals and businesses in the Lone Star State is. Various federal tax filing and payment due dates for individuals and businesses from February 8 Oklahoma or February 11 Texas and Louisiana to June 14. 26 instead of Dec.

What you need to know. As a result affected individuals and businesses will have until June 15 2021 to file returns and pay any tax that would otherwise be due during this period. The Texas Comptroller did match the IRSs extension in 2020 for federal tax returns due to the COVID-19 pandemic so guidance is expected to be forthcoming.

The federal tax filing deadline for 2020 taxes has been automatically extended to May 17 2021. This change aligns Texas with the IRS which has also extended the April 15- tax filing deadline to June 15 for ALL Texas businesses and residents who owe franchise tax. Per IR-2021-59 the 2020 tax return deadline for individuals has been automatically extended from April 15 2021 to May 17 2021.

The extension applies to individuals and businesses in the entire state. The June 15 deadline also applies to quarterly estimated income tax payments due on April 15 and the quarterly payroll and excise tax returns normally. The June 15 deadline also applies to quarterly estimated income tax payments due on April 15 and the quarterly payroll and excise tax returns normally due on April 30.

The IRS announced Monday that it is extending the tax-filing deadline to June 15 for victims of the winter storms in Texas. Just make sure you have a homestead exemption. The extension aligns the agency with the Internal Revenue Service IRS which earlier this week extended the April 15 tax-filing and payment deadline to June 15 for all Texas residents and businesses.

Deadline to protest your Texas property tax appraisal is coming up. What this means to you.

Irs Extends Tax Deadlines For Texas Oklahoma And Louisiana Winter Storm Victims Kiplinger

Irs Extends Tax Deadlines For Texas Oklahoma And Louisiana Winter Storm Victims Kiplinger

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

Your Guide To State Tax Deadlines For Filing Returns Making Estimated Payments During Covid 19

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette

Irs Extends Tax Deadlines For Texas Residents And Businesses Mc Gazette

2020 Tax Deadline Extension What You Need To Know Taxact

2020 Tax Deadline Extension What You Need To Know Taxact

Victims Of Texas Winter Storms Get Tax Deadline Extensions And Other Tax Relief Front Porch News Texas

Victims Of Texas Winter Storms Get Tax Deadline Extensions And Other Tax Relief Front Porch News Texas

Internal Revenue Service Extends Tax Filing Deadline To June 15 2021 Lone Star Legal Aid

Internal Revenue Service Extends Tax Filing Deadline To June 15 2021 Lone Star Legal Aid

Irs Extends Tax Filing Deadline For Texas Over Winter Storms Thehill

Irs Extends Tax Filing Deadline For Texas Over Winter Storms Thehill

/cloudfront-us-east-1.images.arcpublishing.com/dmn/AYWTKAPUKNBUDA3B2YZOXZA4WY.jpg) Irs Moves Tax Deadline Back To June 15 For Texans And Their Businesses In Wake Of Winter Storm

Irs Moves Tax Deadline Back To June 15 For Texans And Their Businesses In Wake Of Winter Storm

Texas Receives Tax Deadline Extension From Irs

Texas Receives Tax Deadline Extension From Irs

/income-tax-deadlines-2021-75aaceca6a8f47eabc8a17a9185f24ac.png) Federal Income Tax Deadlines In 2021

Federal Income Tax Deadlines In 2021

The 2021 Tax Filing Deadline Is Extended For Texas Residents Taxact Blog

The 2021 Tax Filing Deadline Is Extended For Texas Residents Taxact Blog

Tax Day 2021 When S The Last Day To File Taxes Kiplinger

Tax Day 2021 When S The Last Day To File Taxes Kiplinger

Tax Day For Individuals Extended To June 15 For Texas And Other States Impacted By Winter Storm Mckinney Online Mckinney Tx

Tax Day For Individuals Extended To June 15 For Texas And Other States Impacted By Winter Storm Mckinney Online Mckinney Tx

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.