The five states with the highest average combined state and local sales tax rates are Tennessee 953 percent Louisiana 952 percent Arkansas 947 percent Washington 921 percent and Alabama. 16 on profit Employee.

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Resale and wholesale items are also exempt.

Sales tax per state. Many states allow local governments to charge a local sales tax in addition to the statewide sales tax so the actual sales tax rate may vary by locality within each state. The following chart lists the standard state level sales and use. As of December 2020 45 states the District of Columbia and Puerto Rico require a sales tax on many.

1 of all sales Revenue 1m. California 725 Indiana. On top of this most of those states allow local areas such as cities counties and other special taxing districts to have a sales tax.

Although Texas has a set state sales tax rate local jurisdictions including not only cities and counties but also special-purpose districts and transit authorities may impose an additional 2 sales tax. Arizona - - Home rule state. 53 Zeilen State Sales Tax Rates.

415 10 income tax out of gross minus pension health deductions 25 pension contribution out of gross 10 health contribution out of gross - Gross incomes below RON 3600 benefit from personal deductions of up to RON 1310. 37 includes income tax 10 mandatory state pension 18 mandatory public health insurance 73. No statewide sales tax but allows home rule for local sales tax.

Connecticut Delaware-----No general sales tax. Choose any state for more information including local and municiple sales tax rates is applicable. California City County Sales Use Tax Rates effective April 1 2021 These rates may be outdated.

48 Zeilen Use taxes are generally taxed at the same rate as sales taxes and largely. Enter your desired United States zip code to get more accurate sales tax rate. For state use tax rates.

The sales tax rate varies by the state and local government in which the purchase is made. On Sales Tax States states sales tax is the most general cities will give you a US sales tax calculator with a bit more precision and zip code is your best choice. For a list of local option transient rental taxes visit the.

All have a sales tax. 51 Zeilen Here are the 10 states with the highest sales tax rates. No warranty is made as to the accuracy of information provided.

Sales tax returns may be due monthly. You can also get to it by pressing US statescities andor zip code buttons and links. This table and the map above display the base statewide sales tax for each of the fifty states.

Arkansas - California - Colorado Home rule state. In addition to state sales and use tax and discretionary sales surtax Florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels motels apartments rooming houses mobile home parks RV parks condominiums or timeshare resorts for a term of six months or less. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

Products exempt from sales tax are those considered necessities of life such as food and health-related items. Look up the current sales and use tax. Sales tax is a consumption tax meaning that consumers only pay sales tax on taxable items they buy at retail.

States and Washington DC. Some cities enforce economic nexus for local sales tax.

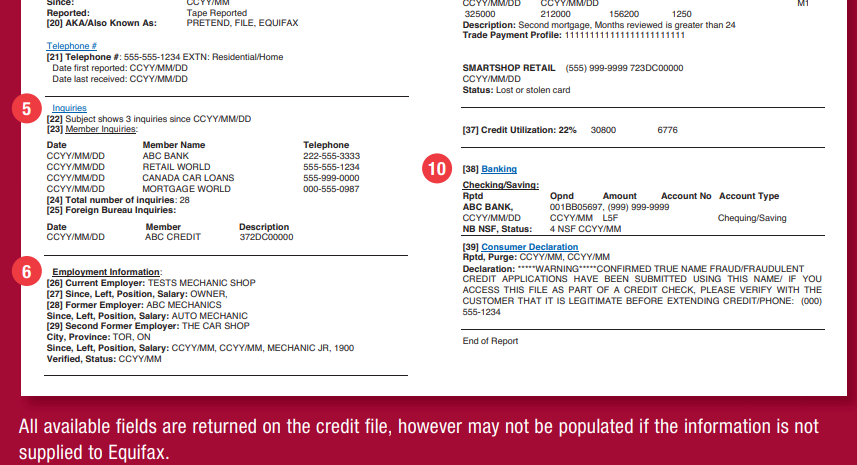

/who-are-the-three-major-credit-bureaus-960416-Final-5c5363db46e0fb0001c07a68.png)